Answered step by step

Verified Expert Solution

Question

1 Approved Answer

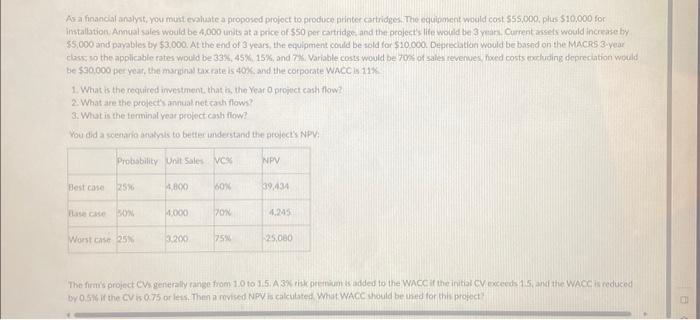

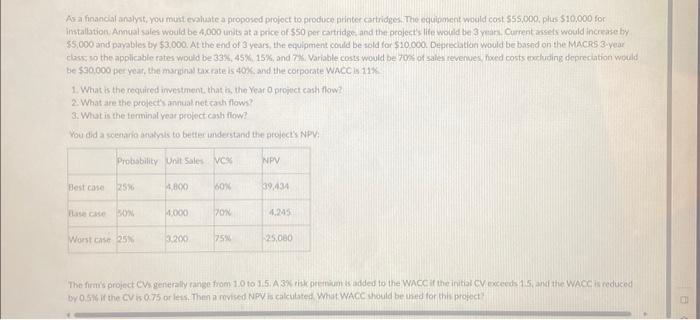

the given answers were 1) 67,000, 2) 26,580 & 29700 & 21900, 3) 9820 4)14% how can i solve it to get those answers step

the given answers were 1) 67,000, 2) 26,580 & 29700 & 21900, 3) 9820 4)14%

As a finandal anslyst, you mut evaluate a proposed project to produce printer cartridges The equiponent would cost $55,000, plus $10,000 for be $30,000 per year, the marphan tax rate is 40K, and the corpocate WACC is 11x. 1. What is the required investment that is, the Year O protect cash flow? 2. What are the project annual net cacts flow? 3. What is the terminal year propecticah llow? You did a seentio atuhis to better inderstand the projects NPV: by 0.54 if the CV is 0.75 of lets, Then a revised NPV is cakutated What WACC unould be whed tor this propect how can i solve it to get those answers step by step?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started