Question

The graph below indicates the EBIT of three operating activities (referring to three currencies) for a companys operations, considering the exchange rate scenarios available. Each

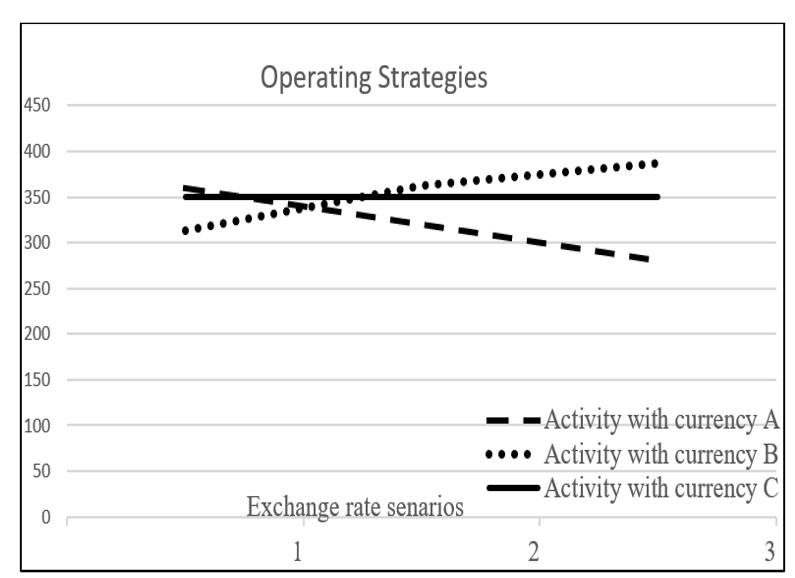

The graph below indicates the EBIT of three operating activities (referring to three currencies) for a company’s operations, considering the exchange rate scenarios available. Each scenario reflects increase in the value of the foreign currency compared to the home currency. For each of the three operating activities

1.discuss the relation between EBIT and exchange rate movements,

2.Which of the three current operating activities is less risky and why?

3.suggest how the company can achieve internal hedging in order to reduce its economic exposure (if any).

4.Explain economic exposure and discuss the empirical evidence arguing in favour of, and against, hedging economic exposure.

5.Discuss the challenges of hedging operating vs transaction FX exposure.

450 400 350 300 250 200 150 100 50 0 Operating Strategies Exchange rate senarios 1 -Activity with currency A Activity with currency B Activity with currency C 3 2

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Discuss the relation between EBIT and exchange rate movements The relation between EBIT and exchan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started