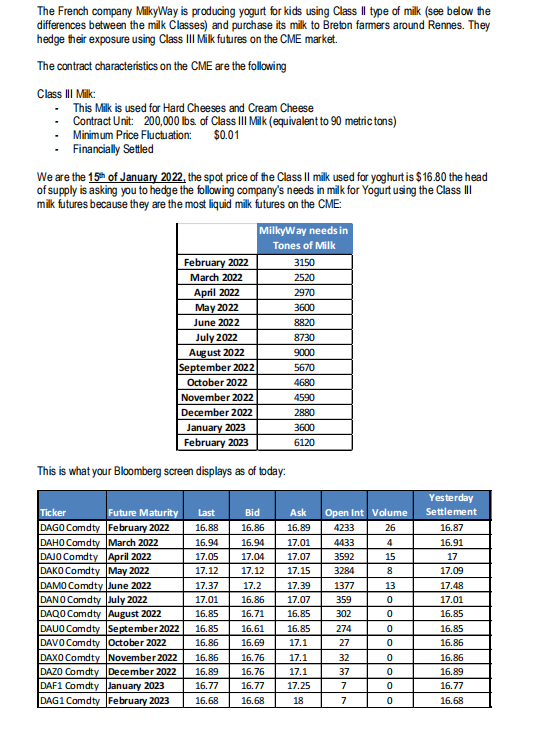

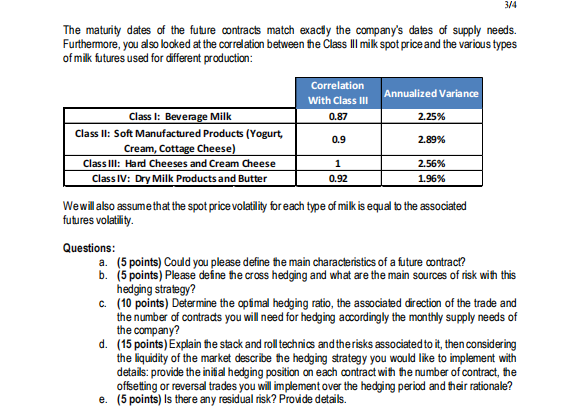

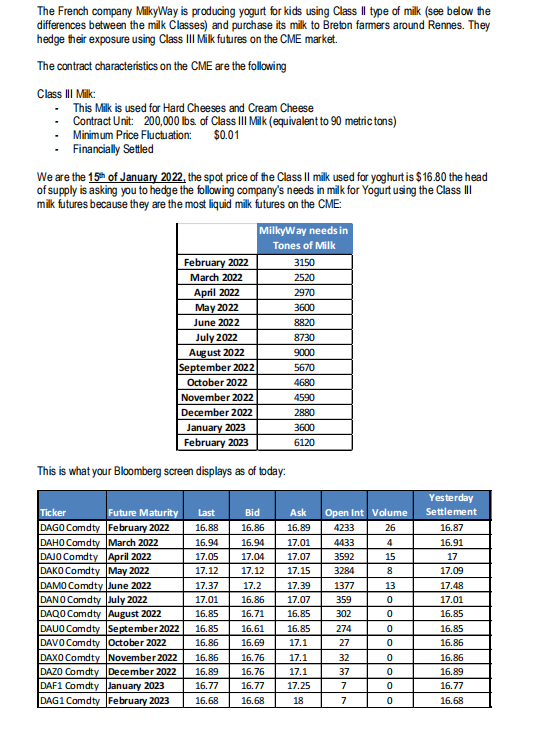

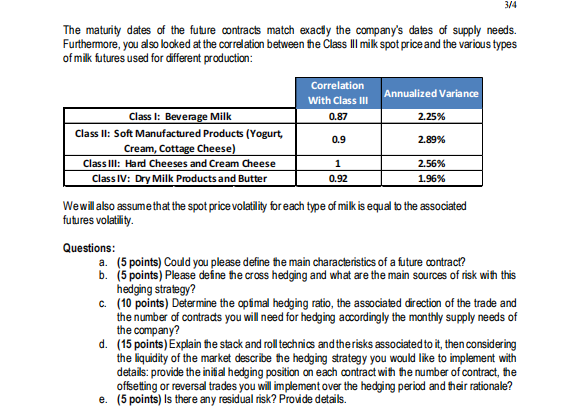

The French company MilkyWay is producing yogurt for kids using Class II type of milk (see below the differences between the milk Classes) and purchase its milk to Breton farmers around Rennes. They hedge their exposure using Class III Milk futures on the CME market. The contract characteristics on the CME are the following Class III Milk: - - - This Milk is used for Hard Cheeses and Cream Cheese Contract Unit: 200,000 lbs. of Class III Milk (equivalent to 90 metric tons) Minimum Price Fluctuation: $0.01 Financially Settled We are the 15th of January 2022, the spot price of the Class II milk used for yoghurt is $16.80 the head of supply is asking you to hedge the following company's needs in milk for Yogurt using the Class III milk futures because they are the most liquid milk futures on the CME: August 2022 February 2022 March 2022 DAXO Comdty DAZO Comdty DAF1 Comdty January 2023 DAG1 Comdty February 2023 November 2022 December 2022 April 2022 May 2022 June 2022 November 2022 December 2022 January 2023 February 2023 This is what your Bloomberg screen displays as of today: Ticker 16.88 Future Maturity Last DAGO Comdty February 2022 DAHO Comdty March 2022 DAJO Comdty April 2022 DAKO Comdty May 2022 DAMO Comdty June 2022 DANO Comdty July 2022 DAQO Comdty DAUO Comdty September 2022 DAVO Comdty October 2022 July 2022 August 2022 September 2022 October 2022 Bid 16.86 16.94 16.94 17.05 17.04 17.12 17.12 MilkyWay needs in Tones of Milk 3150 2520 2970 3600 16.85 16.86 16.86 16.89 16.77 17.37 17.2 17.39 17.01 16.86 17.07 16.85 16.71 16.85 16.85 17.1 16.61 16.69 16.76 16.76 16.77 16.68 16.68 8820 8730 9000 5670 4680 4590 2880 3600 6120 Ask Open Int Volume 16.89 4233 26 17.01 4433 17.07 3592 17.15 3284 17.1 17.1 17.25 18 1377 359 302 274 27 32 37 7 7 4 15 oooooooooo 8 13 0 0 0 0 0 0 0 0 Yesterday Settlement 16.87 16.91 17 17.09 17.48 17.01 16.85 16.85 16.86 16.86 16.89 16.77 16.68 3/4 The maturity dates of the future contracts match exactly the company's dates of supply needs. Furthermore, you also looked at the correlation between the Class III milk spot price and the various types of milk futures used for different production: Class I: Beverage Milk Class II: Soft Manufactured Products (Yogurt, Cream, Cottage Cheese) Class III: Hard Cheeses and Cream Cheese Class IV: Dry Milk Products and Butter Correlation With Class III 0.87 0.9 1 0.92 Annualized Variance 2.25% 2.89% 2.56% 1.96% We will also assume that the spot price volatility for each type of milk is equal to the associated futures volatility. Questions: a. (5 points) Could you please define the main characteristics of a future contract? b. (5 points) Please define the cross hedging and what are the main sources of risk with this hedging strategy? c. (10 points) Determine the optimal hedging ratio, the associated direction of the trade and the number of contracts you will need for hedging accordingly the monthly supply needs of the company? d. (15 points) Explain the stack and roll technics and the risks associated to it, then considering the liquidity of the market describe the hedging strategy you would like to implement with details: provide the initial hedging position on each contract with the number of contract, the offsetting or reversal trades you will implement over the hedging