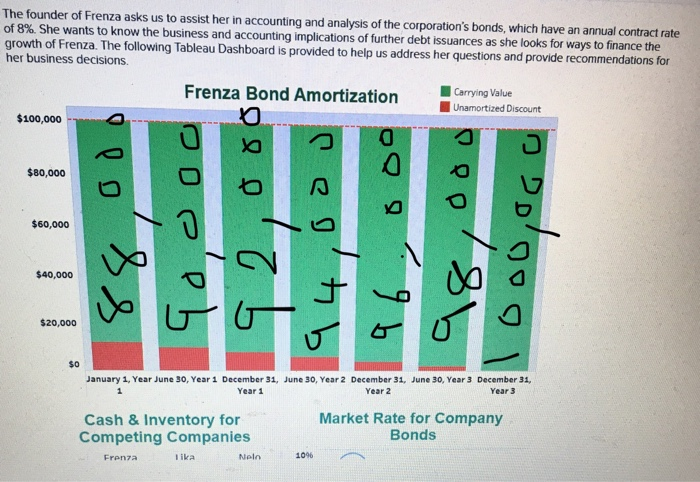

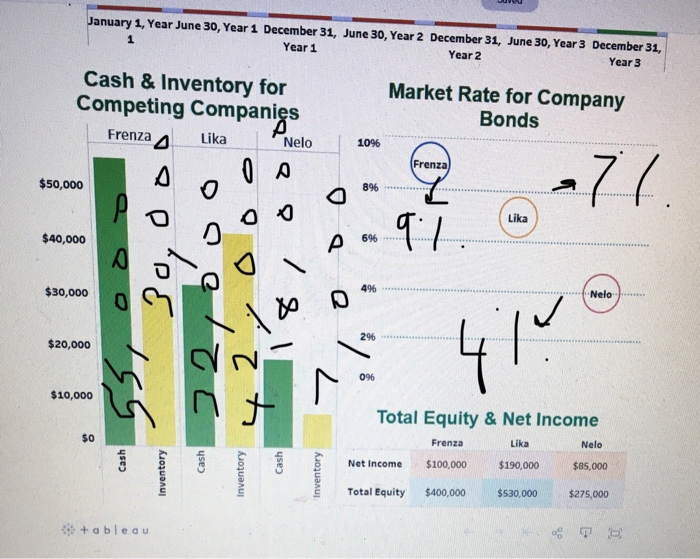

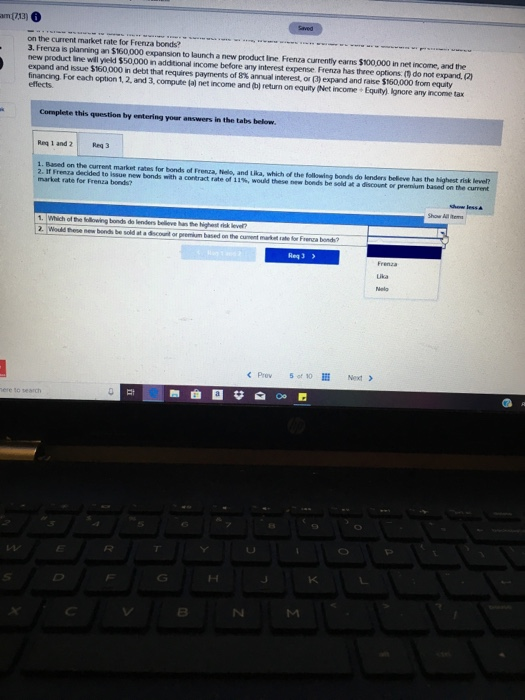

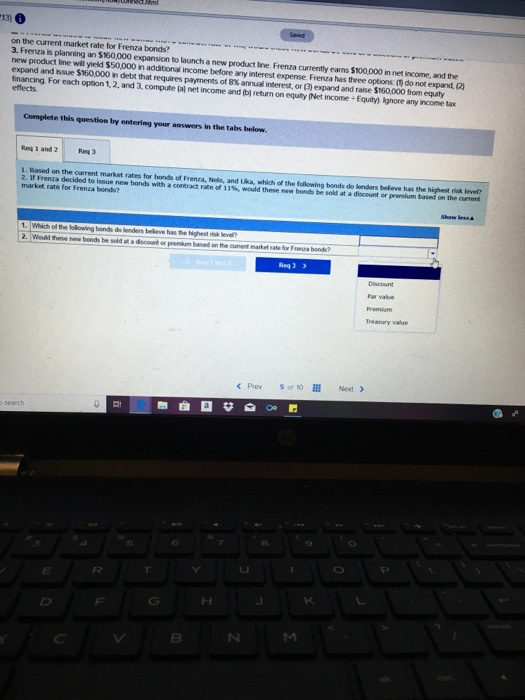

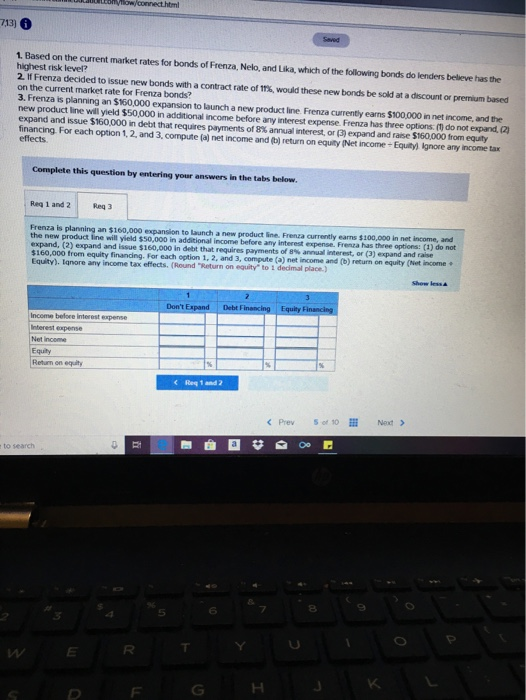

The founder of Frenza asks us to assist her in accounting and analysis of the corporation's bonds, which have an annual contract rate of 8% She wants to know the business and accounting implications of further debt issuances as she looks for ways to finance the growth of Frenza. The following Tableau Dashboard is provided to help us address her questions and provide recommendations for her business decisions Frenza Bond Amortization Carrying Value Unamortized Discount $100,000 $80,000 38 og p h $60,000 oo oo o | $40,000 . 520,000 January 1, Year June 30, Year 1 December 31, June 30, Year 2 December 31, June 30, Year 3 December 31, Year 1 Year 2 Year 3 Cash & Inventory for Competing Companies lika Nel Market Rate for Company Bonds 1046 January 1, Year June 30, Year 1 December 31, June 30, Year 2 December 31, June 30, Year 3 December 31, Year 1 Year 2 Year 3 Cash & Inventory for Market Rate for Company Competing Companies Bonds Frenza Lika Prelo Frenza $50,000 ooo . $40,000 oool oo97. Lubb 3o.do 32ooo GS, OOS $30,000 Nelo $20,000 2 $10,000 Total Equity & Net Income Frenza Lika Nelo Net Income $100,000 $190,000 $85,000 Cash Cash Cash Inventory Inventory Inventory Total Equity $400,000 $530,000 $275,000 + ableau TO 713 on the current market rate for Frenza bonds? 3. Frenza is planning S160000 expansion to launch a new product line Frenza currently earns $100.000 in net income, and the new product line will yold 90,000 in additional income before any interest expense Freuza has three options do not expand, (2) expand and issue $160000 in debt that requires payments of annual interest or expand and are $160000 from equity financing For each option t 2. and computea income and return on equity Net Income Equity Ignore any income tax Complete this question by entering your answers in the tabs below Rey 1 and 2 Req3 1. Based on the current market rates for bonds of Frenza, and Lika, which of the following bonds dolenders believe has the highest risk level 2. If Frenta decided to issue new bands with a contrast rate of 11 bonde a count or prom hand on the current marate for Frenza bonds c v B N M on the current market rate for Frenca bonds? 