Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the full question waa already provided, please help me with question, i dont want to pay you $3.00 more per question. I've paid for help

the full question waa already provided, please help me with question, i dont want to pay you $3.00 more per question. I've paid for help through Chegg.

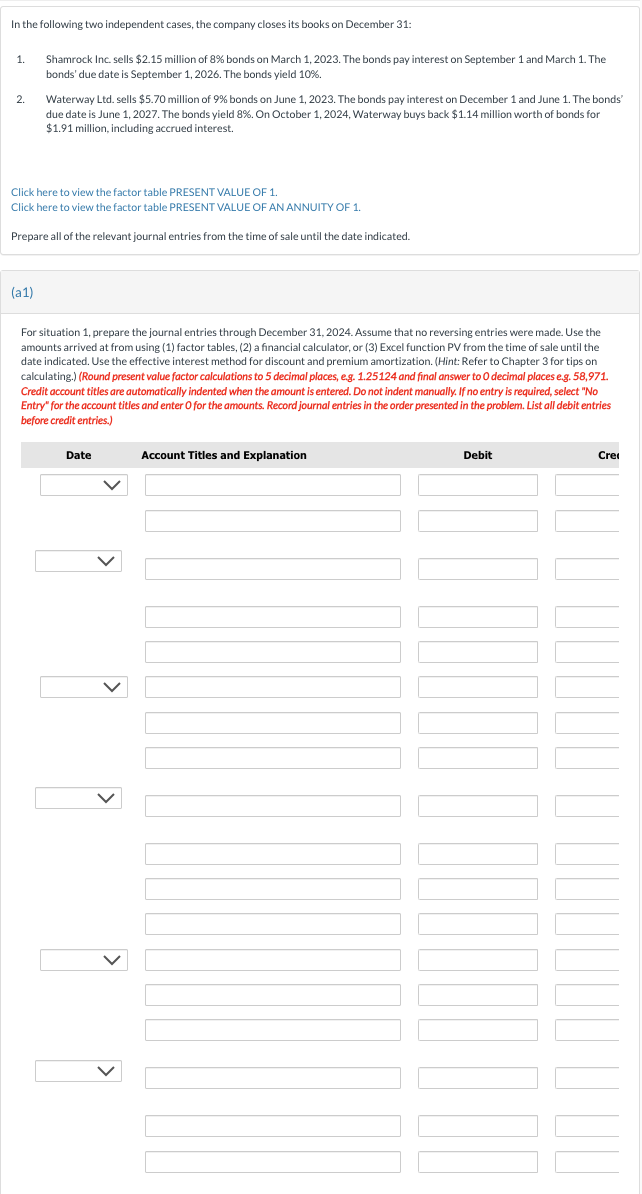

In the following two independent cases, the company closes its books on December 31: 1. Shamrock Inc. sells $2.15 million of 8% bonds on March 1, 2023. The bonds pay interest on September 1 and March 1. The bonds' due date is September 1, 2026. The bonds yield 10%. 2. Waterway Ltd. sells $5.70 million of 9% bonds on June 1,2023 . The bonds pay interest on December 1 and June 1 . The bonds' due date is June 1,2027 . The bonds yield 8%. On October 1,2024 , Waterway buys back $1.14 million worth of bonds for $1.91 million, including accrued interest. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare all of the relevant journal entries from the time of sale until the date indicated. (a1) For situation 1, prepare the journal entries through December 31, 2024. Assume that no reversing entries were made. Use the amounts arrived at from using (1) factor tables, (2) a financial calculator, or (3) Excel function PV from the time of sale until the date indicated. Use the effective interest method for discount and premium amortization. (Hint: Refer to Chapter 3 for tips on calculating.) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places e.g. 58,971 . Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started