Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The government of a heavily indebted country has a range of bonds currently in issue. These include bonds with nominal amounts outstanding of RM4bn

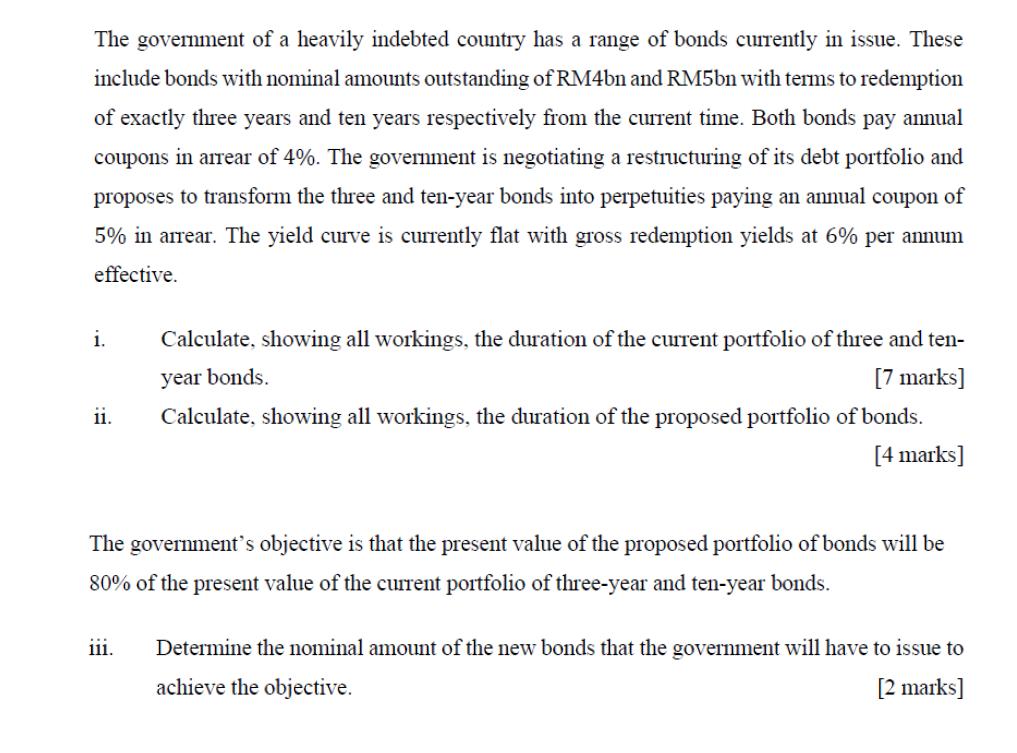

The government of a heavily indebted country has a range of bonds currently in issue. These include bonds with nominal amounts outstanding of RM4bn and RM5bn with terms to redemption of exactly three years and ten years respectively from the current time. Both bonds pay annual coupons in arrear of 4%. The government is negotiating a restructuring of its debt portfolio and proposes to transform the three and ten-year bonds into perpetuities paying an annual coupon of 5% in arrear. The yield curve is currently flat with gross redemption yields at 6% per annum effective. i. ii. Calculate, showing all workings, the duration of the current portfolio of three and ten- year bonds. [7 marks] Calculate, showing all workings, the duration of the proposed portfolio of bonds. [4 marks] The government's objective is that the present value of the proposed portfolio of bonds will be 80% of the present value of the current portfolio of three-year and ten-year bonds. 111. Determine the nominal amount of the new bonds that the government will have to issue to achieve the objective. [2 marks]

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i The duration of the current portfolio of three and tenyear bonds can be calculated using the follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started