Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The gift of the remainder interest in the land will increase the balance of CPS's land by 50%. To record the remainder interest in the

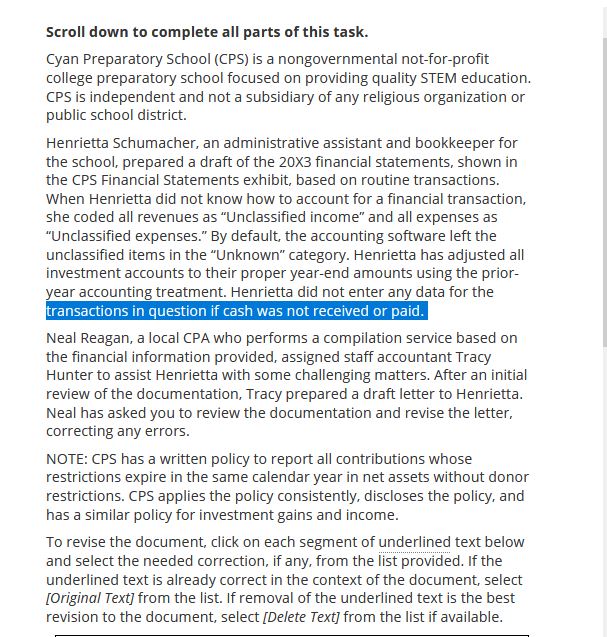

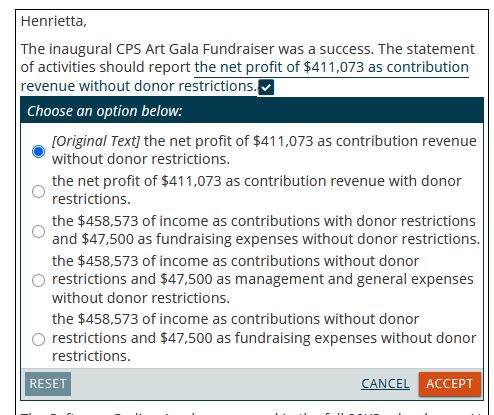

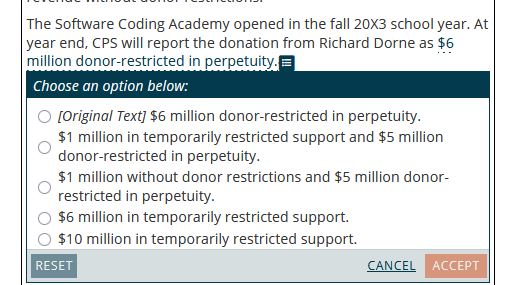

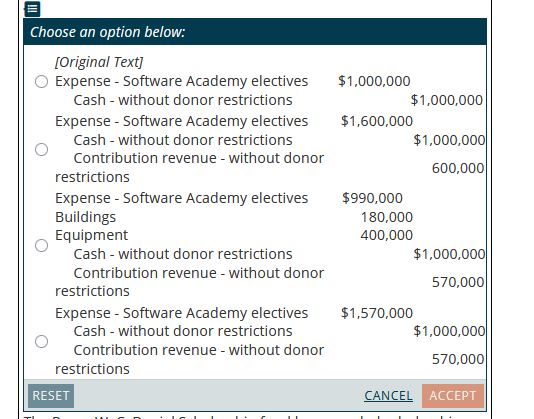

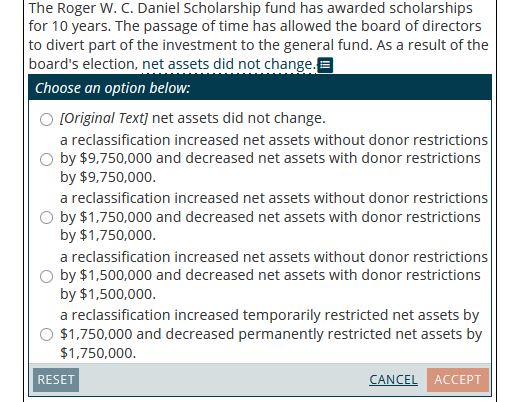

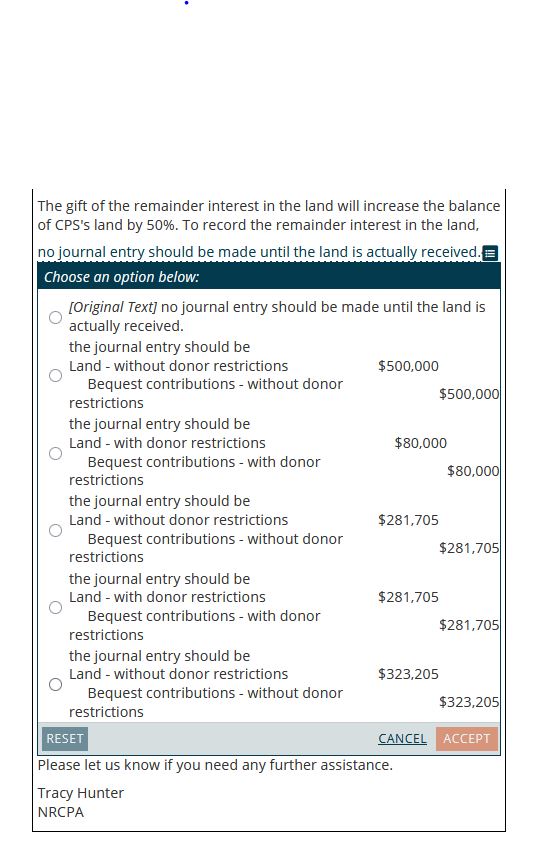

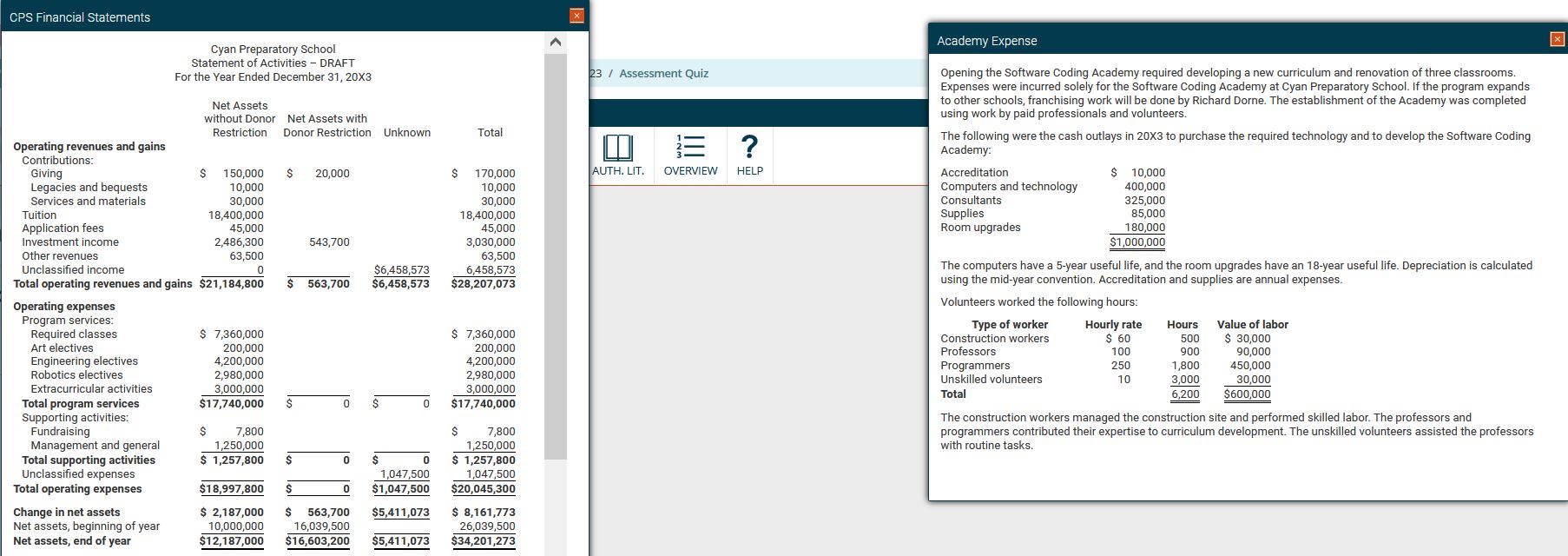

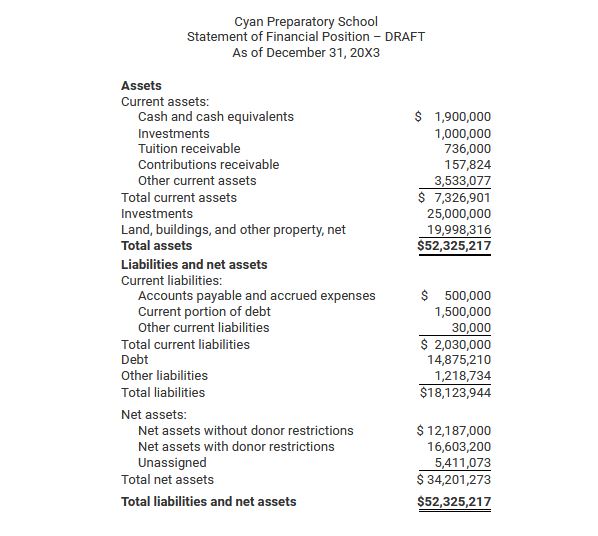

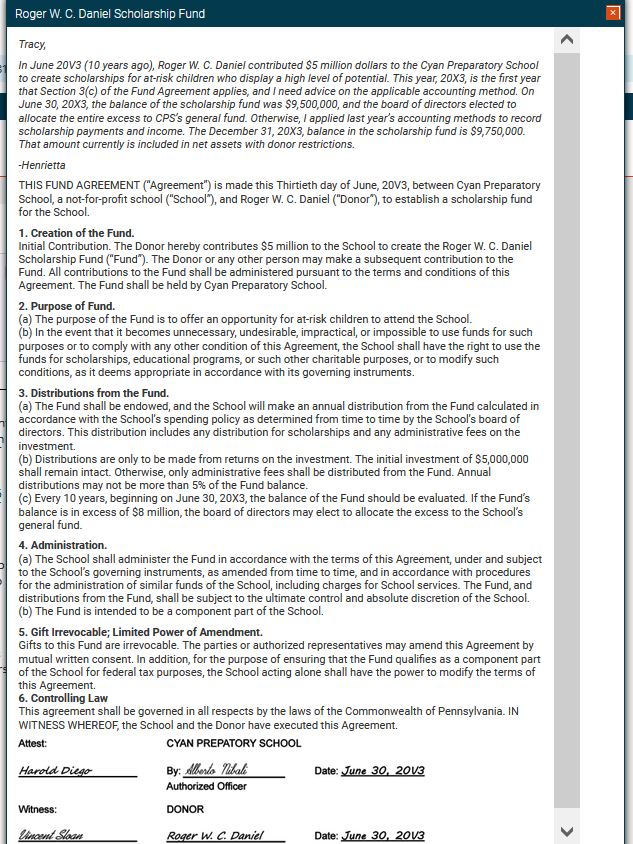

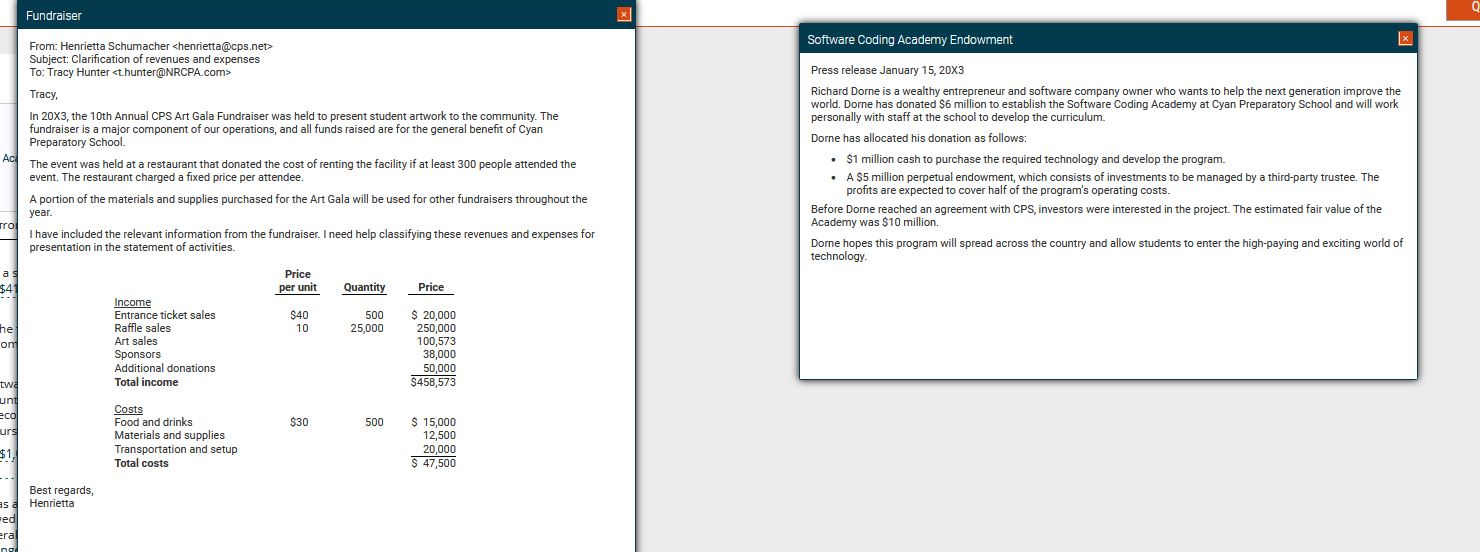

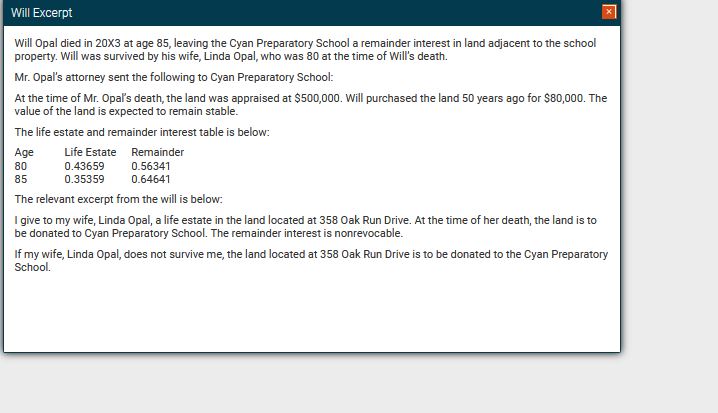

The gift of the remainder interest in the land will increase the balance of CPS's land by 50%. To record the remainder interest in the land, Opening the Software Coding Academy required developing a new curriculum and renovation of three classrooms. Expenses were incurred solely for the Software Coding Academy at Cyan Preparatory School. If the program expands to other schools, franchising work will be done by Richard Dorne. The establishment of the Academy was completed using work by paid professionals and volunteers. The following were the cash outlays in 203 to purchase the required technology and to develop the Software Coding Academy: The computers have a 5-year useful life, and the room upgrades have an 18-year useful life. Depreciation is calculated using the mid-year convention. Accreditation and supplies are annual expenses. Volunteers worked the following hours: The construction workers managed the construction site and performed skilled labor. The professors and programmers contributed their expertise to curriculum development. The unskilled volunteers assisted the professors with routine tasks. From: Henrietta Schumacher Subject: Clarification of revenues and expenses To: Tracy Hunter Tracy, In 20X3, the 10th Annual CPS Art Gala Fundraiser was held to present student artwork to the community. The fundraiser is a major component of our operations, and all funds raised are for the general benefit of Cyan Preparatory School. The event was held at a restaurant that donated the cost of renting the facility if at least 300 people attended the event. The restaurant charged a fixed price per attendee. A portion of the materials and supplies purchased for the Art Gala will be used for other fundraisers throughout the year. I have included the relevant information from the fundraiser. I need help classifying these revenues and expenses for presentation in the statement of activities. Software Coding Academy Endowment Press release January 15,203 Richard Dorne is a wealthy entrepreneur and software company owner who wants to help the next generation improve the world. Dorne has donated \$6 million to establish the Software Coding Academy at Cyan Preparatory School and will work personally with staff at the school to develop the curriculum. Dorne has allocated his donation as follows: - \$1 million cash to purchase the required technology and develop the program. - A$5 million perpetual endowment, which consists of investments to be managed by a third-party