3. Frenza is planning an $10,000 expansion to launch a new product line. Frenza currently earns $100.000 in net income, and the new product line will yield $50,000 in additional income before any interest expense. Frenza has three options. I do not expand, (2) expand and issue $150.000 in debt that requires payments of 8% annual interest or expand and raise $160,000 from equity financing. For each option 12 and 3 compute net income and return on equity Net income-Equity). Ignore any income tax effects Complete this question by entering your answers in the tabs below Reg 1 and 2 Req3 1. Based on the current market rates for bonds of Frenca, N anda , which of the following bonds de ders believe has the highest risk level 2. If Frenza decided to issue new bonds with a contractate of 111 would the bonds be sold at a discount or premium based on the current market rate for Frenza bonds 1. Which of the lowing bonds de lenders b 2. Would these new honda beseda eha g e th 1. Based on the current market rates for bonds of Frenza, Nelo, and Lika, which of the following bonds do lenders believe has the highest risk level? 2. Frenza decided to issue new bonds with a contract rate of 11%, would these new bonds be sold at a discount or premium based on the current market rate for Frenza bonds? 3. Frenza is planning an $160,000 expansion to launch a new product line Frenza currently earns $100.000 in net income, and the new product line will yield $50,000 in additional income before any interest expense Frenza has three options do not expand. 2 expand and issue $160,000 in debt that requires payments of annual interest or expand and raise $160,000 from equity financing. For each option 12 and 3. computea net income and (b) return on equity Net income Equity Ignore any income tax effects Complete this question by entering your answers in the tabs below. Roland 2 Frenza is planning an $160,000 expansion to launch a new product line. Frenta currently earns $100,000 in net income, and the new product line will yield $50,000 in additional income before any interest expense Frenza has three options: (1) do not expand, (2) expand and we $160,000 in dubt that requires payments of interest () expand andra $160,000 from equity financing. For each option 1, 2, and, compute(a) net income and (b) return on equity (Net income Equity). Ignore any income tax effects. (Round Return on equity to 1 decimal place) Don't Expand Debt Financing Equity Financing Nincome Equity Return on equity