Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Four Tests to Measure Investment Returns You are a property manager for a property owned by a group of investors. Your clients have been

The Four Tests to Measure Investment Returns

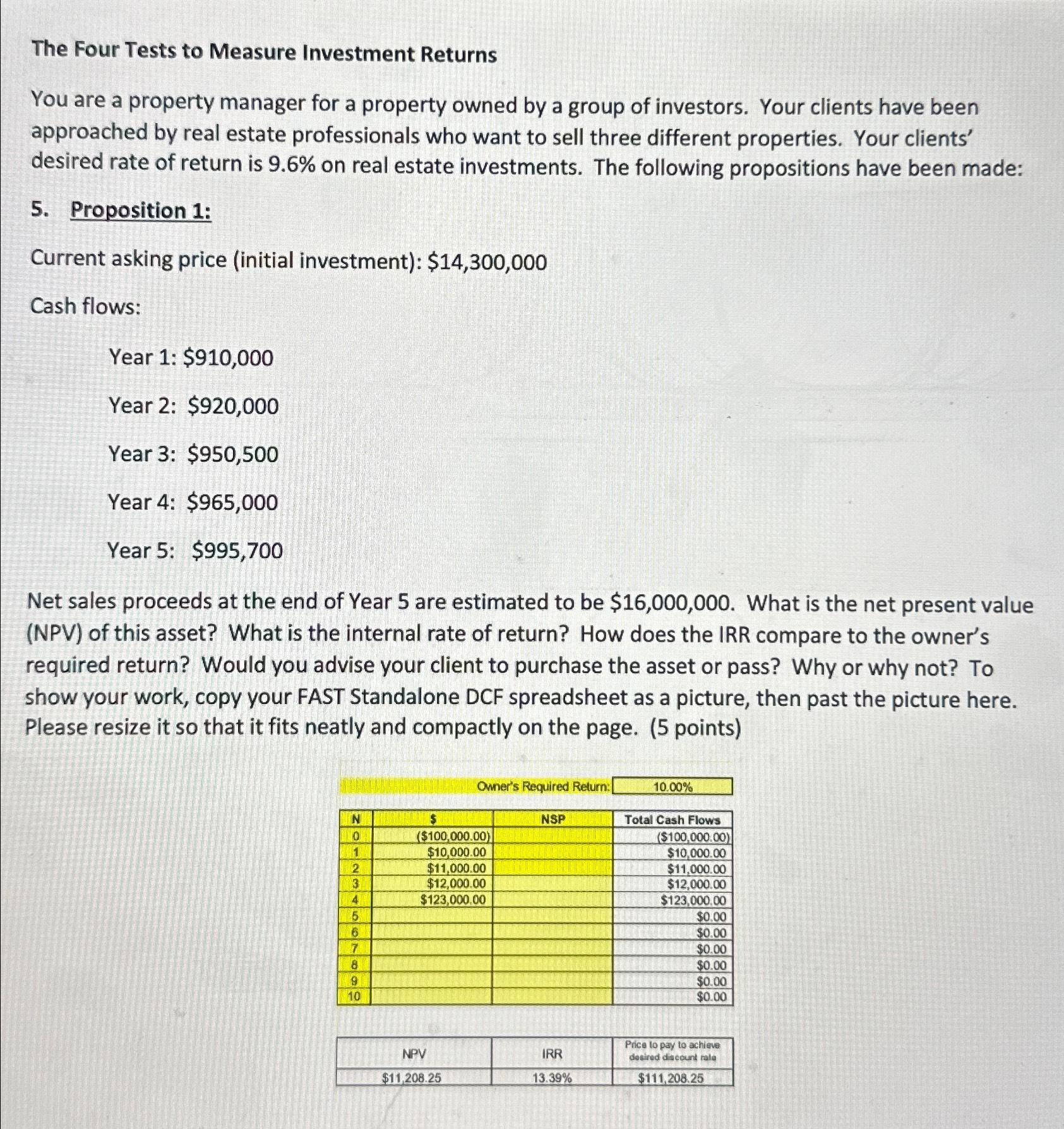

You are a property manager for a property owned by a group of investors. Your clients have been approached by real estate professionals who want to sell three different properties. Your clients' desired rate of return is on real estate investments. The following propositions have been made:

Proposition :

Current asking price initial investment: $

Cash flows:

Year : $

Year : $

Year : $

Year : $

Year : $

Net sales proceeds at the end of Year are estimated to be $ What is the net present value NPV of this asset? What is the internal rate of return? How does the IRR compare to the owner's required return? Would you advise your client to purchase the asset or pass? Why or why not? To show your work, copy your FAST Standalone DCF spreadsheet as a picture, then past the picture here. Please resize it so that it fits neatly and compactly on the page. points

tableOmners Required Retum:,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started