trustee. The profits are expected to cover half of the program's operating costs. Before Dorne reached an agreement with CPS, investors were interested in the project. The estimated fair value of the Academy was $10 million. Dorne hopes this program will spread across the country and allow students to enter the high-paying and exciting world of technology. Henrietta, The inaugural CPS Art Gala Fundraiser was a success. The statement of activities should report the net profit of $411,073 as contribution revenue without donor restrictions. Choose an option below: [Original Text] the net profit of $411,073 as contribution revenue without donor restrictions. the net profit of $411,073 as contribution revenue with donor restrictions. the $458,573 of income as contributions with donor restrictions and $47,500 as fundraising expenses without donor restrictions. the $458,573 of income as contributions without donor restrictions and $47,500 as management and general expenses without donor restrictions. the $458,573 of income as contributions without donor restrictions and $47,500 as fundraising expenses without donor restrictions. The Roger W. C. Daniel Scholarship fund has awarded scholarships for 10 years. The passage of time has allowed the board of directors to divert part of the investment to the general fund. As a result of the board's election, net assets did not change. Choose an option below: [Original Text] net assets did not change. a reclassification increased net assets without donor restrictions by $9,750,000 and decreased net assets with donor restrictions by $9,750,000. a reclassification increased net assets without donor restrictions by $1,750,000 and decreased net assets with donor restrictions by $1,750,000. a reclassification increased net assets without donor restrictions by $1,500,000 and decreased net assets with donor restrictions by $1,500,000. a reclassification increased temporarily restricted net assets by $1,750,000 and decreased permanently restricted net assets by $1,750,000. CANCEL Scroll down to complete all parts of this task. Cyan Preparatory School (CPS) is a nongovernmental not-for-profit college preparatory school focused on providing quality STEM education. CPS is independent and not a subsidiary of any religious organization or public school district. Henrietta Schumacher, an administrative assistant and bookkeeper for the school, prepared a draft of the 203 financial statements, shown in the CPS Financial Statements exhibit, based on routine transactions. When Henrietta did not know how to account for a financial transaction, she coded all revenues as "Unclassified income" and all expenses as "Unclassified expenses." By default, the accounting software left the unclassified items in the "Unknown" category. Henrietta has adjusted all investment accounts to their proper year-end amounts using the prioryear accounting treatment. Henrietta did not enter any data for the transactions in question if cash was not received or paid. Neal Reagan, a local CPA who performs a compilation service based on the financial information provided, assigned staff accountant Tracy Hunter to