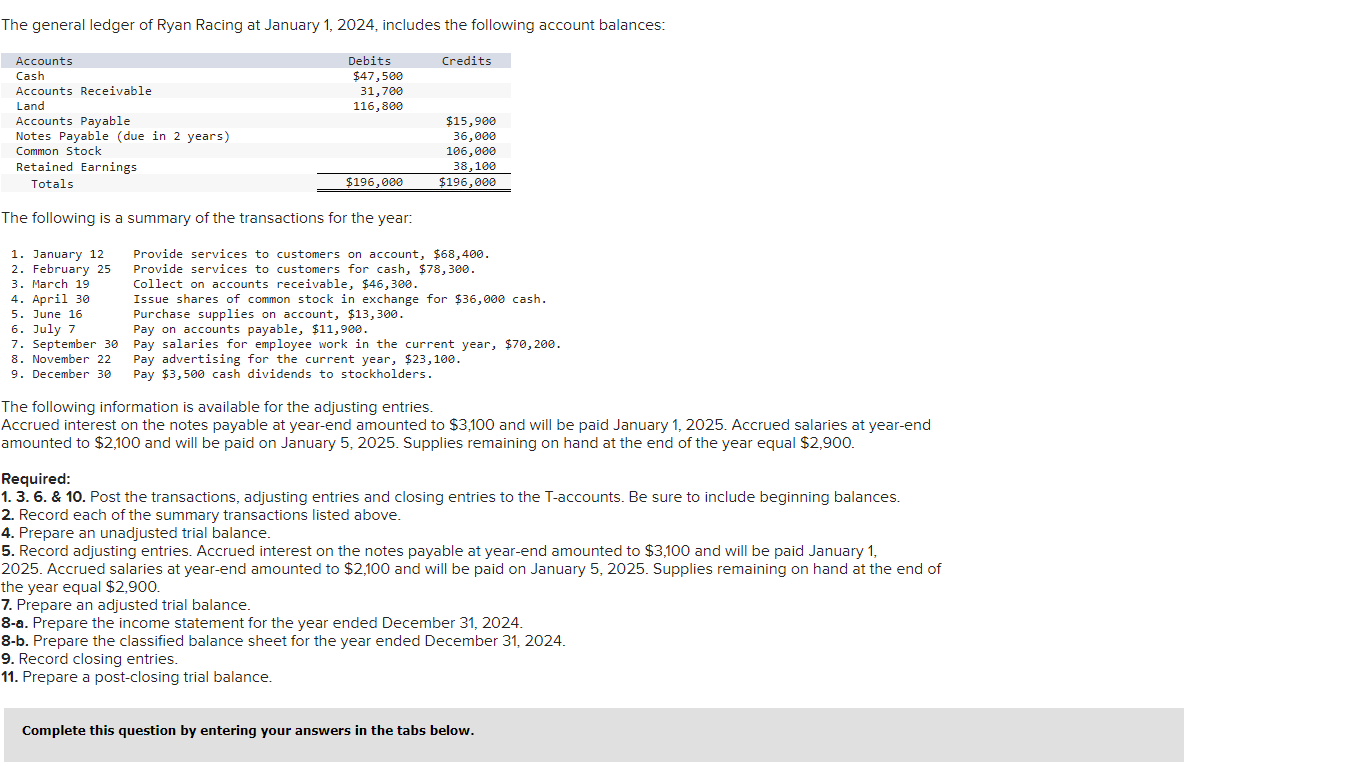

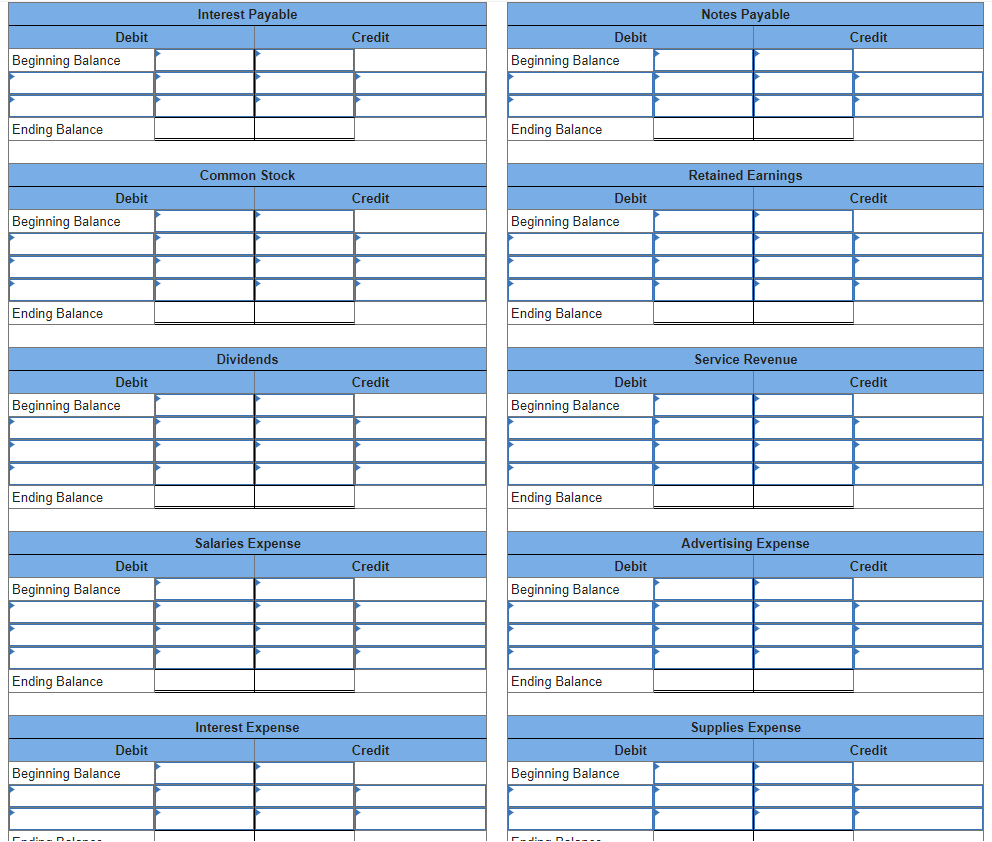

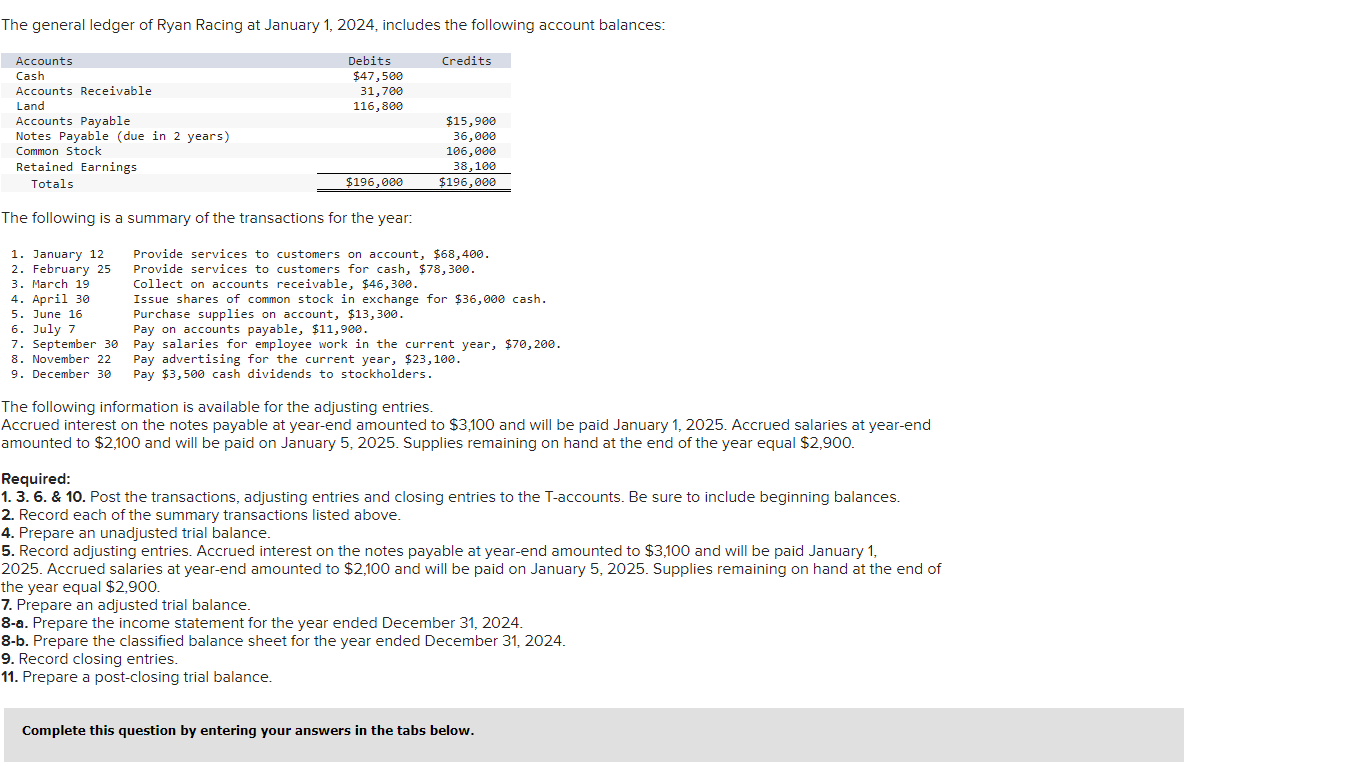

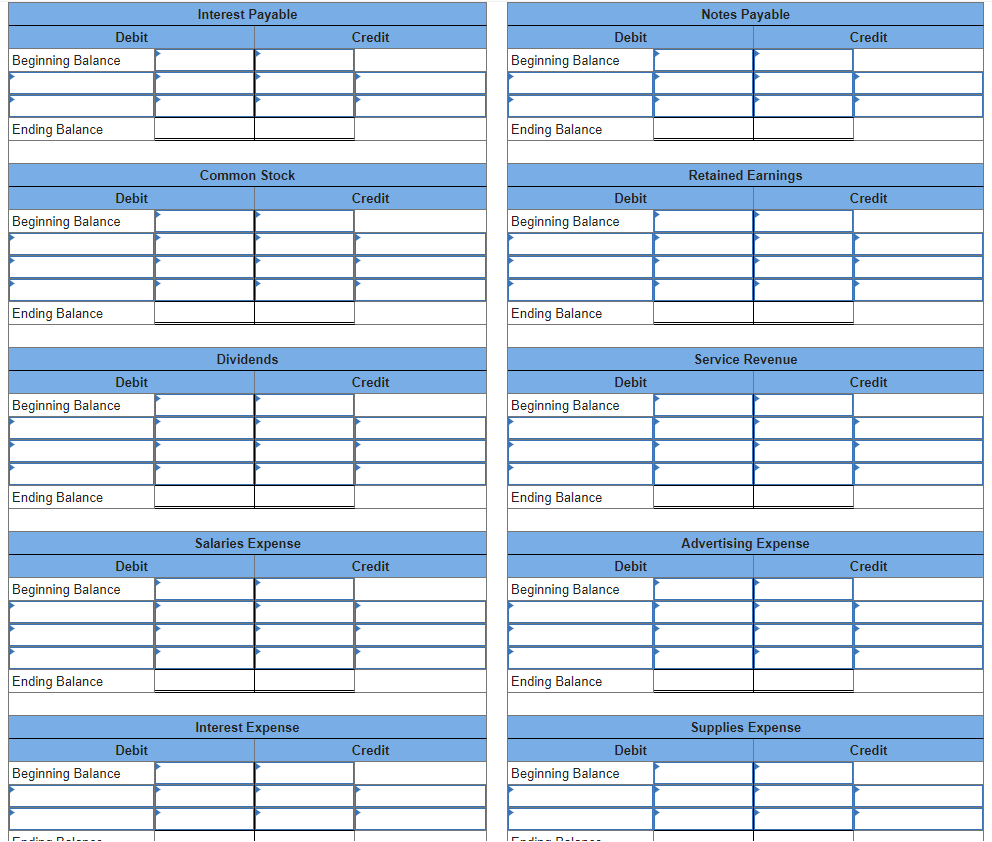

The general ledger of Ryan Racing at January 1, 2024, includes the following account balances: Credits Debits $47,500 31,700 116,800 Accounts Cash Accounts Receivable Land Accounts Payable Notes Payable (due in 2 years) Common Stock Retained Earnings Totals $15,900 36,000 106,000 38,100 $196,000 $196,000 The following is a summary of the transactions for the year: 1. January 12 Provide services to customers on account, $68,400. 2. February 25 Provide services to customers for cash, $78,300. 3. March 19 Collect on accounts receivable, $46,300. 4. April 30 Issue shares of common stock in exchange for $36,000 cash. 5. June 16 Purchase supplies on account, $13,300. 6. July 7 Pay on accounts payable, $11,900 7. September 30 Pay salaries for employee work in the current year, $70,200. 8. November 22 Pay advertising for the current year, $23,100. 