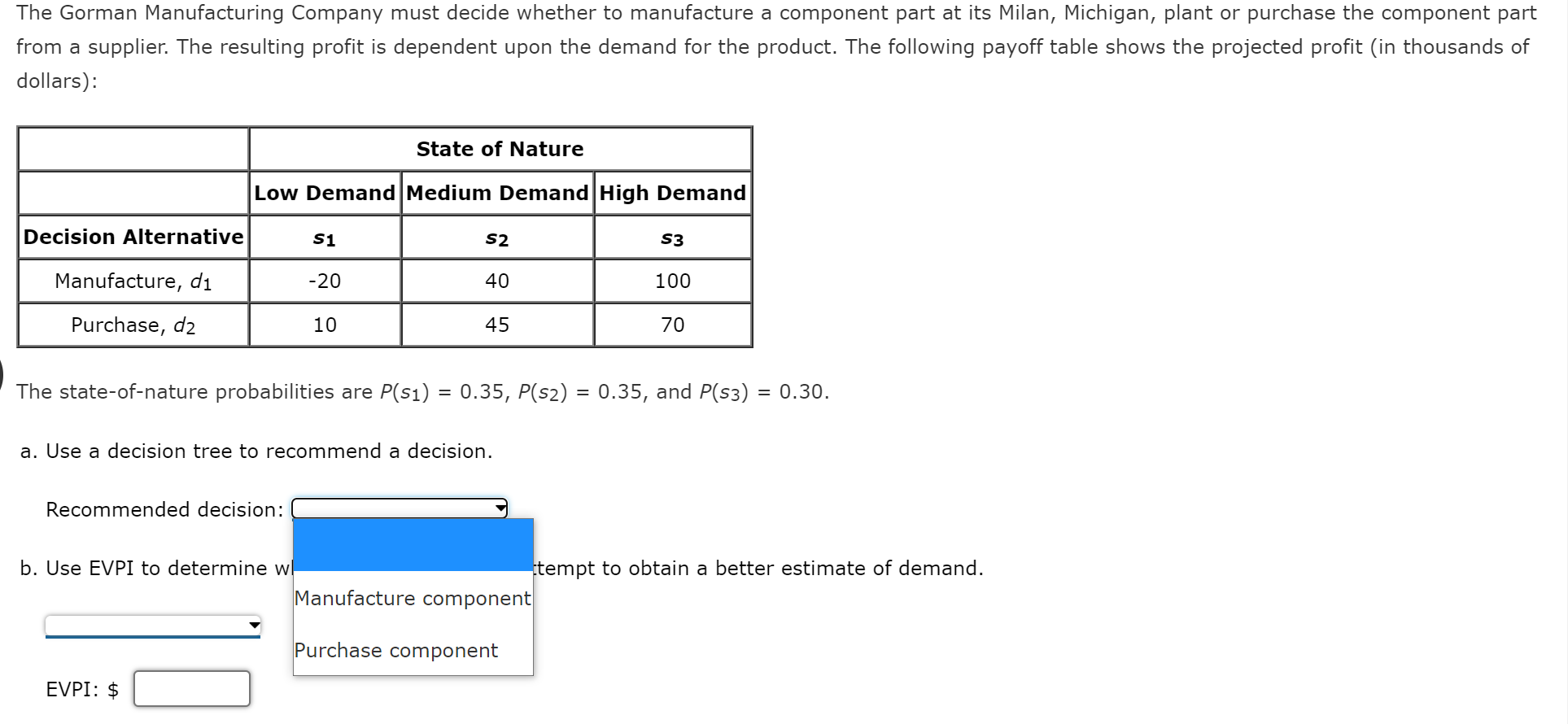

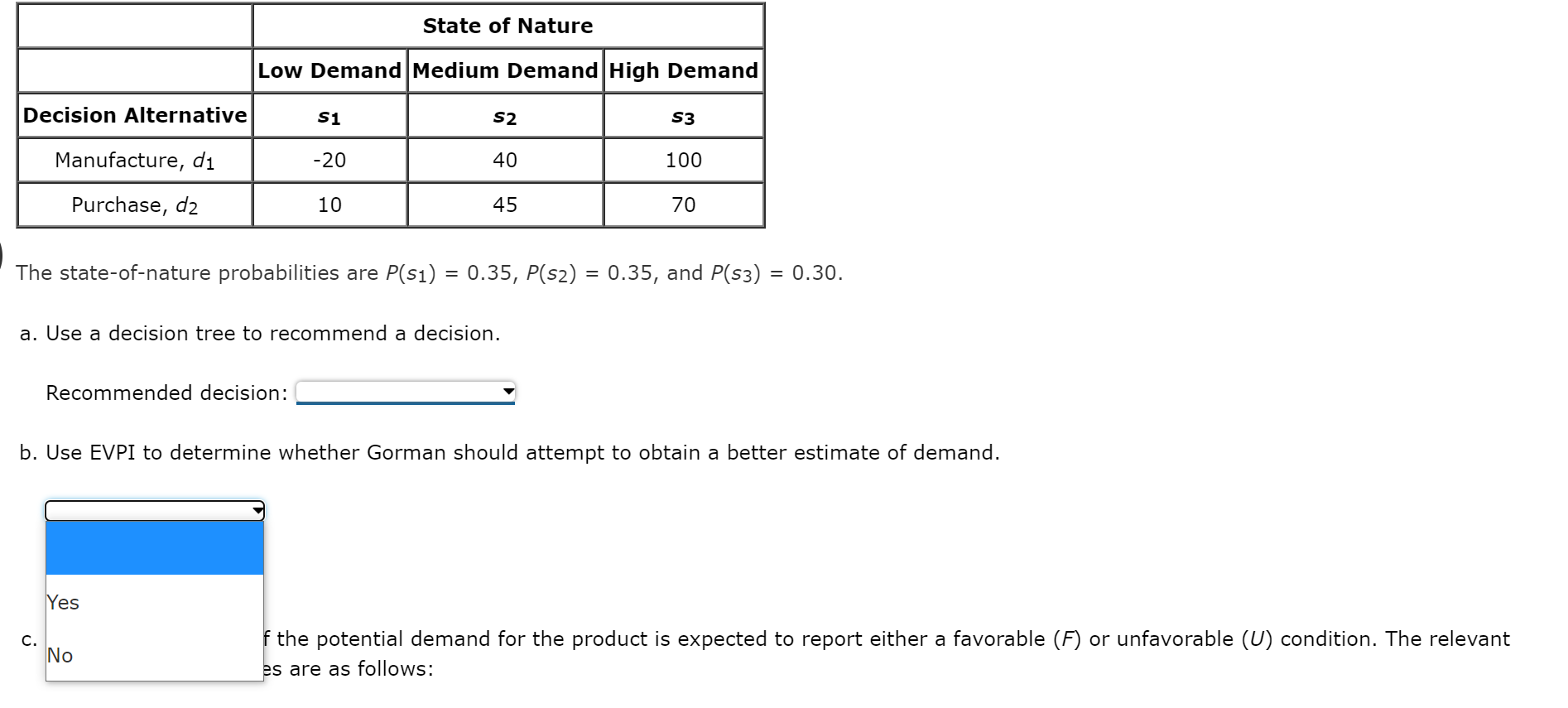

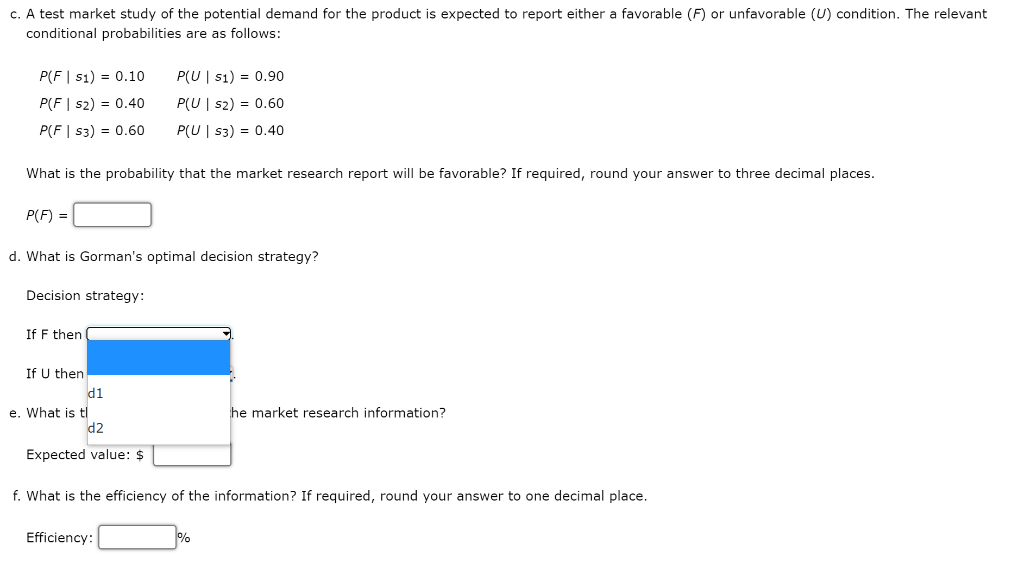

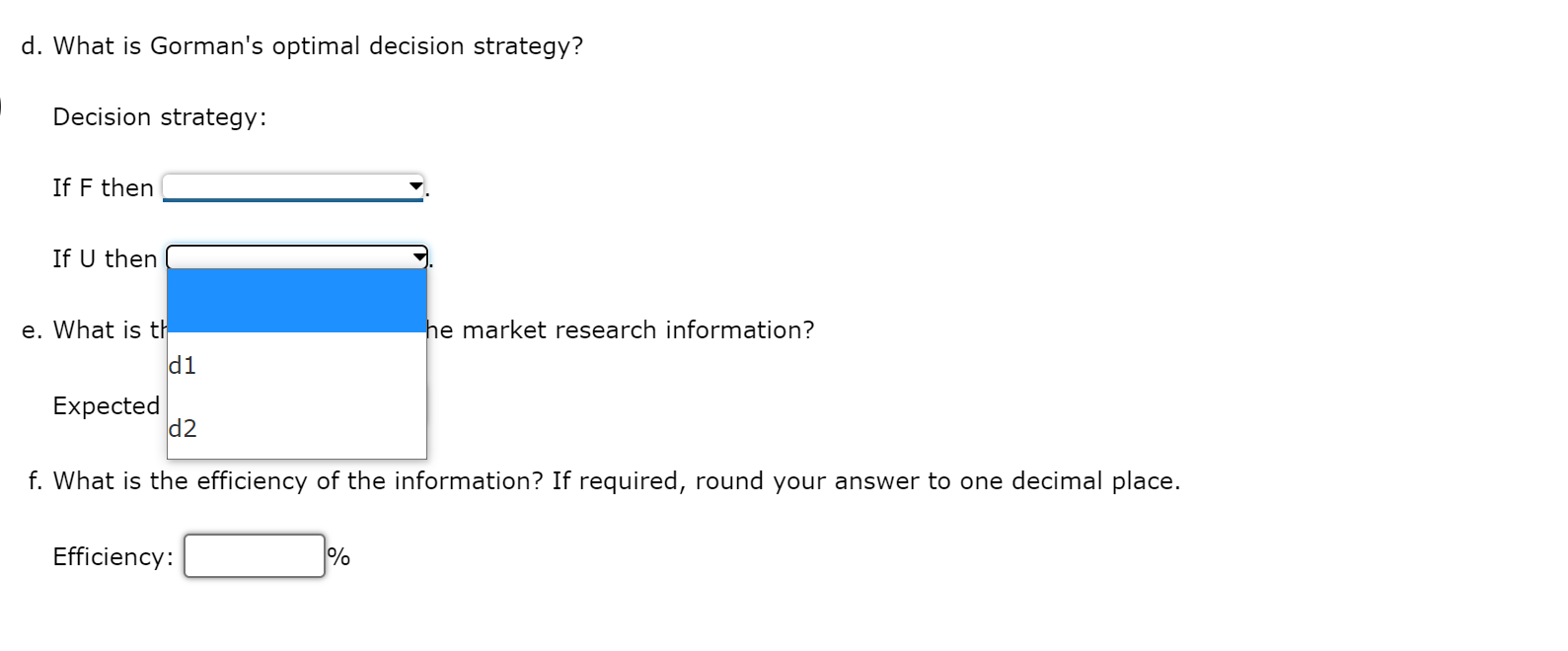

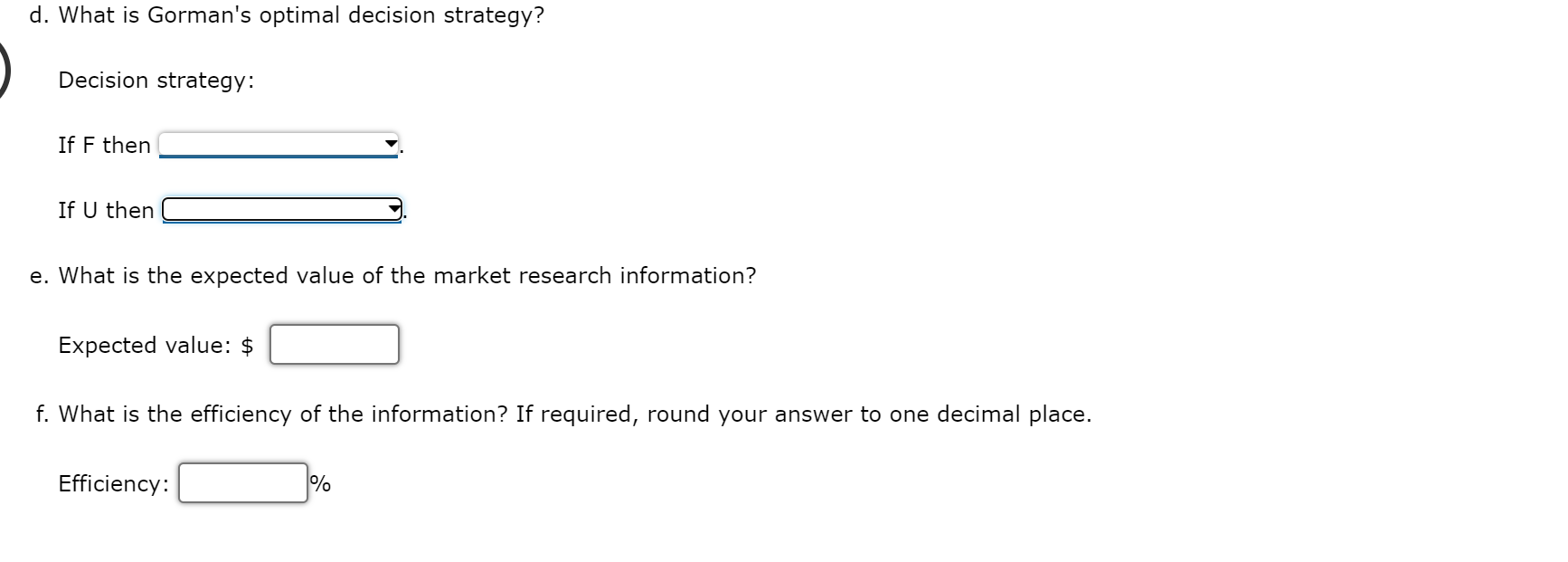

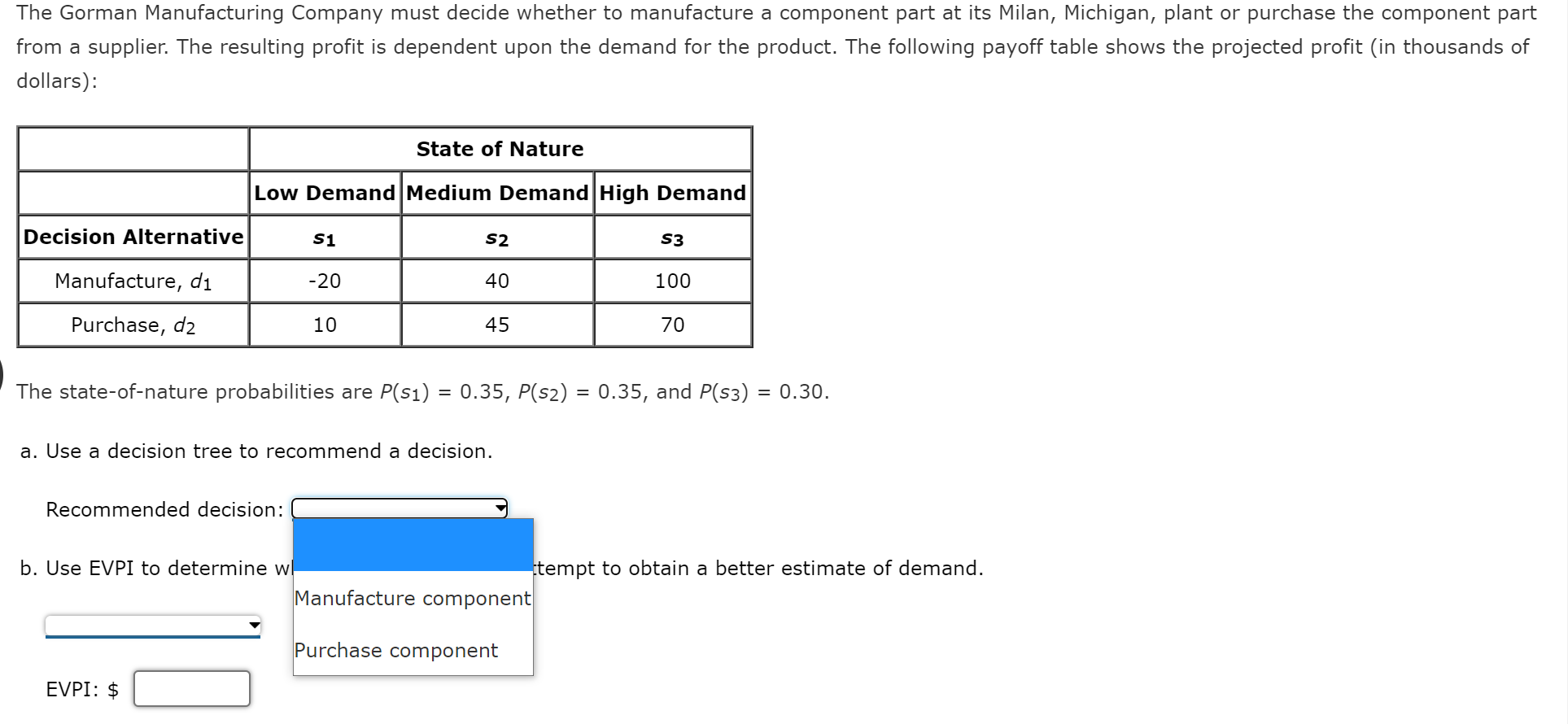

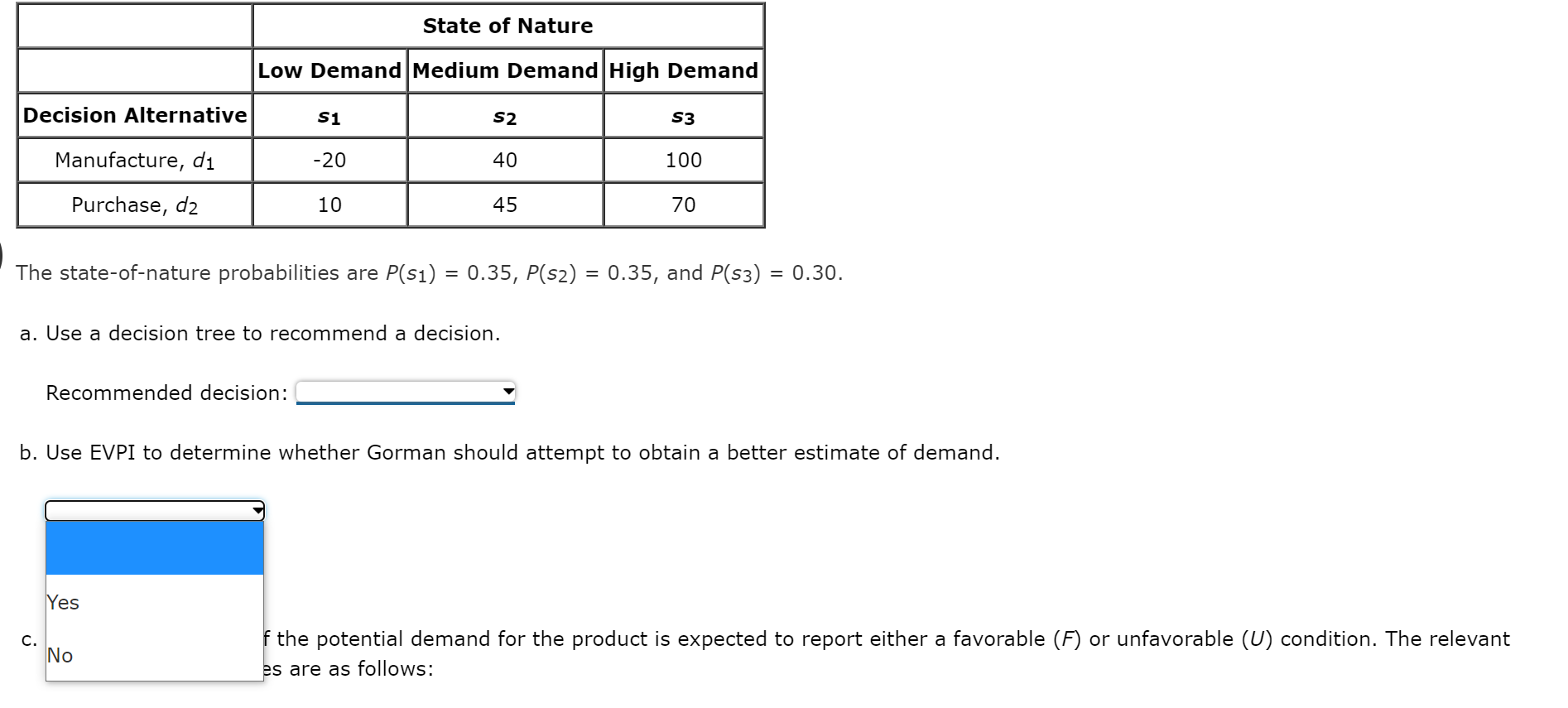

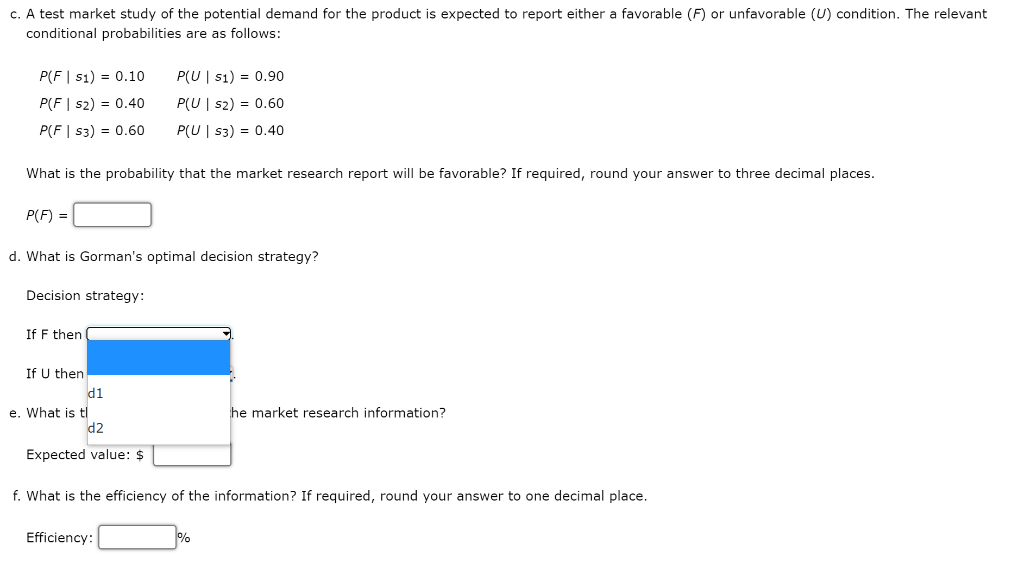

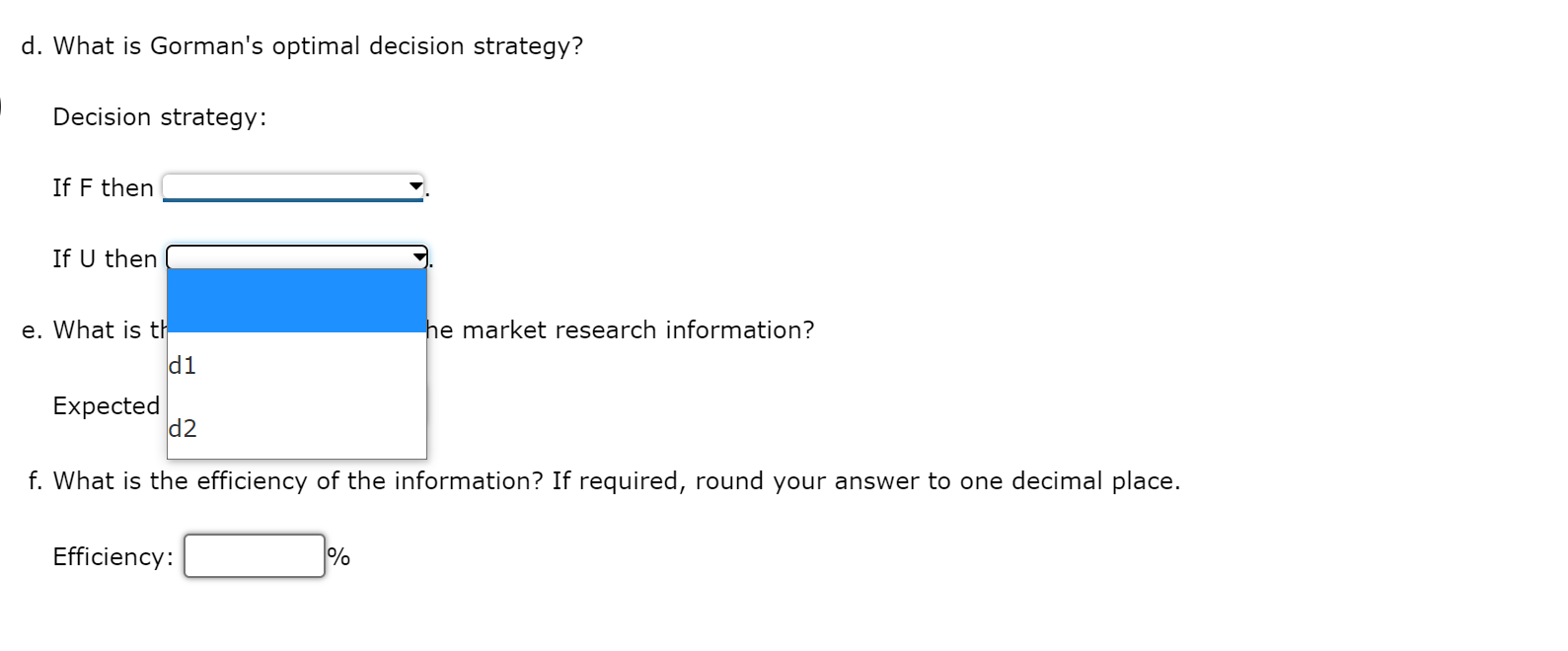