assist Henrietta with some challenging matters. After an initial review of the documentation, Tracy prepared a draft letter to Henrietta. Neal has asked you to review the documentation and revise the letter, correcting any errors. NOTE: CPS has a written policy to report all contributions whose restrictions expire in the same calendar year in net assets without donor restrictions. CPS applies the policy consistently, discloses the policy, and has a similar policy for investment gains and income. To revise the document, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original Text] from the list. If removal of the underlined text is the best revision to the document, select [Delete Text] from the list if available. Will Opal died in 203 at age 85 , leaving the Cyan Preparatory School a remainder interest in land adjacent to the school property. Will was survived by his wife, Linda Opal, who was 80 at the time of Will's death. Mr. Opal's attorney sent the following to Cyan Preparatory School: At the time of Mr. Opal's death, the land was appraised at $500,000. Will purchased the land 50 years ago for $80,000. The value of the land is expected to remain stable. The life estate and remainder interest table is below: The relevant excerpt from the will is below: I give to my wife, Linda Opal, a life estate in the land located at 358 Oak Run Drive. At the time of her death, the land is to be donated to Cyan Preparatory School. The remainder interest is nonrevocable. If my wife, Linda Opal, does not survive me, the land located at 358 Oak Run Drive is to be donated to the Cyan Preparatory School. The Software Coding Academy opened in the fall 203 school year. At year end, CPS will report the donation from Richard Dorne as $6 million donor-restricted in perpetuity. Choose an option below: [Original Text] \$6 million donor-restricted in perpetuity. $1 million in temporarily restricted support and $5 million donor-restricted in perpetuity. $1 million without donor restrictions and $5 million donorrestricted in perpetuity. $6 million in temporarily restricted support. $10 million in temporarily restricted support. Cyan Preparatory School Statement of Financial Position - DRAFT As of December 31,203 The Software Coding Academy opened in the fall 203 school year. At year end, CPS will report the donation from Richard Dorne as $6 million donor-restricted in perpetuity. Choose an option below: [Original Text] $6 million donor-restricted in perpetuity. $1 million in temporarily restricted support and $5 million donor-restricted in perpetuity. $1 million without donor restrictions and $5 million donorrestricted in perpetuity. $6 million in temporarily restricted support. $10 million in temporarily restricted support. Tracy, In June 20V3 (10 years ago), Roger W. C. Daniel contributed \$5 million dollars to the Cyan Preparatory School to create scholarships for at-risk children who display a high level of potential. This year, 20X3, is the first year that Section 3(c) of the Fund Agreement applies, and I need advice on the applicable accounting method. On June 30,203, the balance of the scholarship fund was $9,500,000, and