Answered step by step

Verified Expert Solution

Question

1 Approved Answer

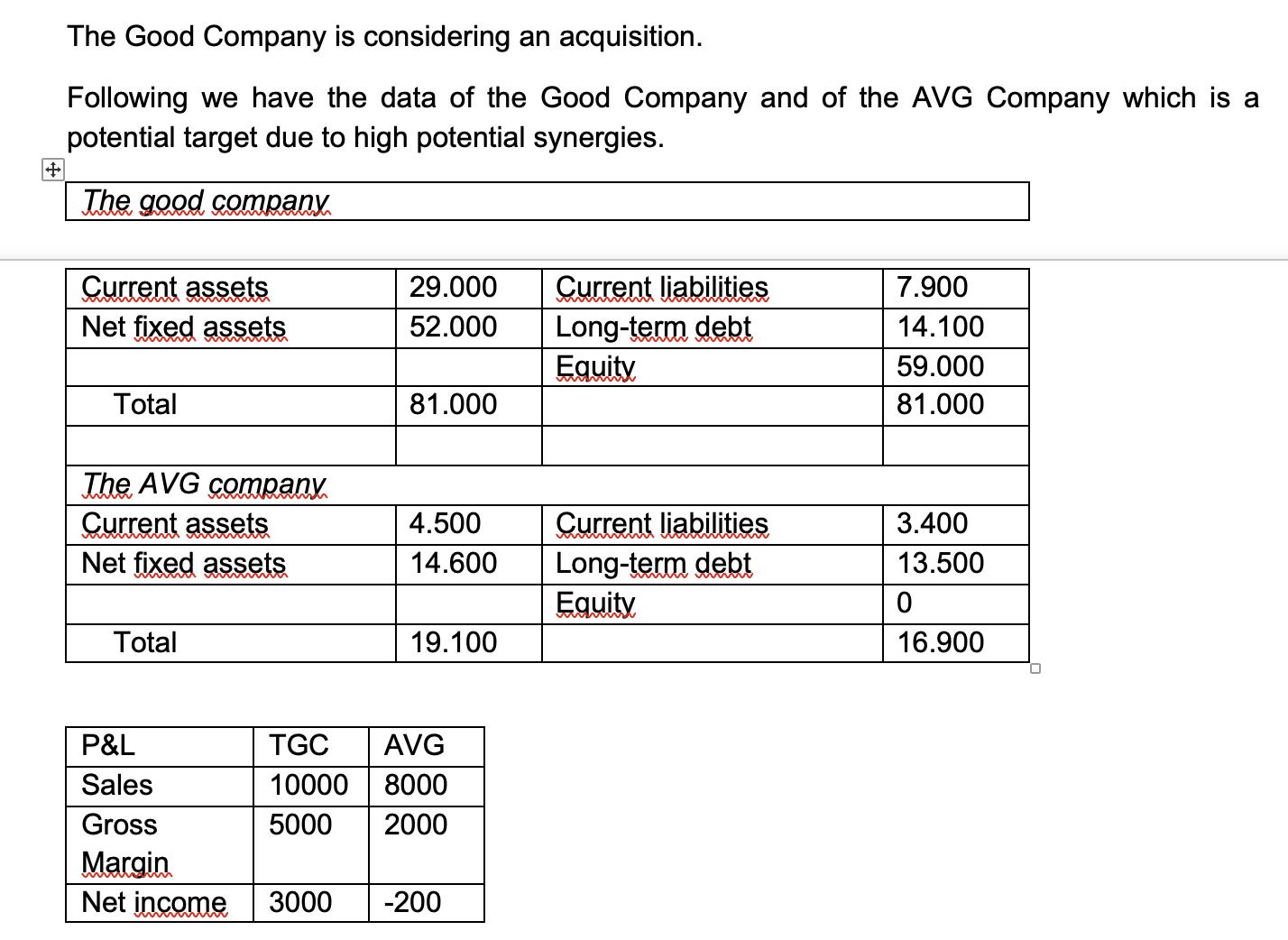

The Good Company is considering an acquisition. Following we have the data of the Good Company and of the AVG Company which is a