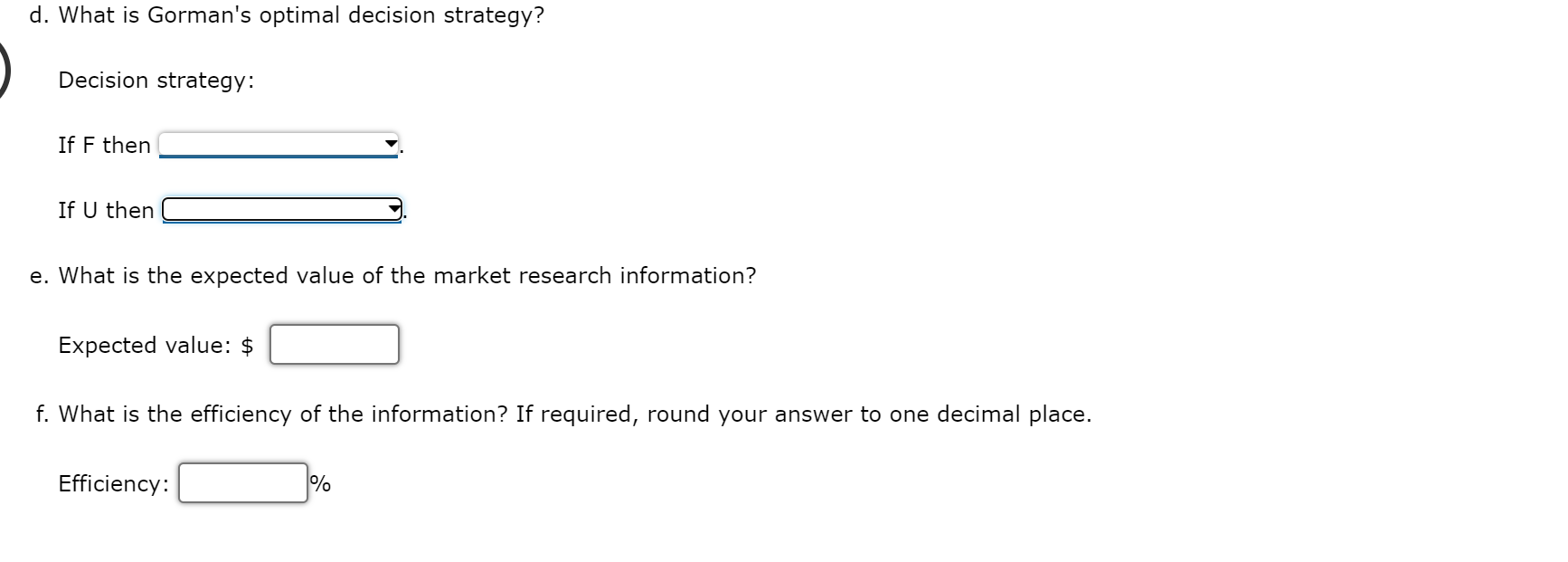

The Gorman Manufacturing Company must decide whether to manufacture a component part at its Milan, Michigan, plant or purchase the component part from a supplier. The resulting profit is dependent upon the demand for the product. The following payoff table shows the projected profit (in thousands of