Answered step by step

Verified Expert Solution

Question

1 Approved Answer

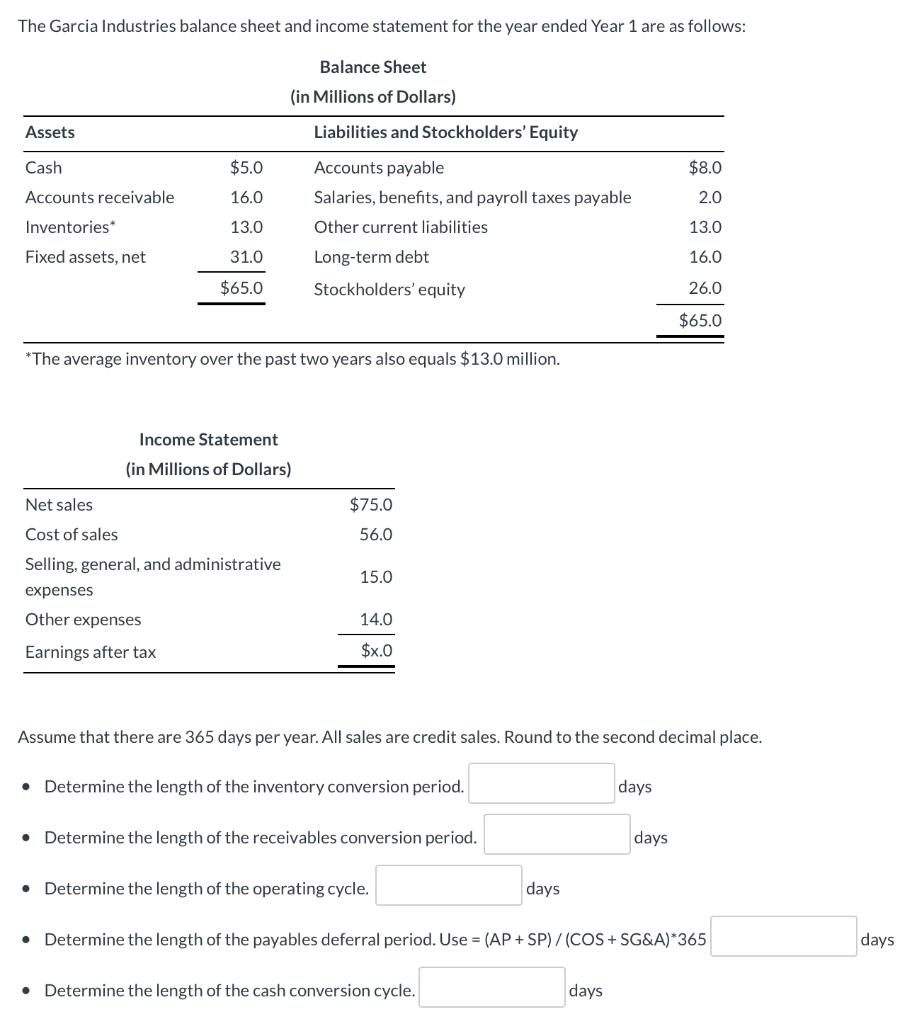

The Garcia Industries balance sheet and income statement for the year ended Year 1 are as follows: Balance Sheet (in Millions of Dollars) Assets

The Garcia Industries balance sheet and income statement for the year ended Year 1 are as follows: Balance Sheet (in Millions of Dollars) Assets Liabilities and Stockholders' Equity Cash $5.0 Accounts payable $8.0 Accounts receivable 16.0 Salaries, benefits, and payroll taxes payable 2.0 Inventories* 13.0 Other current liabilities 13.0 Fixed assets, net 31.0 Long-term debt 16.0 $65.0 Stockholders' equity 26.0 $65.0 *The average inventory over the past two years also equals $13.0 million. Income Statement (in Millions of Dollars) Net sales $75.0 Cost of sales 56.0 Selling, general, and administrative 15.0 expenses Other expenses 14.0 Earnings after tax $x.0 Assume that there are 365 days per year. All sales are credit sales. Round to the second decimal place. Determine the length of the inventory conversion period. Determine the length of the receivables conversion period. days days Determine the length of the operating cycle. days Determine the length of the payables deferral period. Use = (AP+SP)/(COS + SG&A)*365 Determine the length of the cash conversion cycle. days days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the various financial ratios and periods mentioned we need to use the following formula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started