The FY2022 income statement for ABC Company is provided below. Use the following assumptions to forecast ABC's income statement for FY2023: Net sales will

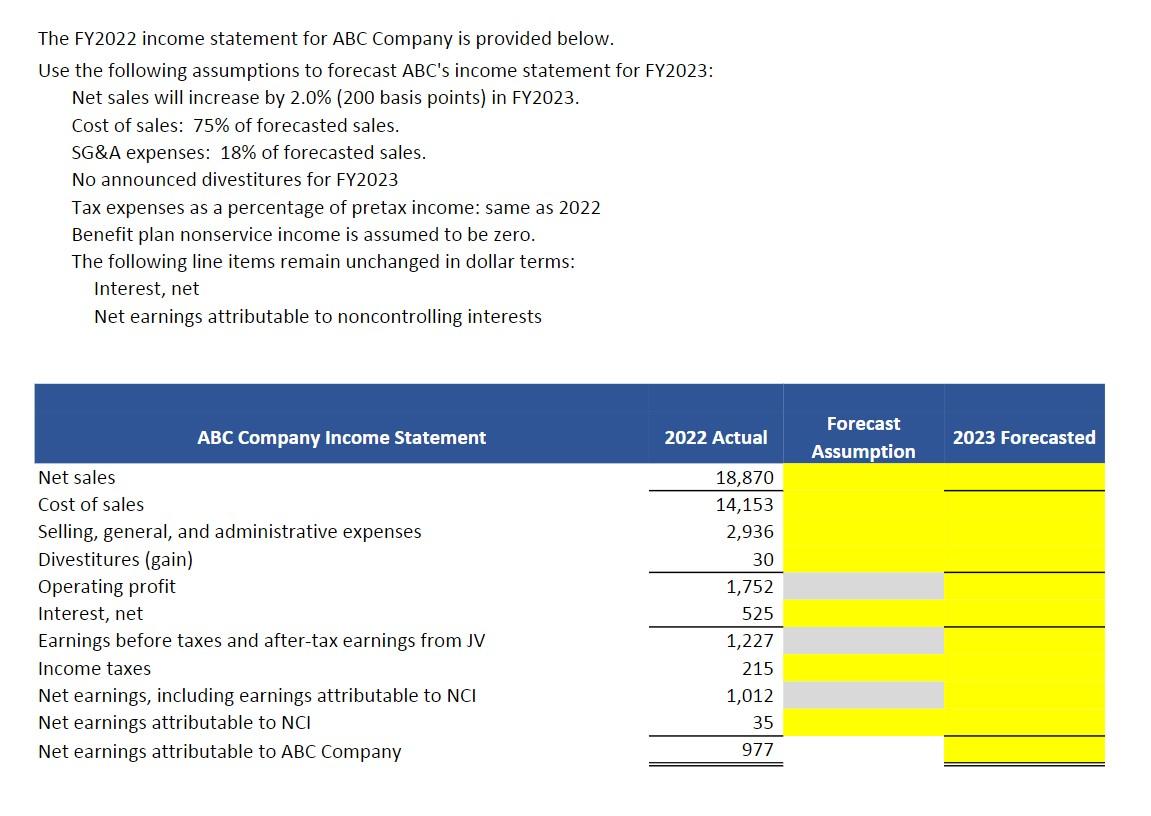

The FY2022 income statement for ABC Company is provided below. Use the following assumptions to forecast ABC's income statement for FY2023: Net sales will increase by 2.0% (200 basis points) in FY2023. Cost of sales: 75% of forecasted sales. SG&A expenses: 18% of forecasted sales. No announced divestitures for FY2023 Tax expenses as a percentage of pretax income: same as 2022 Benefit plan nonservice income is assumed to be zero. The following line items remain unchanged in dollar terms: Interest, net Net earnings attributable to noncontrolling interests ABC Company Income Statement Net sales Cost of sales Selling, general, and administrative expenses Divestitures (gain) Operating profit Interest, net Earnings before taxes and after-tax earnings from JV Income taxes Net earnings, including earnings attributable to NCI Net earnings attributable to NCI Net earnings attributable to ABC Company 2022 Actual 18,870 14,153 2,936 30 1,752 525 1,227 215 1,012 35 977 Forecast Assumption 2023 Forecasted

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION FORCATED ABC s INCOME STSTEMENT FOR THE YEAR 202...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started