Question

The Fund invests, under normal circumstances, at least 80%of its assets in equity securities of non-U.S. companies that meet certain financial and environmental, social, and

The Fund invests, under normal circumstances, at least 80%of its assets in equity securities of non-U.S. companies that meet certain financial and environmental, social, and governance ("ESG") criteria. The Fund's 80% policy is a non-fundamental investment policy that can be changed by the Fund upon 60 days' prior notice to shareholders. Equity securities include common stocks, preferred stocks, convertible securities, depositary receipts such as American Depositary Receipts ("ADRs"), Global Depositary Receipts ("GDRs") and European Depositary Receipts ("EDRs"), and interests in other investment companies, including exchange-traded funds ("ETFs") that invest in equity securities.

Benchmark: MSCI All Country World Ex-USA Index

The Fund invests, under normal circumstances, at least 80% of its assets in equity securities of U.S. and nonU.S. companies that meet certain financial and environmental, social, and governance ("ESG") criteria. The Fund's 80% policy is a non-fundamental investment policy that can be changed by the Fund upon 60 days' prior notice to shareholders. Equity securities include common stocks, preferred stocks, convertible securities, depositary receipts such as American Depositary Receipts ("ADRs"), Global Depositary Receipts ("GDRs") and European Depositary Receipts ("EDRs"), and interests in other investment companies, including exchange-traded funds ("ETFs") that invest in equity securities. The Fund's sub-advisor, Rockefeller & Co., LLC ("Rockefeller"), selects investments for the Fund based on an evaluation of a company's financial condition and its ESG practices. Rockefeller applies "bottom-up" security analysis that includes fundamental, sector-based research in seeking to identify businesses that have high or improving returns on capital, barriers to competition, and compelling valuations. Rockefeller's ESG evaluation considers ESG criteria such as corporate governance practices, product quality and safety, workplace diversity practices, environmental impact and sustainability, community investment and development, and human rights record. The Fund invests in securities of any size, but generally focuses on larger, more established companies. The Fund invests primarily in securities of companies domiciled in developed markets, but may invest up to 30% of its net assets in securities of companies domiciled in emerging and frontier markets. Emerging markets are defined as those countries not included in the MSCI World Index, a developed market index. As of June 30, 2021, the countries in the MSCI World Index included: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The country composition of the MSCI World Index can change over time. Frontier markets are those emerging market countries that have the smallest, least mature economies and least developed capital markets.

Assignment:

Read through the investment objectives for the fund above. Discuss in detail:

1. The nature of the ESG objectives and how the fund pursues them.

2. How would you characterize the fund's approach? What do you think of the approach? Does the discussion give you sufficient information to understand how individual stocks are chosen?

