The Fraser River Corporation has purchased a new piece of factory equipment on January 1, 2018, and wishes to compare three depreciation methods: straight-line, double-declining-balance, and units-of-production.

The equipment costs $400,000 and has an estimated useful life of four years, or 8,000 machine hours. At the end of four years, the equipment is estimated a residual value of $20,000.

Requirements;

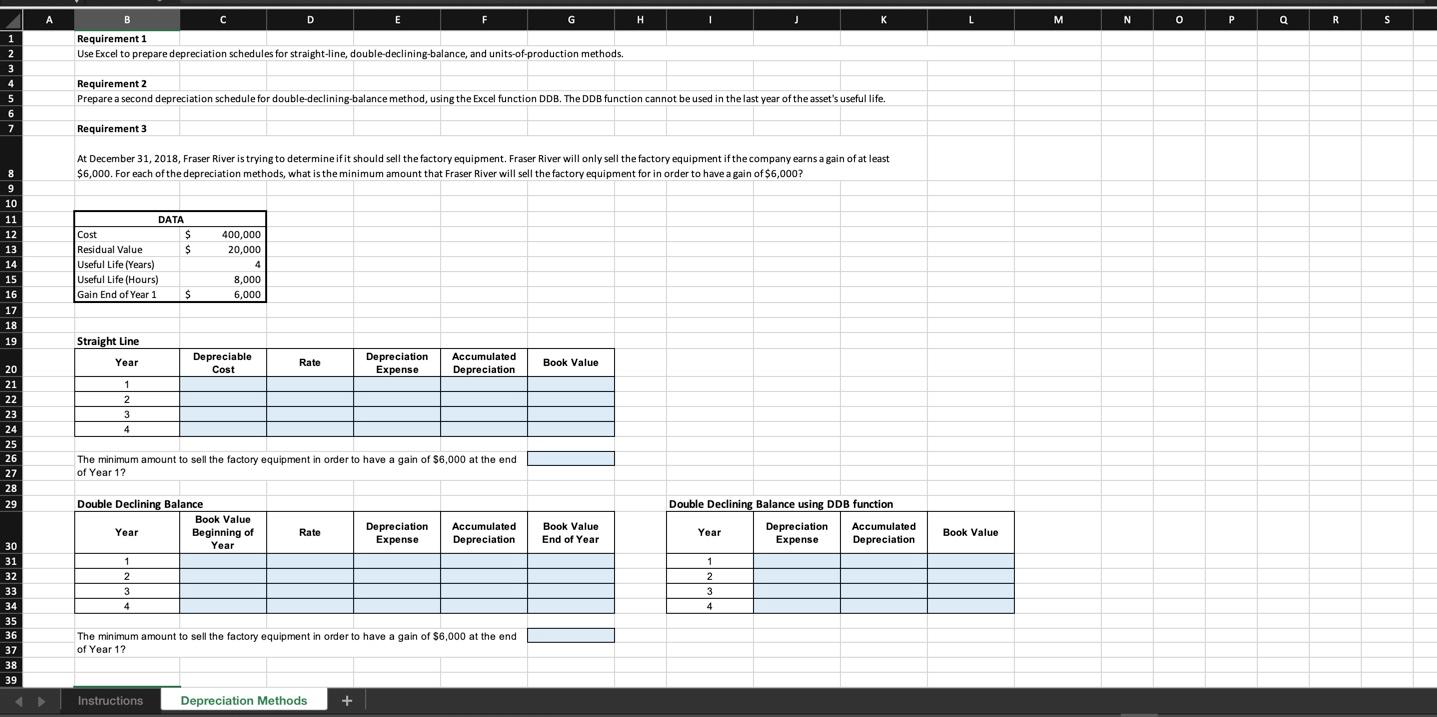

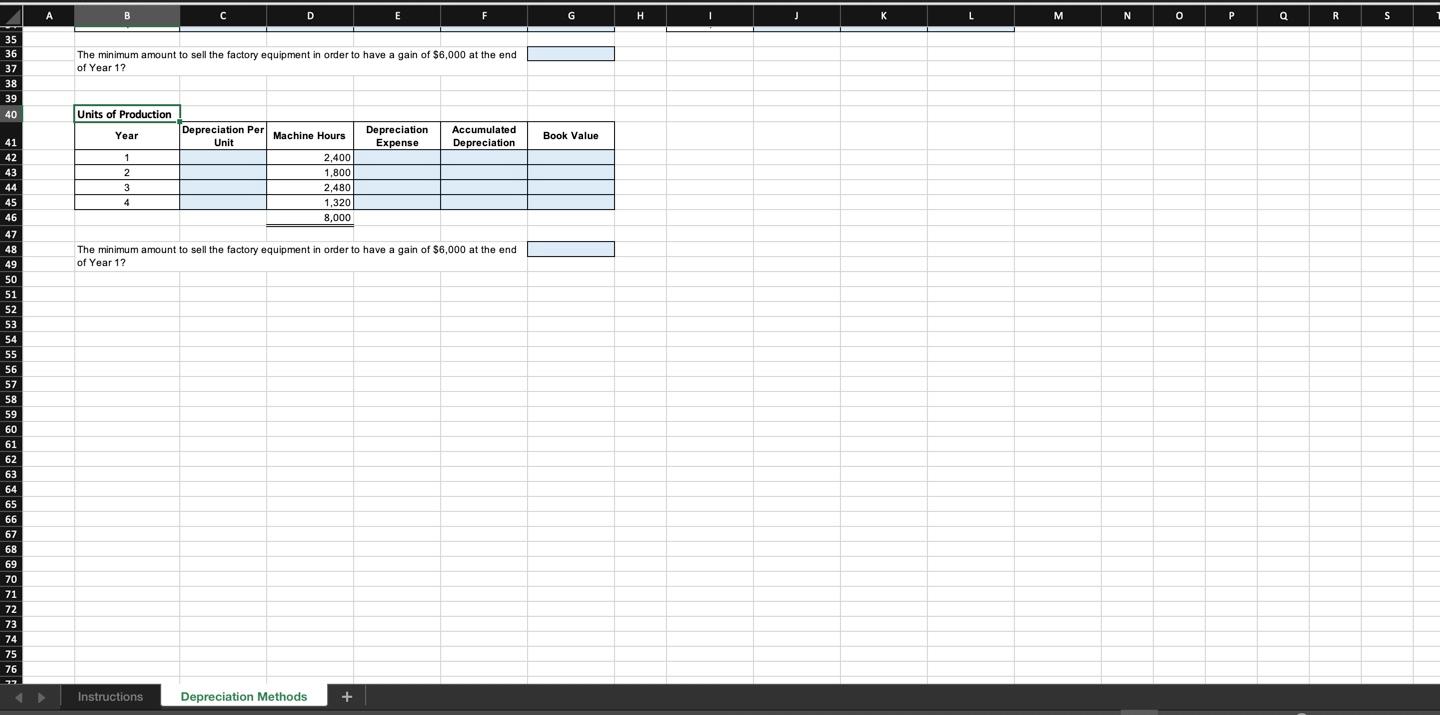

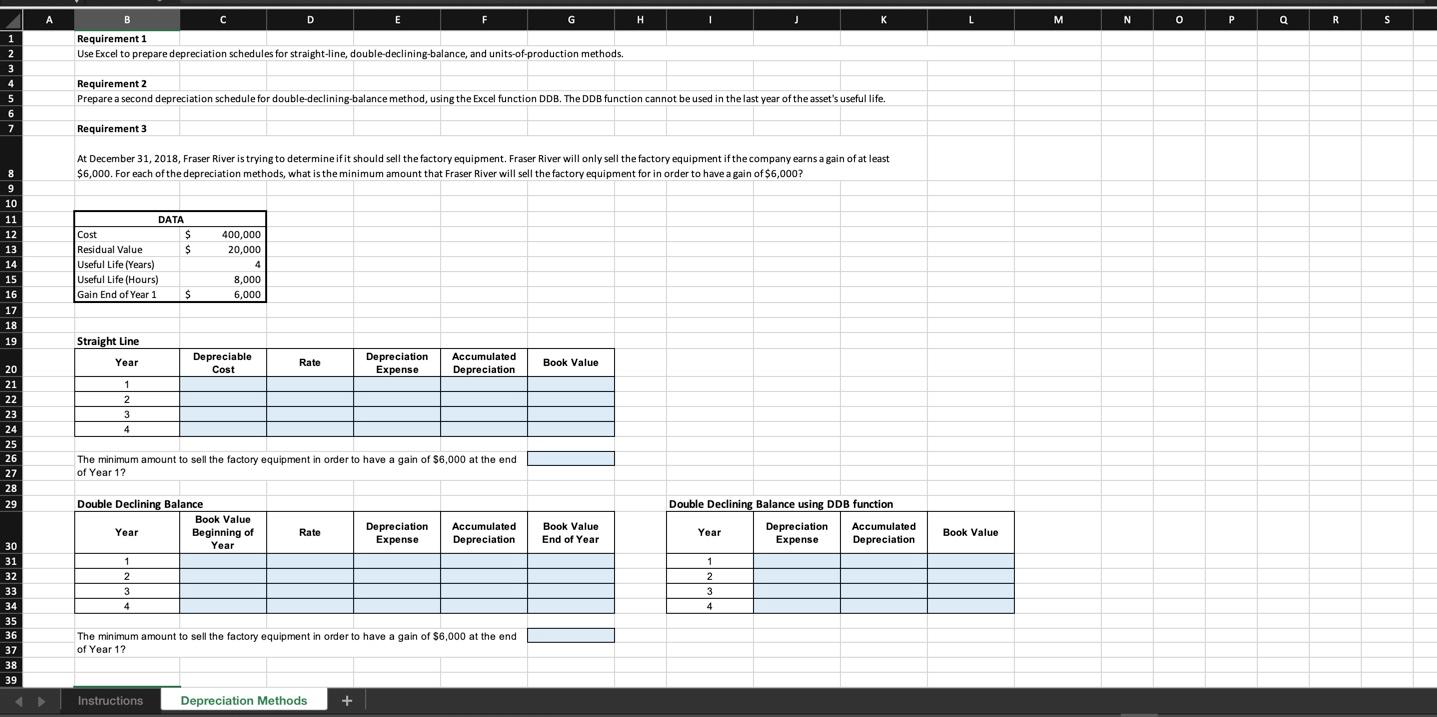

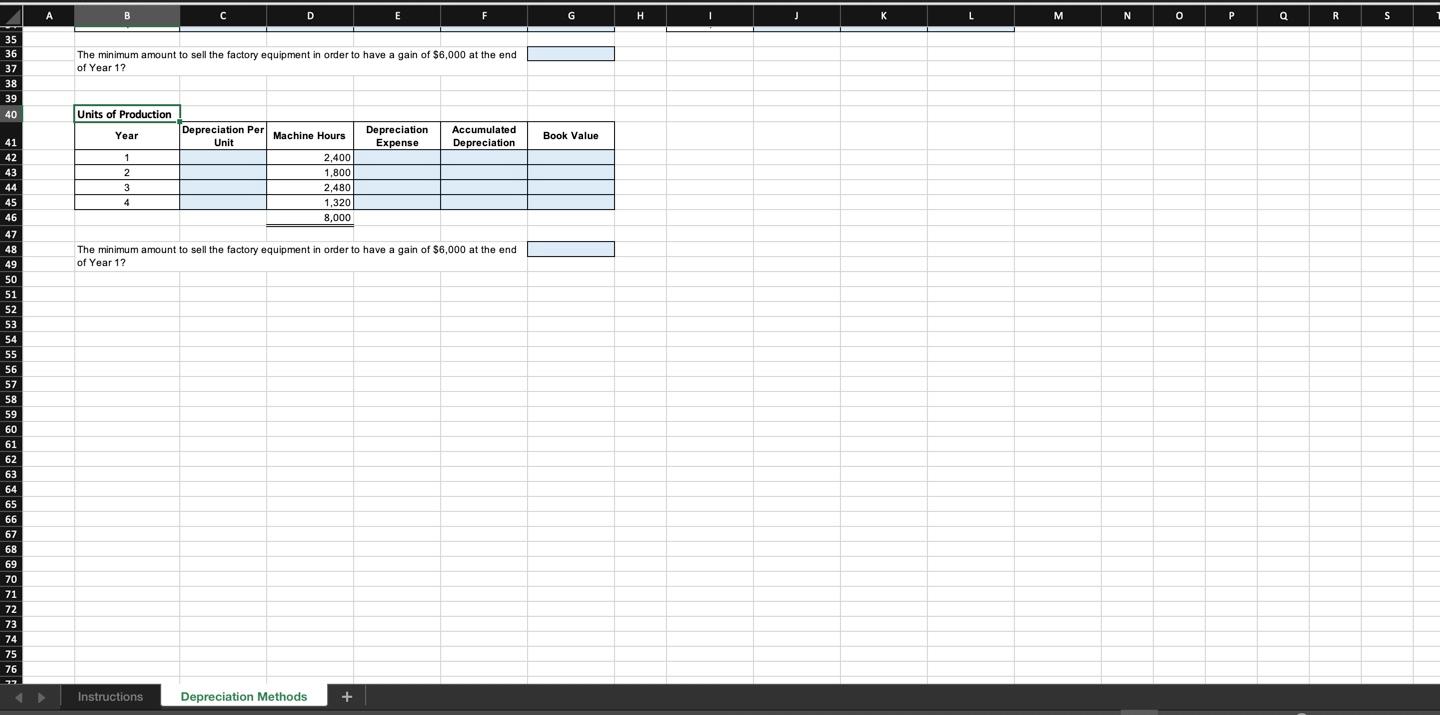

1. Use Excel to prepare depreciation schedules for straight-lone, double-declining-balance, and units-of-production methods

2. Prepare a second depreciation schedule for double-declining-balance method, using the Excel function DDB. The DDB function cannot be used in the last year of the asset's useful life.

3. At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns a gain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment for in order to have a gain of $6,000?

