Answered step by step

Verified Expert Solution

Question

1 Approved Answer

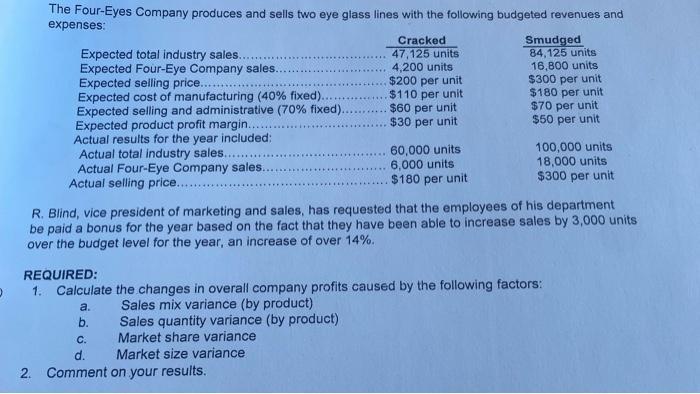

The Four-Eyes Company produces and sells two eye glass lines with the following budgeted revenues and expenses: Expected total industry sales.... Expected Four-Eye Company

The Four-Eyes Company produces and sells two eye glass lines with the following budgeted revenues and expenses: Expected total industry sales.... Expected Four-Eye Company sales. Expected selling price... Expected cost of manufacturing (40% fixed). Expected selling and administrative (70% fixed). Expected product profit margin... Actual results for the year included: Actual total industry sales.... Actual Four-Eye Company sales. Actual selling price..... Cracked 47,125 units 4,200 units $200 per unit $110 per unit $60 per unit $30 per unit d. 2. Comment on your results. 60,000 units 6,000 units $180 per unit Smudged 84,125 units 16,800 units $300 per unit $180 per unit $70 per unit $50 per unit 100,000 units 18,000 units $300 per unit R. Blind, vice president of marketing and sales, has requested that the employees of his department be paid a bonus for the year based on the fact that they have been able to increase sales by 3,000 units over the budget level for the year, an increase of over 14%. REQUIRED: 1. Calculate the changes in overall company profits caused by the following factors: a. Sales mix variance (by product) b. Sales quantity variance (by product) C. Market share variance Market size variance

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 a Sales mix variance by product Smudged glasses 16800 units 300 per unit 5040000 4200 units 110 pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started