the board of directors elected to allocate the entire excess to CPS's general fund. Otherwise, I applied last year's accounting methods to record scholarship payments and income. The December 31,20X3, balance in the scholarship fund is $9,750,000. That amount currently is included in net assets with donor restrictions. -Henrietta THIS FUND AGREEMENT ("Agreement") is made this Thirtieth day of June, 20V3, between Cyan Preparatory School, a not-for-profit school ("School"), and Roger W. C. Daniel ("Donor"), to establish a scholarship fund for the School. 1. Creation of the Fund. Initial Contribution. The Donor hereby contributes \$5 million to the School to create the Roger W. C. Daniel Scholarship Fund ("Fund"). The Donor or any other person may make a subsequent contribution to the Fund. All contributions to the Fund shall be administered pursuant to the terms and conditions of this Agreement. The Fund shall be held by Cyan Preparatory School. 2. Purpose of Fund. (a) The purpose of the Fund is to offer an opportunity for at-risk children to attend the School. (b) In the event that it becomes unnecessary, undesirable, impractical, or impossible to use funds for such purposes or to comply with any other condition of this Agreement, the School shall have the right to use the funds for scholarships, educational programs, or such other charitable purposes, or to modify such conditions, as it deems appropriate in accordance with its governing instruments. 3. Distributions from the Fund. (a) The Fund shall be endowed, and the School will make an annual distribution from the Fund calculated in accordance with the School's spending policy as determined from time to time by the School's board of directors. This distribution includes any distribution for scholarships and any administrative fees on the investment. (b) Distributions are only to be made from returns on the investment. The initial investment of $5,000,000 shall remain intact. Otherwise, only administrative fees shall be distributed from the Fund. Annual distributions may not be more than 5% of the Fund balance. (c) Every 10 years, beginning on June 30,20X3, the balance of the Fund should be evaluated. If the Fund's balance is in excess of $8 million, the board of directors may elect to allocate the excess to the School's general fund. 4. Administration. (a) The School shall administer the Fund in accordance with the terms of this Agreement, under and subject to the School's governing instruments, as amended from time to time, and in accordance with procedures for the administration of similar funds of the School, including charges for School services. The Fund, and distributions from the Fund, shall be subject to the ultimate control and absolute discretion of the School. (b) The Fund is intended to be a component part of the School. 5. Gift Irrevocable; Limited Power of Amendment. Gifts to this Fund are irrevocable. The parties or authorized representatives may amend this Agreement by mutual written consent. In addition, for the purpose of ensuring that the Fund qualifies as a component part of the School for federal tax purposes, the School acting alone shall have the power to modify the terms of this Agreement. 6. Controlling Law This agreement shall be governed in all respects by the laws of the Commonwealth of Pennsylvania. IN WITNESS WHEREOF, the School and the Donor have executed this Agreement. Attest: CYAN PREPATORY SCHOOL

