Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the following account balances: Account Title Cash Accounts receivable

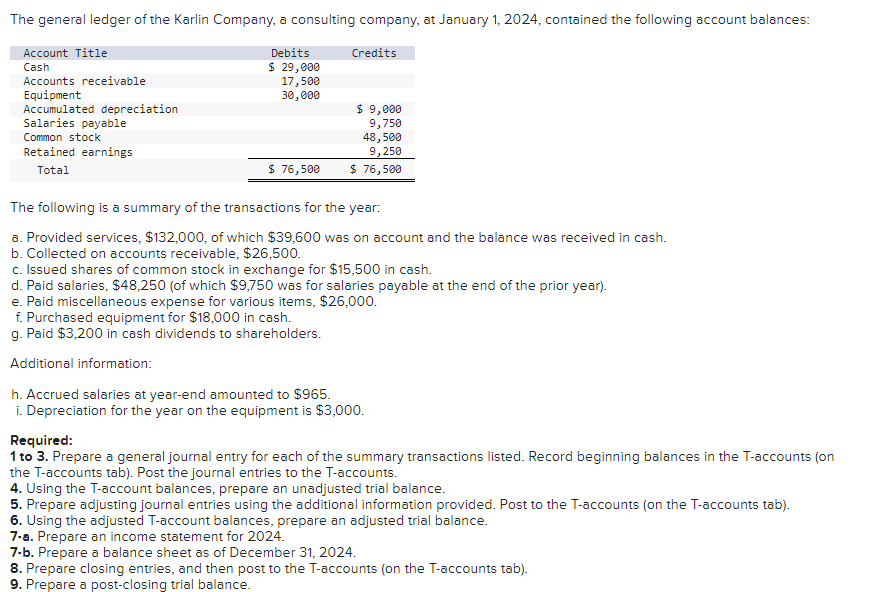

The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the following account balances: Account Title Cash Accounts receivable Equipment Accumulated depreciation Salaries payable Common stock Retained earnings Total Debits Credits $ 29,000 17,500 30,000 $ 9,000 9,750 48,500 9,250 $ 76,500 $ 76,500 The following is a summary of the transactions for the year: a. Provided services, $132,000, of which $39,600 was on account and the balance was received in cash. b. Collected on accounts receivable, $26,500. c. Issued shares of common stock in exchange for $15,500 in cash. d. Paid salaries, $48,250 (of which $9,750 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $26,000. f. Purchased equipment for $18,000 in cash. g. Paid $3,200 in cash dividends to shareholders. Additional information: h. Accrued salaries at year-end amounted to $965. i. Depreciation for the year on the equipment is $3,000. Required: 1 to 3. Prepare a general journal entry for each of the summary transactions listed. Record beginning balances in the T-accounts (on the T-accounts tab). Post the journal entries to the T-accounts. 4. Using the T-account balances, prepare an unadjusted trial balance. 5. Prepare adjusting journal entries using the additional information provided. Post to the T-accounts (on the T-accounts tab). 6. Using the adjusted T-account balances, prepare an adjusted trial balance. 7-a. Prepare an income statement for 2024. 7-b. Prepare a balance sheet as of December 31, 2024. 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). 9. Prepare a post-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started