9. December 30 Pay $3,500 cash dividends to stockholders. The following information is available for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $3,100 and will be paid January 1, 2025. Accrued salaries at year-end amounted to $2,100 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2,900. Required: 1. 3. 6. & 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. 2. Record each of the summary transactions listed above. 4. Prepare an unadjusted trial balance. 5. Record adjusting entries. Accrued interest on the notes payable at year-end amounted to $3,100 and will be paid January 1, 2025. Accrued salaries at year-end amounted to $2,100 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2,900. 7. Prepare an adjusted trial balance. 8-a. Prepare the income statement for the year ended December 31, 2024. 8-b. Prepare the classified balance sheet for the year ended December 31, 2024. 9. Record closing entries. 11. Prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Cash Accounts Receivable Credit Credit Debit Beginning Balance Debit Beginning Balance Ending Balance Ending Balance Supplies Land Credit Debit Credit Debit Beginning Balance Beginning Balance End. Bal. End. Bal. Accounts Payable Salaries Payable Credit Credit Debit Beginning Balance Debit Beginning Balance Ending Balance Ending Balance Interest Payable Notes Payable Credit Credit Debit Beginning Balance Debit Beginning Balance Ending Balance Ending Balance Interest Payable Notes Payable Credit Credit Debit Beginning Balance Debit Beginning Balance Ending Balance Ending Balance Common Stock Retained Earnings Credit Credit Debit Beginning Balance Debit Beginning Balance Ending Balance Ending Balance Dividends Service Revenue Credit Credit Debit Beginning Balance Debit Beginning Balance Ending Balance Ending Balance Salaries Expense Advertising Expense Credit Credit Debit Beginning Balance Debit Beginning Balance Ending Balance Ending Balance Interest Expense Supplies Expense Credit Credit Debit Beginning Balance Debit Beginning Balance ------- J-D-I