The gift of the remainder interest in the land will increase the balance of CPS's land by 50%. To record the remainder interest in the land, Opening the Software Coding Academy required developing a new curriculum and renovation of three classrooms. Expenses were incurred solely for the Software Coding Academy at Cyan Preparatory School. If the program expands to other schools, franchising work will be done by Richard Dorne. The establishment of the Academy was completed using work by paid professionals and volunteers. The following were the cash outlays in 203 to purchase the required technology and to develop the Software Coding Academy: The computers have a 5-year useful life, and the room upgrades have an 18-year useful life. Depreciation is calculated using the mid-year convention. Accreditation and supplies are annual expenses. Volunteers worked the following hours: The construction workers managed the construction site and performed skilled labor. The professors and programmers contributed their expertise to curriculum development. The unskilled volunteers assisted the professors with routine tasks. From: Henrietta Schumacher Subject: Clarification of revenues and expenses To: Tracy Hunter Tracy, In 20X3, the 10th Annual CPS Art Gala Fundraiser was held to present student artwork to the community. The fundraiser is a major component of our operations, and all funds raised are for the general benefit of Cyan Preparatory School. The event was held at a restaurant that donated the cost of renting the facility if at least 300 people attended the event. The restaurant charged a fixed price per attendee. A portion of the materials and supplies purchased for the Art Gala will be used for other fundraisers throughout the year. I have included the relevant information from the fundraiser. I need help classifying these revenues and expenses for presentation in the statement of activities. Software Coding Academy Endowment Press release January 15,203 Richard Dorne is a wealthy entrepreneur and software company owner who wants to help the next generation improve the world. Dorne has donated \$6 million to establish the Software Coding Academy at Cyan Preparatory School and will work personally with staff at the school to develop the curriculum. Dorne has allocated his donation as follows: - \$1 million cash to purchase the required technology and develop the program. - A$5 million perpetual endowment, which consists of investments to be managed by a third-party trustee. The profits are expected to cover half of the program's operating costs. Before Dorne reached an agreement with CPS, investors were interested in the project. The estimated fair value of the Academy was $10 million. Dorne hopes this program will spread across the country and allow students to enter the high-paying and exciting world of