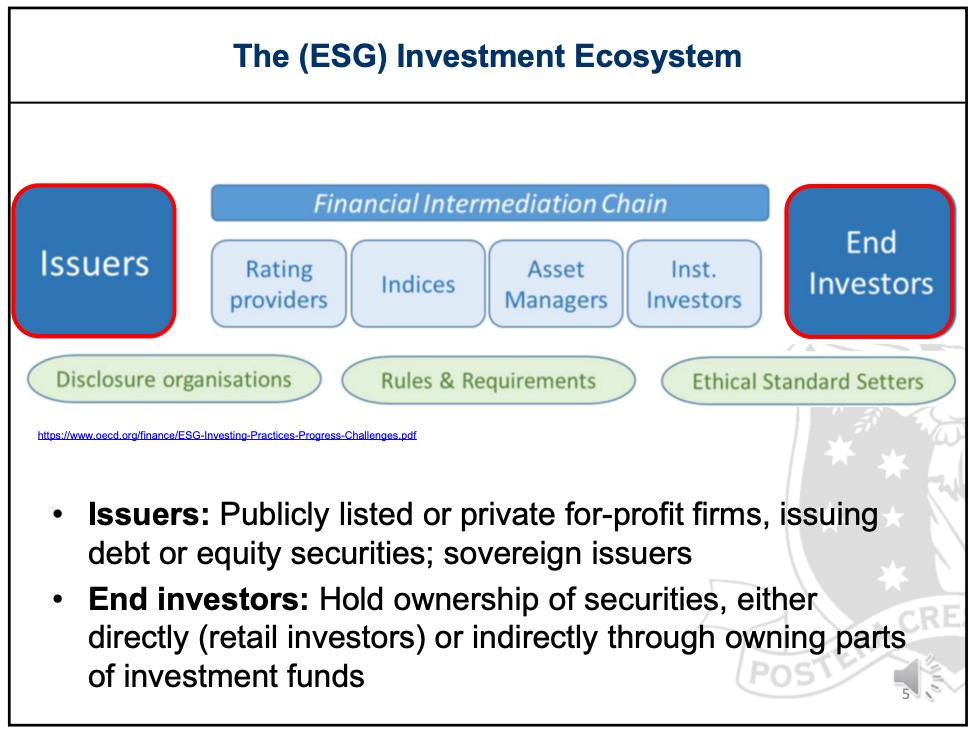

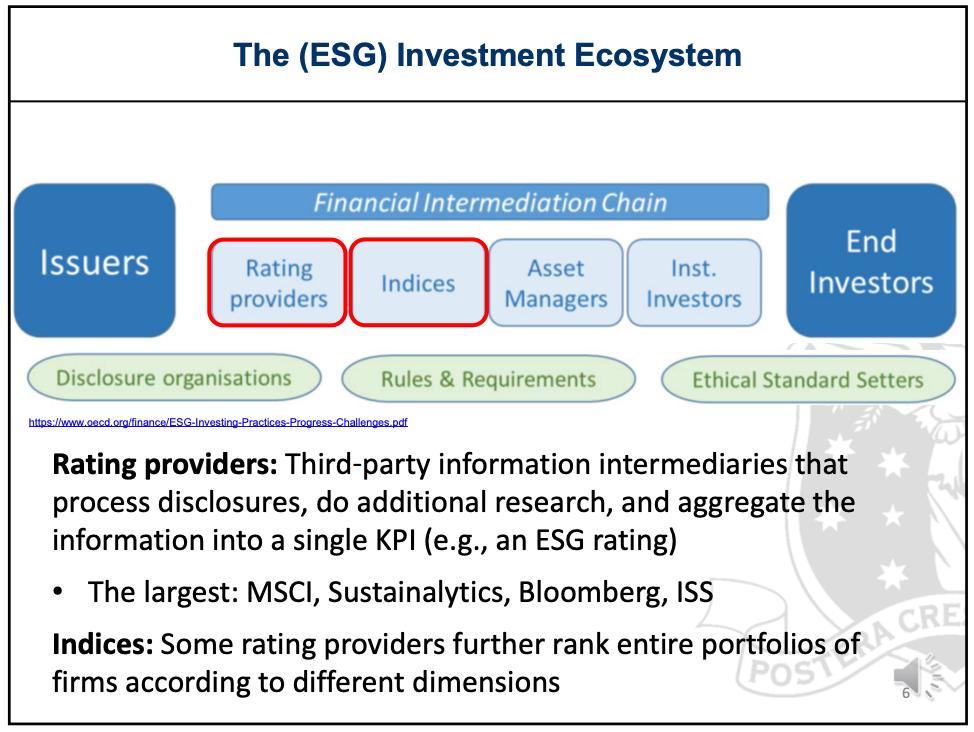

Issuers The (ESG) Investment Ecosystem Disclosure organisations Financial Intermediation Chain Rating providers Indices https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf Asset Inst. Managers Investors Rules & Requirements End Investors Ethical Standard Setters Issuers: Publicly listed or private for-profit firms, issuing debt or equity securities; sovereign issuers End investors: Hold ownership of securities, either directly (retail investors) or indirectly through owning parts of investment funds CRE ping pa

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The Fund invests under normal circumstances at least 80of its as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started