Answered step by step

Verified Expert Solution

Question

1 Approved Answer

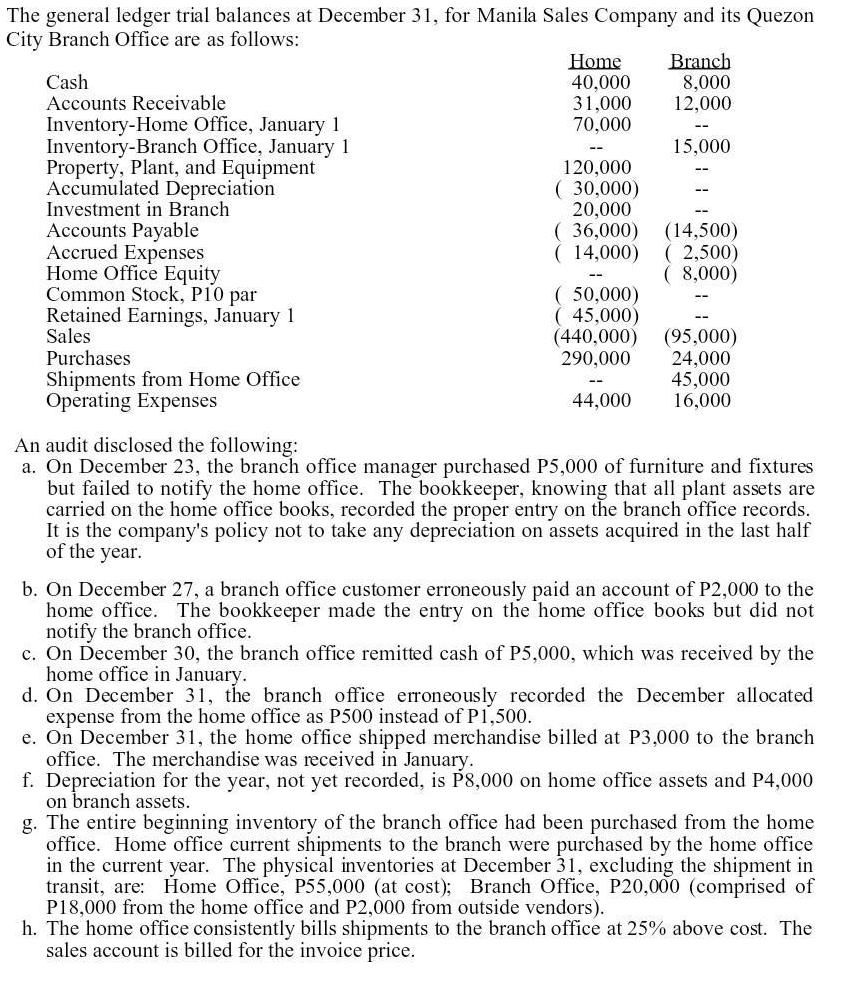

The general ledger trial balances at December 31, for Manila Sales Company and its Quezon City Branch Office are as follows: Cash Accounts Receivable

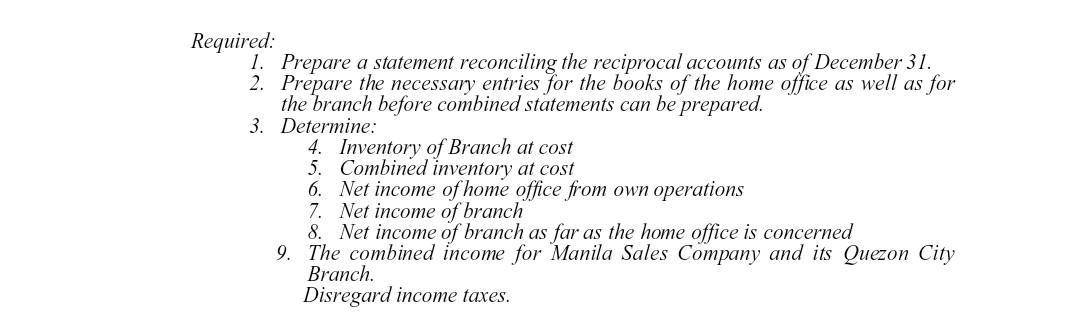

The general ledger trial balances at December 31, for Manila Sales Company and its Quezon City Branch Office are as follows: Cash Accounts Receivable Inventory-Home Office, January 1 Inventory-Branch Office, January 1 Property, Plant, and Equipment Accumulated Depreciation Investment in Branch. Accounts Payable Accrued Expenses Home Office Equity Common Stock, P10 par Retained Earnings, January 1 Sales Purchases Shipments from Home Office Operating Expenses Home 40,000 31,000 70,000 120,000 ( 30,000) 20,000 ( 36,000) ( 14,000) ( 50,000) ( 45,000) (440,000) 290,000 44,000 Branch 8,000 12,000 15,000 (14,500) (2,500) (8,000) (95,000) 24,000 45,000 16,000 An audit disclosed the following: a. On December 23, the branch office manager purchased P5,000 of furniture and fixtures but failed to notify the home office. The bookkeeper, knowing that all plant assets are carried on the home office books, recorded the proper entry on the branch office records. It is the company's policy not to take any depreciation on assets acquired in the last half of the year. b. On December 27, a branch office customer erroneously paid an account of P2,000 to the home office. The bookkeeper made the entry on the home office books but did not notify the branch office. c. On December 30, the branch office remitted cash of P5,000, which was received by the home office in January. d. On December 31, the branch office erroneously recorded the December allocated expense from the home office as P500 instead of P1,500. e. On December 31, the home office shipped merchandise billed at P3,000 to the branch office. The merchandise was received in January. f. Depreciation for the year, not yet recorded, is P8,000 on home office assets and P4,000 on branch assets. g. The entire beginning inventory of the branch office had been purchased from the home office. Home office current shipments to the branch were purchased by the home office in the current year. The physical inventories at December 31, excluding the shipment in transit, are: Home Office, P55,000 (at cost); Branch Office, P20,000 (comprised of P18,000 from the home office and P2,000 from outside vendors). h. The home office consistently bills shipments to the branch office at 25% above cost. The sales account is billed for the invoice price. Required: 1. Prepare a statement reconciling the reciprocal accounts as of December 31. 2. Prepare the necessary entries for the books of the home office as well as for the branch before combined statements can be prepared. 3. Determine: 4. Inventory of Branch at cost 5. Combined inventory at cost 6. Net income of home office from own operations 7. Net income of branch 8. Net income of branch as far as the home office is concerned 9. The combined income for Manila Sales Company and its Quezon City Branch. Disregard income taxes.

Step by Step Solution

★★★★★

3.60 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Financial Statements of Marmila Sales Company and Quezon City Branch Office As of December 31 2023 Balance Sheet Assets Home Office Branch Office Consolidated Current Assets Cash 40000 16...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started