technology. Henrietta, The inaugural CPS Art Gala Fundraiser was a success. The statement of activities should report the net profit of $411,073 as contribution revenue without donor restrictions. Choose an option below: [Original Text] the net profit of $411,073 as contribution revenue without donor restrictions. the net profit of $411,073 as contribution revenue with donor restrictions. the $458,573 of income as contributions with donor restrictions and $47,500 as fundraising expenses without donor restrictions. the $458,573 of income as contributions without donor restrictions and $47,500 as management and general expenses without donor restrictions. the $458,573 of income as contributions without donor restrictions and $47,500 as fundraising expenses without donor restrictions. The Roger W. C. Daniel Scholarship fund has awarded scholarships for 10 years. The passage of time has allowed the board of directors to divert part of the investment to the general fund. As a result of the board's election, net assets did not change. Choose an option below: [Original Text] net assets did not change. a reclassification increased net assets without donor restrictions by $9,750,000 and decreased net assets with donor restrictions by $9,750,000. a reclassification increased net assets without donor restrictions by $1,750,000 and decreased net assets with donor restrictions by $1,750,000. a reclassification increased net assets without donor restrictions by $1,500,000 and decreased net assets with donor restrictions by $1,500,000. a reclassification increased temporarily restricted net assets by $1,750,000 and decreased permanently restricted net assets by $1,750,000. CANCEL Scroll down to complete all parts of this task. Cyan Preparatory School (CPS) is a nongovernmental not-for-profit college preparatory school focused on providing quality STEM education. CPS is independent and not a subsidiary of any religious organization or public school district. Henrietta Schumacher, an administrative assistant and bookkeeper for the school, prepared a draft of the 203 financial statements, shown in the CPS Financial Statements exhibit, based on routine transactions. When Henrietta did not know how to account for a financial transaction, she coded all revenues as "Unclassified income" and all expenses as "Unclassified expenses." By default, the accounting software left the unclassified items in the "Unknown" category. Henrietta has adjusted all investment accounts to their proper year-end amounts using the prioryear accounting treatment. Henrietta did not enter any data for the transactions in question if cash was not received or paid. Neal Reagan, a local CPA who performs a compilation service based on the financial information provided, assigned staff accountant Tracy Hunter to assist Henrietta with some challenging matters. After an initial review of the documentation, Tracy prepared a draft letter to Henrietta. Neal has asked you to review the documentation and revise the letter, correcting any errors. NOTE: CPS has a written policy to report all contributions whose restrictions expire in the same calendar year in net assets