Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The goal of this assignment is to help you understand certain situations in which the traditional corporate finance theory objective function (maximizing firm value)

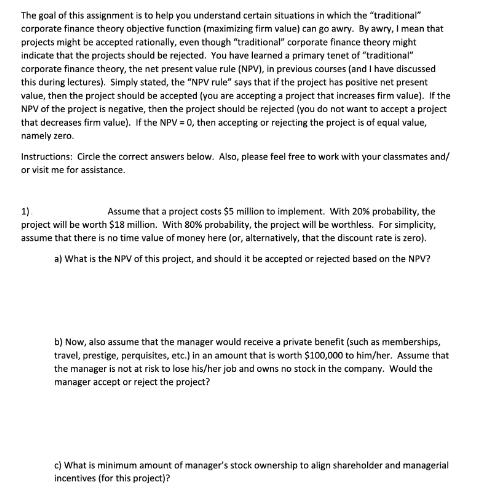

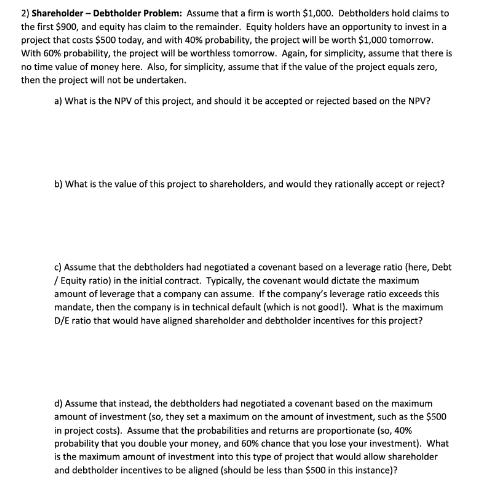

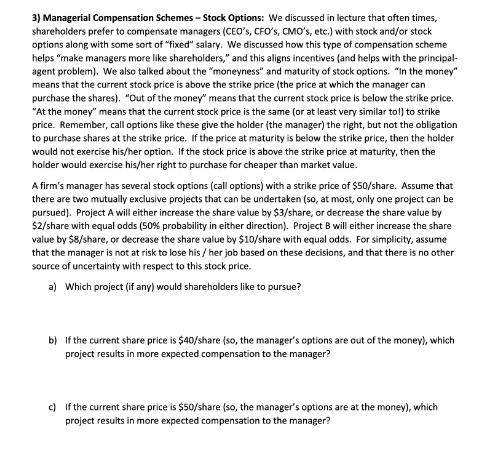

The goal of this assignment is to help you understand certain situations in which the "traditional" corporate finance theory objective function (maximizing firm value) can go awry. By awry, I mean that projects might be accepted rationally, even though "traditional" corporate finance theory might indicate that the projects should be rejected. You have learned a primary tenet of "traditional" corporate finance theory, the net present value rule (NPV), in previous courses (and I have discussed this during lectures). Simply stated, the "NPV rule" says that if the project has positive net present value, then the project should be accepted (you are accepting a project that increases firm value). If the NPV of the project is negative, then the project should be rejected (you do not want to accept a project that decreases firm value). If the NPV = 0, then accepting or rejecting the project is of equal value, namely zero. Instructions: Circle the correct answers below. Also, please feel free to work with your classmates and/ or visit me for assistance. 1) Assume that a project costs $5 million to implement. With 20% probability, the project will be worth $18 million. With 80% probability, the project will be worthless. For simplicity, assume that there is no time value of money here (or, alternatively, that the discount rate is zero). a) What is the NPV of this project, and should it be accepted or rejected based on the NPV? b) Now, also assume that the manager would receive a private benefit (such as memberships, travel, prestige, perquisites, etc.) in an amount that is worth $100,000 to him/her. Assume that the manager is not at risk to lose his/her job and owns no stock in the company. Would the manager accept or reject the project? c) What is minimum amount of manager's stock ownership to align shareholder and managerial incentives (for this project)? 2) Shareholder - Debtholder Problem: Assume that a firm is worth $1,000. Debtholders hold claims to the first $900, and equity has claim to the remainder. Equity holders have an opportunity to invest in a project that costs $500 today, and with 40% probability, the project will be worth $1,000 tomorrow. With 60% probability, the project will be worthless tomorrow. Again, for simplicity, assume that there is no time value of money here. Also, for simplicity, assume that if the value of the project equals zero, then the project will not be undertaken. a) What is the NPV of this project, and should it be accepted or rejected based on the NPV? b) What is the value of this project to shareholders, and would they rationally accept or reject? c) Assume that the debtholders had negotiated a covenant based on a leverage ratio (here, Debt /Equity ratio) in the initial contract. Typically, the covenant would dictate the maximum amount of leverage that a company can assume. If the company's leverage ratio exceeds this mandate, then the company is in technical default (which is not good!). What is the maximum D/E ratio that would have aligned shareholder and debtholder incentives for this project? d) Assume that instead, the debtholders had negotiated a covenant based on the maximum amount of investment (so, they set a maximum on the amount of investment, such as the $500 in project costs). Assume that the probabilities and returns are proportionate (so, 40% probability that you double your money, and 60% chance that you lose your investment). What is the maximum amount of investment into this type of project that would allow shareholder and debtholder incentives to be aligned (should be less than $500 in this instance)? 3) Managerial Compensation Schemes - Stock Options: We discussed in lecture that often times, shareholders prefer to compensate managers (CEO's, CFO's, CMO's, etc.) with stock and/or stock options along with some sort of "fixed" salary. We discussed how this type of compensation scheme helps "make managers more like shareholders," and this aligns incentives (and helps with the principal- agent problem). We also talked about the "moneyness" and maturity of stock options. "In the money" means that the current stock price is above the strike price (the price at which the manager can purchase the shares). "Out of the money" means that the current stock price is below the strike price. "At the money" means that the current stock price is the same (or at least very similar to!) to strike price. Remember, call options like these give the holder (the manager) the right, but not the obligation to purchase shares at the strike price. If the price at maturity is below the strike price, then the holder would not exercise his/her option. If the stock price is above the strike price at maturity, then the holder would exercise his/her right to purchase for cheaper than market value. A firm's manager has several stock options (call options) with a strike price of $50/share. Assume that there are two mutually exclusive projects that can be undertaken (so, at most, only one project can be pursued). Project A will either increase the share value by $3/share, or decrease the share value by $2/share with equal odds (50% probability in either direction). Project B will either increase the share value by $8/share, or decrease the share value by $10/share with equal odds. For simplicity, assume that the manager is not at risk to lose his/her job based on these decisions, and that there is no other source of uncertainty with respect to this stock price. a) which project (if any) would shareholders like to pursue? b) If the current share price is $40/share (so, the manager's options are out of the money), which project results in more expected compensation to the manager? c) If the current share price is $50/share (so, the manager's options are at the money), which project results in more expected compensation to the manager? d) If the current share price is $60/share (so, the manager's options are in the money), which project results in more expected compensation to the manager? e) In this example, under which setting is shareholder and manager incentives aligned?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started