Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Four Lions Limited (hereafter the Company) is a private, unregulated company involved in the manufacture of primary products. The Company also is involved

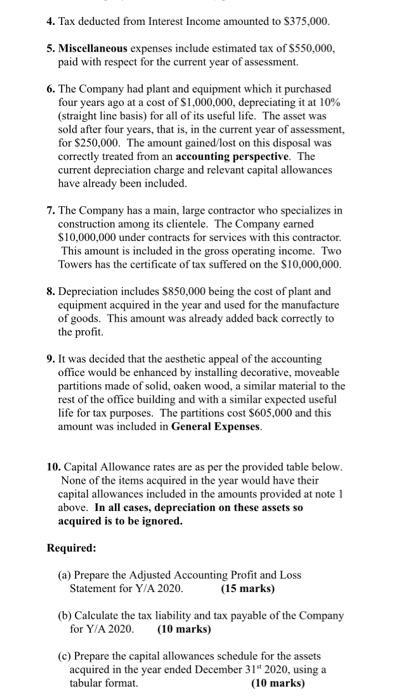

The Four Lions Limited (hereafter the Company) is a private, unregulated company involved in the manufacture of primary products. The Company also is involved in the construction of small buildings. It acts through a large contractor with respect to these services. Harry Lane, the accountant, worked out the corporate income subject to tax but, in his haste to meet the directors' tight deadline, ended up making a number of errors, both of commission and omission. He has called you, his best friend and class-mate from Utekkit and Gwaan (Utek), the premier business university in the region. You were taught taxation by the simple but knowledgeable, Franco PD. Harry believes that he has captured all the "add back" and "deduct" items but you are not so sure that this is so, despite his positive labelling of the net profit as shown below. (Brief explanatory notes are required for full marks) The details for the period to year ended December 31", 2020 are as below: Net Profit after adding back all disallowed expenditures (save for the ones mentioned in the notes below!) is $15,000,000. 1. Capital allowances and charges were computed as follows: Annual Allowances, $1,000,000, Balancing Allowances, $900,000, and Balancing Charges, $500,000 These amounts do not include any allowances on assets acquired in the year unless so stated. The Company is developing a process which it hopes to patent in a few years. It has commenced intense Research and Development activities. The capitalized cost of such activities for the current year amounted to $1,750,000 million and was charged to Insurance. 3. The Company's directors declared a dividend of $0.10 per ordinary share in March 2020 and paid a dividend on its ordinary shares of $0.09 per share for the year. The amount of this dividend was included in Miscellaneous expenses. The Company has 8,000,000 fully paid shares. 4. Tax deducted from Interest Income amounted to $375,000. 5. Miscellaneous expenses include estimated tax of $550,000, paid with respect for the current year of assessment. 6. The Company had plant and equipment which it purchased four years ago at a cost of $1,000,000, depreciating it at 10% (straight line basis) for all of its useful life. The asset was sold after four years, that is, in the current year of assessment, for $250,000. The amount gained/lost on this disposal was correctly treated from an accounting perspective. The current depreciation charge and relevant capital allowances have already been included. 7. The Company has a main, large contractor who specializes in construction among its clientele. The Company earned $10,000,000 under contracts for services with this contractor. This amount is included in the gross operating income. Two Towers has the certificate of tax suffered on the $10,000,000. 8. Depreciation includes $850,000 being the cost of plant and equipment acquired in the year and used for the manufacture of goods. This amount was already added back correctly to the profit. 9. It was decided that the aesthetic appeal of the accounting office would be enhanced by installing decorative, moveable partitions made of solid, oaken wood, a similar material to the rest of the office building and with a similar expected useful life for tax purposes. The partitions cost $605,000 and this amount was included in General Expenses. 10. Capital Allowance rates are as per the provided table below. None of the items acquired in the year would have their capital allowances included in the amounts provided at note 1 above. In all cases, depreciation on these assets so acquired is to be ignored. Required: (a) Prepare the Adjusted Accounting Profit and Loss Statement for Y/A 2020. (15 marks) (b) Calculate the tax liability and tax payable of the Company for Y/A 2020. (10 marks) (c) Prepare the capital allowances schedule for the assets acquired in the year ended December 31" 2020, using a tabular format. (10 marks)

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Adjusted Accounting Profit and Loss Statement for YA 2020 Revenue Sales 15000000 Cost of good...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started