period and their rationale? e. (5 points) Is there any residual risk? Provide details. The French company MilkyWay is producing yogurt for kids using Class II type of milk (see below the differences between the milk Classes) and purchase its milk to Breton farmers around Rennes. They hedge their exposure using Class III Milk futures on the CME market. The contract characteristics on the CME are the following Class III Milk: - - - This Milk is used for Hard Cheeses and Cream Cheese Contract Unit: 200,000 lbs. of Class III Milk (equivalent to 90 metric tons) Minimum Price Fluctuation: $0.01 Financially Settled We are the 15th of January 2022, the spot price of the Class II milk used for yoghurt is $16.80 the head of supply is asking you to hedge the following company's needs in milk for Yogurt using the Class III milk futures because they are the most liquid milk futures on the CME: August 2022 February 2022 March 2022 DAXO Comdty DAZO Comdty DAF1 Comdty January 2023 DAG1 Comdty February 2023 November 2022 December 2022 April 2022 May 2022 June 2022 November 2022 December 2022 January 2023 February 2023 This is what your Bloomberg screen displays as of today: Ticker 16.88 Future Maturity Last DAGO Comdty February 2022 DAHO Comdty March 2022 DAJO Comdty April 2022 DAKO Comdty May 2022 DAMO Comdty June 2022 DANO Comdty July 2022 DAQO Comdty DAUO Comdty September 2022 DAVO Comdty October 2022 July 2022 August 2022 September 2022 October 2022 Bid 16.86 16.94 16.94 17.05 17.04 17.12 17.12 MilkyWay needs in Tones of Milk 3150 2520 2970 3600 16.85 16.86 16.86 16.89 16.77 17.37 17.2 17.39 17.01 16.86 17.07 16.85 16.71 16.85 16.85 17.1 16.61 16.69 16.76 16.76 16.77 16.68 16.68 8820 8730 9000 5670 4680 4590 2880 3600 6120 Ask Open Int Volume 16.89 4233 26 17.01 4433 17.07 3592 17.15 3284 17.1 17.1 17.25 18 1377 359 302 274 27 32 37 7 7 4 15 oooooooooo 8 13 0 0 0 0 0 0 0 0 Yesterday Settlement 16.87 16.91 17 17.09 17.48 17.01 16.85 16.85 16.86 16.86 16.89 16.77 16.68 3/4 The maturity dates of the future contracts match exactly the company's dates of supply needs. Furthermore, you also looked at the correlation between the Class III milk spot price and the various types of milk futures used for different production: Class I: Beverage Milk Class II: Soft Manufactured Products (Yogurt, Cream, Cottage Cheese) Class III: Hard Cheeses and Cream Cheese Class IV: Dry Milk Products and Butter Correlation With Class III 0.87 0.9 1 0.92 Annualized Variance 2.25% 2.89% 2.56% 1.96% We will also assume that the spot price volatility for each type of milk is equal to the associated futures volatility. Questions: a. (5 points) Could you please define the main characteristics of a future contract? b. (5 points) Please define the cross hedging and what are the main sources of risk with this hedging strategy? c. (10 points) Determine the optimal hedging ratio, the associated direction of the trade and the number of contracts you will need for hedging accordingly the monthly supply needs of the company? d. (15 points) Explain the stack and roll technics and the risks associated to it, then considering the liquidity of the market describe the hedging strategy you would like to implement with details: provide the initial hedging position on each contract with the number of contract, the offsetting or reversal trades you will implement over the hedging period and their rationale? e. (5 points) Is there any residual risk? Provide details