Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The graph above shows a hypothetical loanable funds market. Currently the market is in equilibrium. Lenders and borrowers expect the inflation rate for the

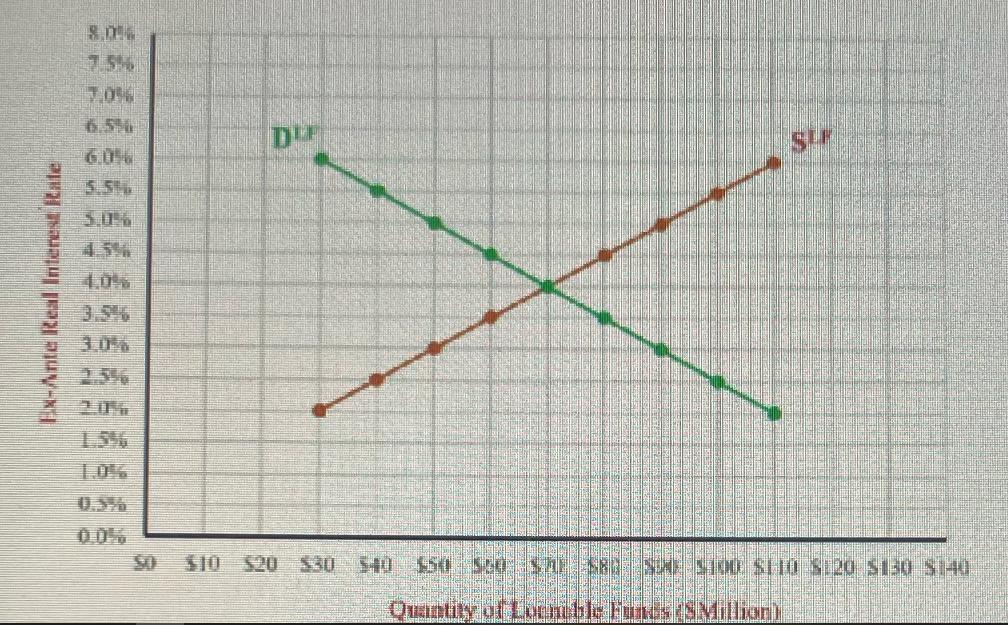

The graph above shows a hypothetical loanable funds market. Currently the market is in equilibrium. Lenders and borrowers expect the inflation rate for the next year to be 2 percent and the nominal interest rate is percent. Suppose that oil prices increase and as a result lenders and borrowers revise their expectations of inflation upwards to 4 percent. According to Fisher, this event creates an excess demand for loanable funds equal to million dollars in the very short run. However, soon the nominal interest rate changes percent and the real interest to rate equals percent. Ex-Ante Real Interest Rate --- 7.54 CI | [I F 0... NET OT ORAL Tr

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the excess demand for loanable funds in the very short run we need to consider the impa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started