Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The founders of The Red Squirrel Patisserie were aware that at some point the company would have to move away from labour intensive manual

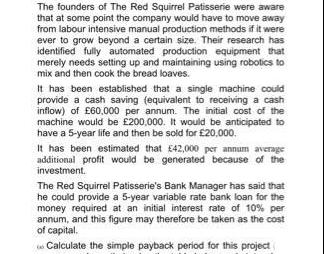

The founders of The Red Squirrel Patisserie were aware that at some point the company would have to move away from labour intensive manual production methods if it were ever to grow beyond a certain size. Their research has identified fully automated production equipment that merely needs setting up and maintaining using robotics to mix and then cook the bread loaves. It has been established that a single machine could provide a cash saving (equivalent to receiving a cash inflow) of 60,000 per annum. The initial cost of the machine would be 200,000. It would be anticipated to have a 5-year life and then be sold for 20,000. It has been estimated that 42,000 per annum average additional profit would be generated because of the investment. The Red Squirrel Patisserie's Bank Manager has said that he could provide a 5-year variable rate bank loan for the money required at an initial interest rate of 10% per annum, and this figure may therefore be taken as the cost of capital. Calculate the simple payback period for this project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the simple payback period for the project we need to determine the time it takes for the cumulative cash inflows to recover the initial i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started