Answered step by step

Verified Expert Solution

Question

1 Approved Answer

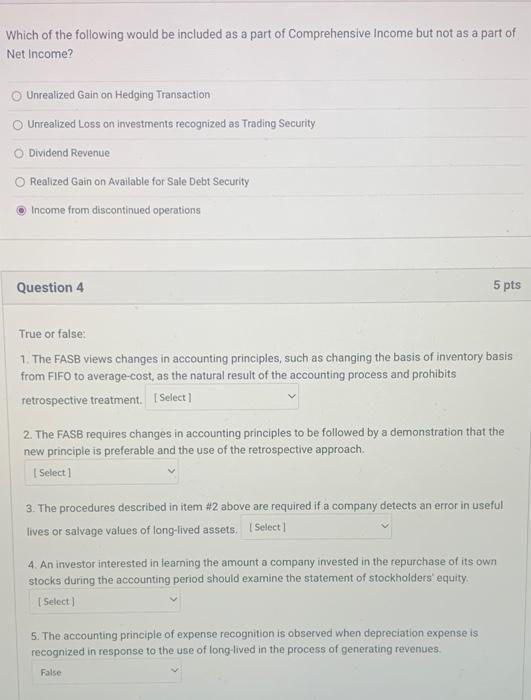

Which of the following would be included as a part of Comprehensive Income but not as a part of Net Income? Unrealized Gain on

Which of the following would be included as a part of Comprehensive Income but not as a part of Net Income? Unrealized Gain on Hedging Transaction Unrealized Loss on investments recognized as Trading Security Dividend Revenue O Realized Gain on Available for Sale Debt Security Income from discontinued operations Question 4 5 pts True or false: 1. The FASB views changes in accounting principles, such as changing the basis of inventory basis from FIFO to average-cost, as the natural result of the accounting process and prohibits retrospective treatment. [Select] 2. The FASB requires changes in accounting principles to be followed by a demonstration that the new principle is preferable and the use of the retrospective approach. [Select] 3. The procedures described in item #2 above are required if a company detects an error in useful lives or salvage values of long-lived assets. [Select] 4. An investor interested in learning the amount a company invested in the repurchase of its own stocks during the accounting period should examine the statement of stockholders' equity. [Select] 5. The accounting principle of expense recognition is observed when depreciation expense is recognized in response to the use of long-lived in the process of generating revenues. False

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Unrealized Gain on Hedging Transaction Unrealized Loss on investments recognized as Trading Security ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started