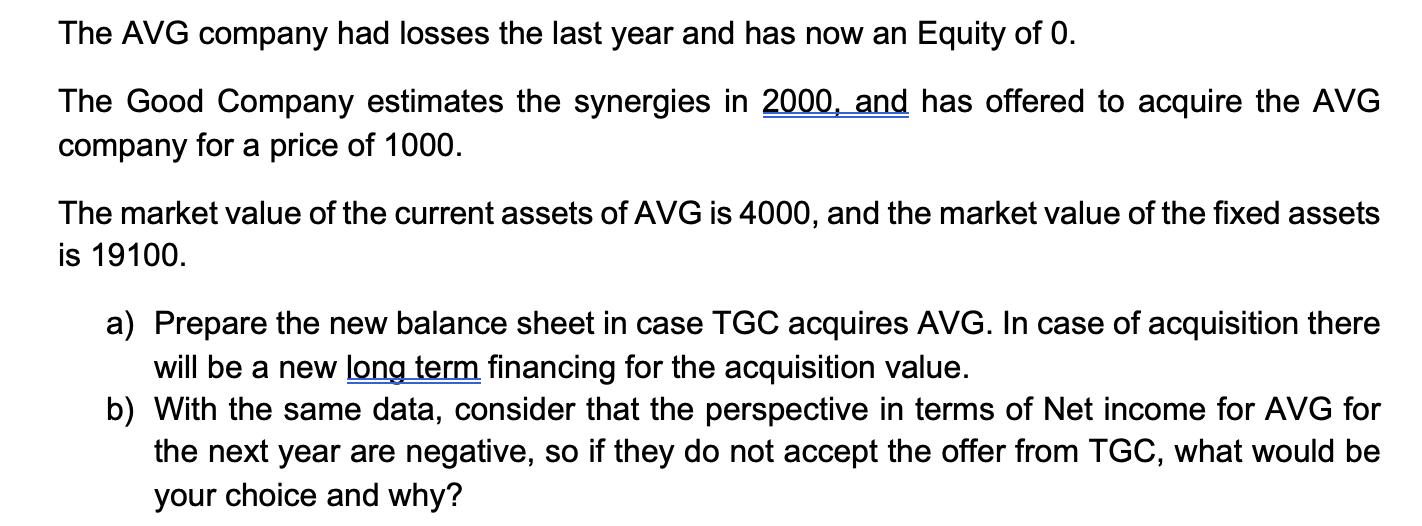

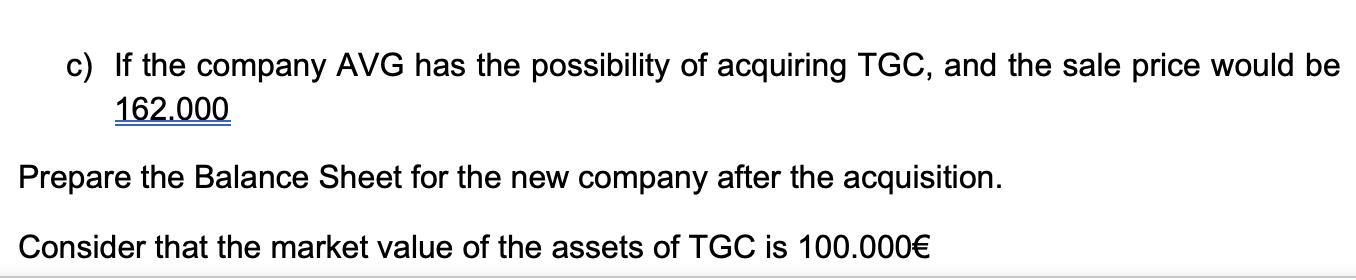

The Good Company is considering an acquisition. Following we have the data of the Good Company and of the AVG Company which is a potential target due to high potential synergies. The good company. Current assets Net fixed assets Total The AVG company Current assets Net fixed assets Total 29.000 52.000 81.000 4.500 14.600 19.100 P&L Sales Gross Margin Net income 3000 -200 TGC AVG 10000 8000 5000 2000 Current liabilities Long-term debt Equity Current liabilities Long-term debt Equity 7.900 14.100 59.000 81.000 3.400 13.500 0 16.900 The AVG company had losses the last year and has now an Equity of 0. The Good Company estimates the synergies in 2000, and has offered to acquire the AVG company for a price of 1000. The market value of the current assets of AVG is 4000, and the market value of the fixed assets is 19100. a) Prepare the new balance sheet in case TGC acquires AVG. In case of acquisition there will be a new long term financing for the acquisition value. b) With the same data, consider that the perspective in terms of Net income for AVG for the next year are negative, so if they do not accept the offer from TGC, what would be your choice and why? c) If the company AVG has the possibility of acquiring TGC, and the sale price would be 162.000 Prepare the Balance Sheet for the new company after the acquisition. Consider that the market value of the assets of TGC is 100.000

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a New Balance Sheet after Acquisition TGC acquires AVG Good Company TGC Side Current Assets 29000 un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started