dollars): State of Nature Low Demand Medium Demand High Demand Decision Alternative S1 S2 S3 Manufacture, di -20 40 100 Purchase, d2 10 45 70 The state-of-nature probabilities are P(S1) = 0.35, P(S2) = 0.35, and P(53) = 0.30. = a. Use a decision tree to recommend a decision. Recommended decision: b. Use EVPI to determine wl itempt to obtain a better estimate of demand. Manufacture component Purchase component EVPI: $ State of Nature Low Demand Medium Demand High Demand Decision Alternative S1 S2 S3 Manufacture, di -20 40 100 Purchase, d2 10 45 70 The state-of-nature probabilities are P(51) = 0.35, P(S2) = 0.35, and P(53) = 0.30. = = a. Use a decision tree to recommend a decision. Recommended decision: b. Use EVPI to determine whether Gorman should attempt to obtain a better estimate of demand. Yes c. INo f the potential demand for the product is expected to report either a favorable (F) or unfavorable (U) condition. The relevant es are as follows: c. A test market study of the potential demand for the product is expected to report either a favorable (F) or unfavorable (U) condition. The relevant conditional probabilities are as follows: P(F51) = 0.10 PCF | s2) = 0.40 P(FS3) = 0.60 P( US1) = 0.90 P( U52) = 0.60 P( US3) = 0.40 What is the probability that the market research report will be favorable? If required, round your answer to three decimal places. P(F) = d. What is Gorman's optimal decision strategy? Decision strategy: If F then If U then di e. What is tl d2 he market research information? Expected value: $ f. What is the efficiency of the information? If required, round your answer to one decimal place. Efficiency: % d. What is Gorman's optimal decision strategy? Decision strategy: If F then If U then he market research information? e. What is th d1 Expected d2 f. What is the efficiency of the information? If required, round your answer to one decimal place. Efficiency: % d. What is Gorman's optimal decision strategy? Decision strategy: If F then If U then e. What is the expected value of the market research information? Expected value: $ f. What is the efficiency of the information? If required, round your answer to one decimal place. Efficiency: %