without donor restrictions. CPS applies the policy consistently, discloses the policy, and has a similar policy for investment gains and income. To revise the document, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original Text] from the list. If removal of the underlined text is the best revision to the document, select [Delete Text] from the list if available. Will Opal died in 203 at age 85 , leaving the Cyan Preparatory School a remainder interest in land adjacent to the school property. Will was survived by his wife, Linda Opal, who was 80 at the time of Will's death. Mr. Opal's attorney sent the following to Cyan Preparatory School: At the time of Mr. Opal's death, the land was appraised at $500,000. Will purchased the land 50 years ago for $80,000. The value of the land is expected to remain stable. The life estate and remainder interest table is below: The relevant excerpt from the will is below: I give to my wife, Linda Opal, a life estate in the land located at 358 Oak Run Drive. At the time of her death, the land is to be donated to Cyan Preparatory School. The remainder interest is nonrevocable. If my wife, Linda Opal, does not survive me, the land located at 358 Oak Run Drive is to be donated to the Cyan Preparatory School. The Software Coding Academy opened in the fall 203 school year. At year end, CPS will report the donation from Richard Dorne as $6 million donor-restricted in perpetuity. Choose an option below: [Original Text] \$6 million donor-restricted in perpetuity. $1 million in temporarily restricted support and $5 million donor-restricted in perpetuity. $1 million without donor restrictions and $5 million donorrestricted in perpetuity. $6 million in temporarily restricted support. $10 million in temporarily restricted support. Cyan Preparatory School Statement of Financial Position - DRAFT As of December 31,203 The Software Coding Academy opened in the fall 203 school year. At year end, CPS will report the donation from Richard Dorne as $6 million donor-restricted in perpetuity. Choose an option below: [Original Text] $6 million donor-restricted in perpetuity. $1 million in temporarily restricted support and $5 million donor-restricted in perpetuity. $1 million without donor restrictions and $5 million donorrestricted in perpetuity. $6 million in temporarily restricted support. $10 million in temporarily restricted support. Tracy, In June 20V3 (10 years ago), Roger W. C. Daniel contributed \$5 million dollars to the Cyan Preparatory School to create scholarships for at-risk children who display a high level of potential. This year, 20X3, is the first year that Section 3(c) of the Fund Agreement applies, and I need advice on the applicable accounting method. On June 30,203, the balance of the scholarship fund was $9,500,000, and the board of directors elected to allocate the entire excess to CPS's general fund. Otherwise, I applied last year's accounting methods to record scholarship payments and income. The December 31,20X3, balance in the scholarship fund is $9,750,000. That amount currently is included in net assets with donor restrictions. -Henrietta THIS FUND AGREEMENT ("Agreement") is made this Thirtieth day of June, 20V3, between Cyan Preparatory School, a not-for-profit school ("School"), and Roger W. C. Daniel ("Donor"), to establish a scholarship fund for the School. 