Question

The Fulton Company is establishing a line of credit with its bank. The line of credit will have a nominal interest rate of 4.74% and

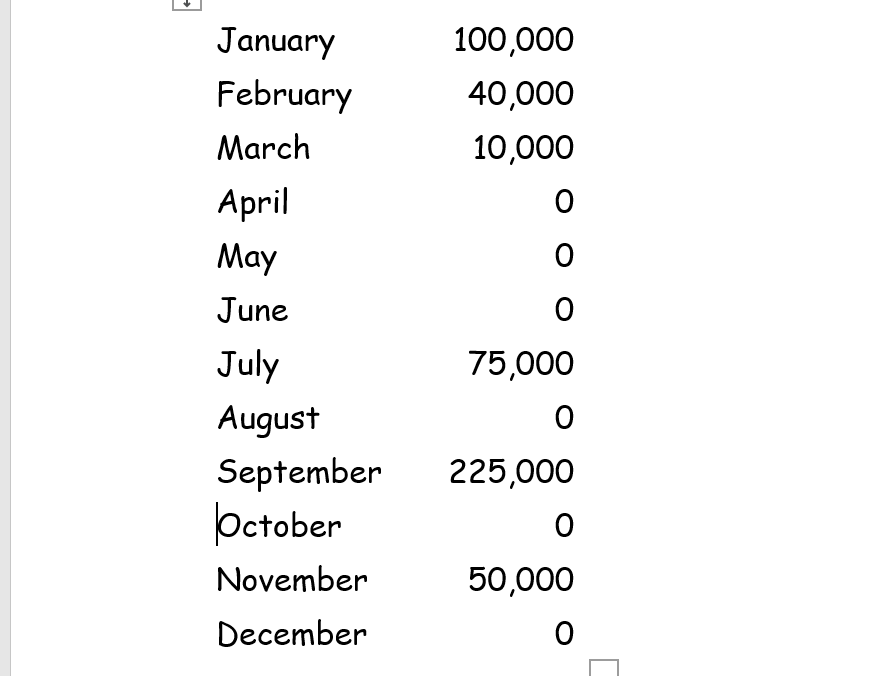

The Fulton Company is establishing a line of credit with its bank. The line of credit will have a nominal interest rate of 4.74% and require compensating balances of 10% on the amount borrowed and 3% on the size of the line of credit. Fulton forecasts the following deficits for the next 12 months:

The commitment fee (based on the unused portion of the line of credit) is 0.35%. Fulton realizes that the deficit estimates are not known with certainty. Thus, the company will set up the credit line such that it can borrow up to 30% more than it largest expected deficit. Answer the following questions and show all your work.

- Based on the terms given by the lender, what should the size of the line of credit be?

- What is the effective rate of the line of credit?

- What is the dollar cost to Fulton for including the 30% buffer?

- Suppose that the lender will apply $4,000 of idle balances that Fulton has in other accounts with the bank toward the required compensating balances. What should the size of the line of credit be if you include the idle balances? What is the effective rate?

January February March April May June July August September October November December 100,000 40,000 10,000 0 0 75,000 0 225,000 0 50,000 0

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 the line of the credit is an account that lets you the borrow money when you need it up to a prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started