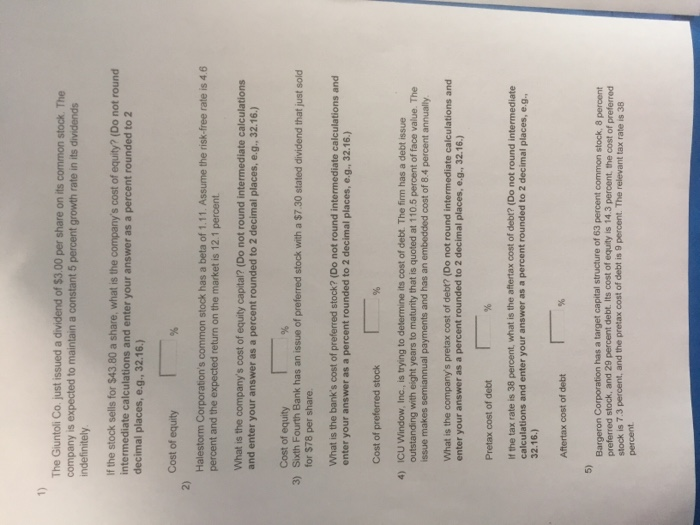

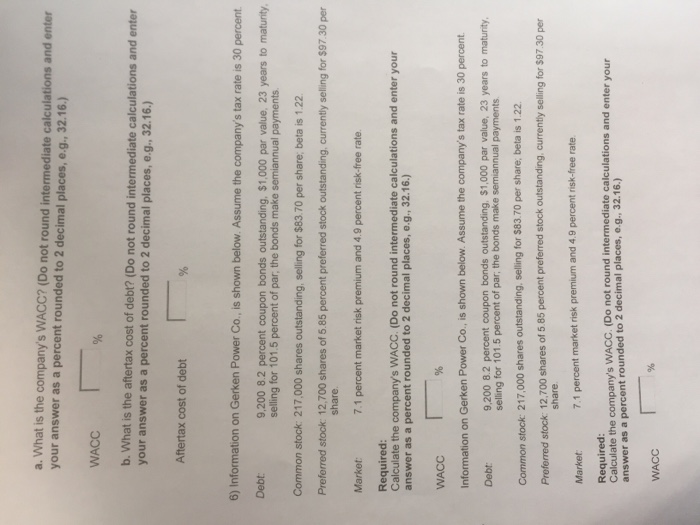

The Giuntoli Co just issued a dividend of $3.00 per share on its common stock. The company is expected to maintain a constant 5 percent growth rate in its dividends indefinitely f the stock sells for $43.80 a share, what is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g, 32.16.) Cost of equity 2) Halestorm Corporation's common stock has a beta of 1.11. Assume the risk-free rate is 46 percent and the expected return on the market is 12.1 percent What is the company's cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) Cost of equity for $78 per share 3) Sixth Fourth Bank has an issue of preferred stock with a $7.30 stated dividend that just sold What is the bank's cost of preferred stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Cost of preferred stock 4) ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with eight years to maturity that is quoted at 110.5 percent of face value. The issue makes semiannual payments and has an embedded cost of 8.4 percent annually What is the company's pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Pretax cost of debt If the tax rate is 38 percent, what is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g 32.16.) % Aftertax cost of debt Bargeron Corporation has a target capital structure of 63 percent common stock, 8 percent preferred stock, and 29 percent debt. Its cost of equity is 14.3 percent, the cost of preferred stock is 7.3 percent, and the pretax cost of debt is 9 percent. The relevant tax rate is 38 percent a. What is the company's WACC? (Do not round intermediate calculations a your answer as a percent rounded to 2 decimal places, e.g, 32.16.) WACC b. What is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Aftertax cost of debt 6) Information on Gerken Power Co, is shown below. Assume the company's tax rate is 30 percent Debt 9,200 8.2 percent coupon bonds outstanding, $1,000 par value, 23 years to maturity selling for 101.5 percent of par, the bonds make semiannual payments Common stock: 217,000 shares outstanding, selling for $83.70 per share; beta is 1.22 Preferred stock: 12,700 shares of 5.85 percent preferred stock outstanding, currently selling for $97.30 per share 7.1 percent market risk premium and 4.9 percent risk-free rate Market Required: Calculate the company's WACC. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16) WACC Information on Gerken Power Co., is shown below. Assume the company's tax rate is 30 percent Debt 9,200 8.2 percent coupon bonds outstanding, $1,000 par value, 23 years to maturity selling for 101.5 percent of par, the bonds make semiannual payments Common stock: 217,000 shares outstanding. selling for $83.70 per share, beta is 1.22 Proferred stock: 12,700 shares of 5.85 percent preferred stock outstanding. currently selling for $97.30 per share 7.1 percent market risk premium and 4.9 percent risk-free rate Market Required Calculate the company's WACC. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) % WACC