PLEASE HELP. The instructions for the rest of it is in the screenshots below.

S V V W Y Z A E F G H I J K L M M N 0 Q R 1 Chapter 9 2 Using Excel P9-42 Using Excel to prepare depreciation schedules 4 The Fraser River Corporation has purchased a new piece of factory equipment on January 1, 2018, and wishes to compare three depreciation methods: straight-line, double-declining-balance, and units-of- 5 5 production 6 7 The equipment costs $400,000 and has an estimated useful life of four years, or 8,000 machine hours. At the end of four years, the equipment is estimated to have a residual value of $20,000. 8 9 Requirements 10 1. Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-production methods. 11 2. Prepare a second depreciation schedule for double-declining balance method, using the Excel function DDB. The DDB function cannot be used in the last year of the asset's useful life. 3. At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns again of at least $6,000. For each 12 of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment for in order to have a gain of $6,000? , a $ 13 14 Excel Skills 15 1. Create formulas with absolute and relative cell references. 16 2. Format the cells as accounting number format. . 17 3. Use the Excel function DDB to calculate double-declining balance depreciation. 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 Instructions Depreciation Methods + A H J K L M N 0 P P Q R S B D E G Requirement 1 Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-production methods. 1 2 3 4 5 6 7 Requirement 2 Prepare a second depreciation schedule for double-declining-balance method, using the Excel function DDB. The DDB function cannot be used in the last year of the asset's useful life. Requirement 3 At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns a gain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment for in order to have a gain of $6,000? 8 9 10 11 12 13 14 15 16 DATA Cost $ Residual Value $ Useful Life (Years) Useful Life (Hours) Gain End of Year 1 $ $ 400,000 20,000 4 8.000 6,000 17 18 19 Straight Line Year Depreciable Cost Rate Depreciation Expense Accumulated Depreciation Book Value 1 1 2 3 4 20 21 22 23 24 25 26 27 28 29 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Year 12 Double Declining Balance Book Value Year Beginning of Year Depreciation Expense Rate Accumulated Depreciation Book Value End of Year Double Declining Balance using DDB function Year Depreciation Accumulated Expense Depreciation Book Value 1 2 2 3 1 1 2 3 4 4 30 31 32 33 34 35 36 37 38 39 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Year 1? Instructions Depreciation Methods + A B D E F G H J J K L M N 0 0 P Q Q R R S 35 36 37 38 39 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Year 1? 40 Units of Production Year Depreciation Per Unit Machine Hours Depreciation Expense Accumulated Depreciation Book Value 41 42 43 1 2 3 2,400 1,800 2,480 1.3201 8,000 4 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Year 12 44 45 46 47 40 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 70 wmn2 71 72 73 74 75 76 92 Instructions Depreciation Methods +