1. Creation of the Fund. Initial Contribution. The Donor hereby contributes \$5 million to the School to create the Roger W. C. Daniel Scholarship Fund ("Fund"). The Donor or any other person may make a subsequent contribution to the Fund. All contributions to the Fund shall be administered pursuant to the terms and conditions of this Agreement. The Fund shall be held by Cyan Preparatory School. 2. Purpose of Fund. (a) The purpose of the Fund is to offer an opportunity for at-risk children to attend the School. (b) In the event that it becomes unnecessary, undesirable, impractical, or impossible to use funds for such purposes or to comply with any other condition of this Agreement, the School shall have the right to use the funds for scholarships, educational programs, or such other charitable purposes, or to modify such conditions, as it deems appropriate in accordance with its governing instruments. 3. Distributions from the Fund. (a) The Fund shall be endowed, and the School will make an annual distribution from the Fund calculated in accordance with the School's spending policy as determined from time to time by the School's board of directors. This distribution includes any distribution for scholarships and any administrative fees on the investment. (b) Distributions are only to be made from returns on the investment. The initial investment of $5,000,000 shall remain intact. Otherwise, only administrative fees shall be distributed from the Fund. Annual distributions may not be more than 5% of the Fund balance. (c) Every 10 years, beginning on June 30,20X3, the balance of the Fund should be evaluated. If the Fund's balance is in excess of $8 million, the board of directors may elect to allocate the excess to the School's general fund. 4. Administration. (a) The School shall administer the Fund in accordance with the terms of this Agreement, under and subject to the School's governing instruments, as amended from time to time, and in accordance with procedures for the administration of similar funds of the School, including charges for School services. The Fund, and distributions from the Fund, shall be subject to the ultimate control and absolute discretion of the School. (b) The Fund is intended to be a component part of the School. 5. Gift Irrevocable; Limited Power of Amendment. Gifts to this Fund are irrevocable. The parties or authorized representatives may amend this Agreement by mutual written consent. In addition, for the purpose of ensuring that the Fund qualifies as a component part of the School for federal tax purposes, the School acting alone shall have the power to modify the terms of this Agreement. 6. Controlling Law This agreement shall be governed in all respects by the laws of the Commonwealth of Pennsylvania. IN WITNESS WHEREOF, the School and the Donor have executed this Agreement. Attest: CYAN PREPATORY SCHOOL Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started