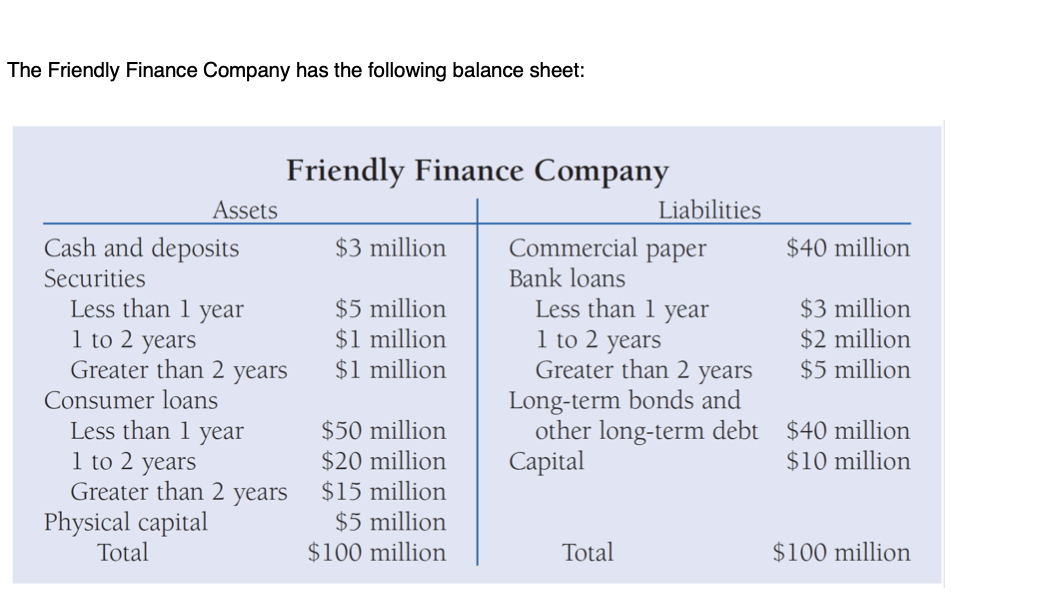

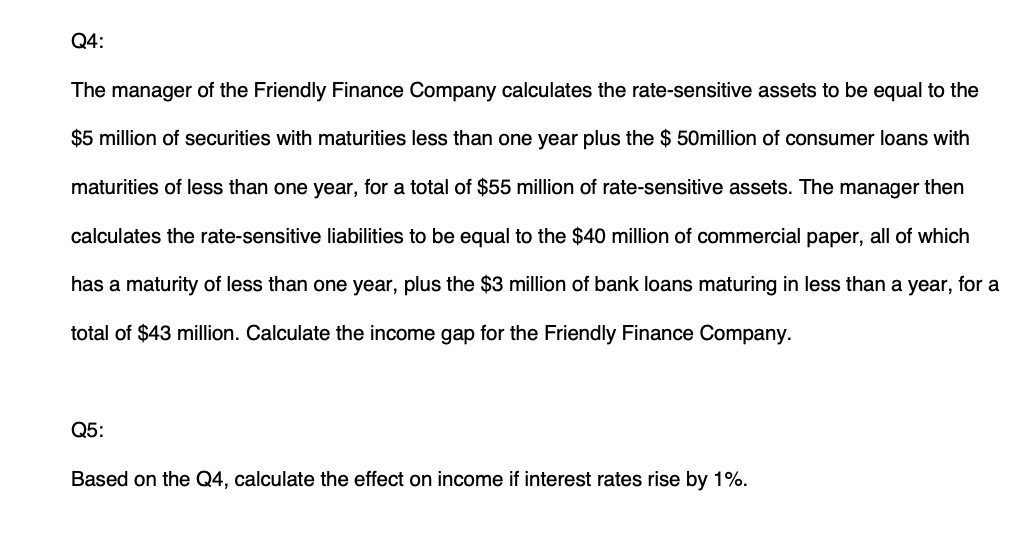

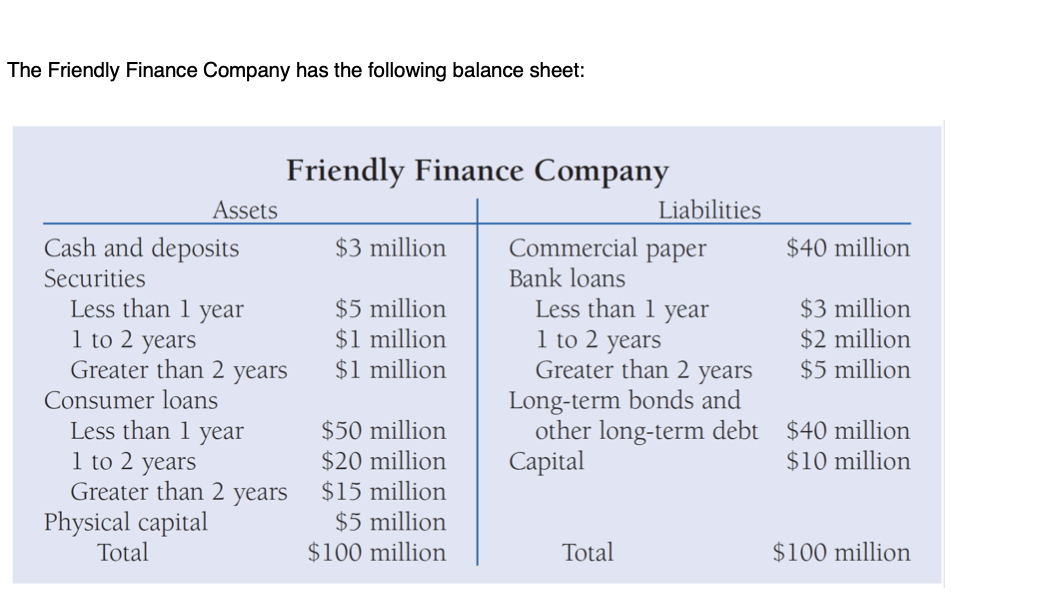

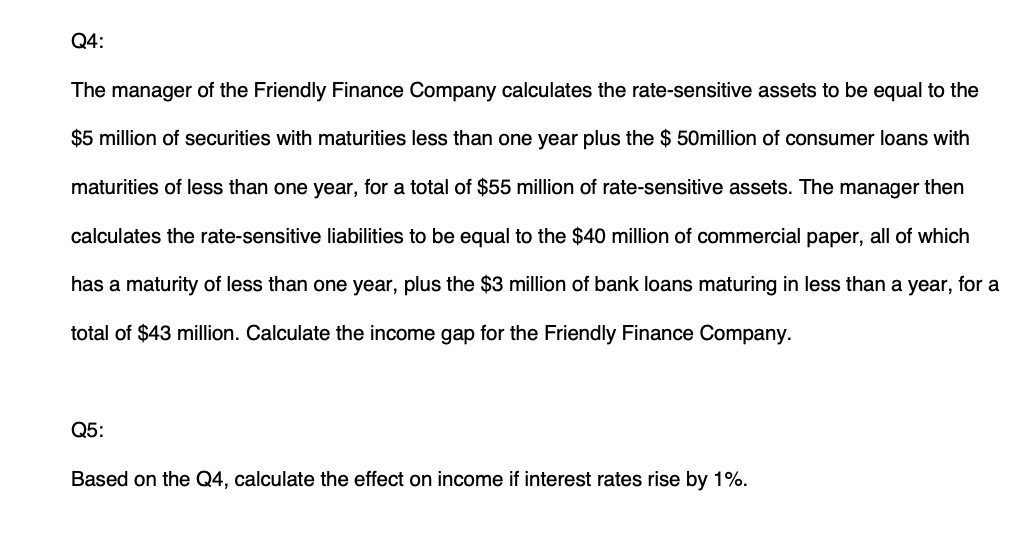

The Friendly Finance Company has the following balance sheet: 1 to 2 years Friendly Finance Company Assets Liabilities Cash and deposits $3 million Commercial paper $40 million Securities Bank loans Less than 1 year $5 million Less than 1 year $3 million $1 million 1 to 2 years $2 million Greater than 2 years $1 million Greater than 2 years $5 million Consumer loans Long-term bonds and Less than 1 year $50 million other long-term debt $40 million $20 million Capital $10 million Greater than 2 years $15 million Physical capital $5 million Total $100 million Total $100 million 1 to 2 years Q4: The manager of the Friendly Finance Company calculates the rate-sensitive assets to be equal to the $5 million of securities with maturities less than one year plus the $ 50million of consumer loans with maturities of less than one year, for a total of $55 million of rate-sensitive assets. The manager then calculates the rate-sensitive liabilities to be equal to the $40 million of commercial paper, all of which has a maturity of less than one year, plus the $3 million of bank loans maturing in less than a year, for a total of $43 million. Calculate the income gap for the Friendly Finance Company. Q5: Based on the Q4, calculate the effect on income if interest rates rise by 1%. The Friendly Finance Company has the following balance sheet: 1 to 2 years Friendly Finance Company Assets Liabilities Cash and deposits $3 million Commercial paper $40 million Securities Bank loans Less than 1 year $5 million Less than 1 year $3 million $1 million 1 to 2 years $2 million Greater than 2 years $1 million Greater than 2 years $5 million Consumer loans Long-term bonds and Less than 1 year $50 million other long-term debt $40 million $20 million Capital $10 million Greater than 2 years $15 million Physical capital $5 million Total $100 million Total $100 million 1 to 2 years Q4: The manager of the Friendly Finance Company calculates the rate-sensitive assets to be equal to the $5 million of securities with maturities less than one year plus the $ 50million of consumer loans with maturities of less than one year, for a total of $55 million of rate-sensitive assets. The manager then calculates the rate-sensitive liabilities to be equal to the $40 million of commercial paper, all of which has a maturity of less than one year, plus the $3 million of bank loans maturing in less than a year, for a total of $43 million. Calculate the income gap for the Friendly Finance Company. Q5: Based on the Q4, calculate the effect on income if interest rates rise by 1%