Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Green Shingle purchased a parcel of land 6 years ago for $299,500. At that time, the firm invested $64,000 grading the site so

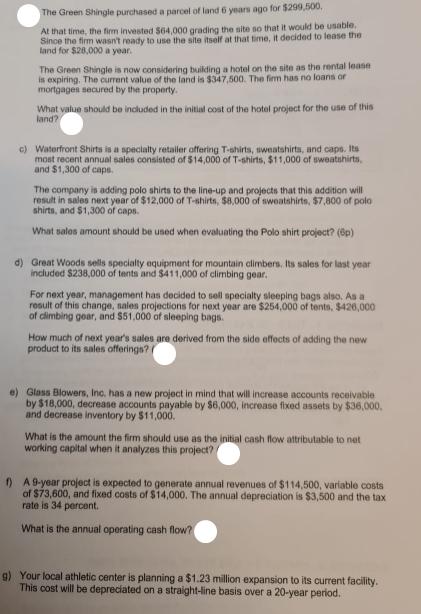

The Green Shingle purchased a parcel of land 6 years ago for $299,500. At that time, the firm invested $64,000 grading the site so that it would be usable. Since the firm wasn't ready to use the site itself at that time, it decided to lease the land for $28,000 a year. The Green Shingle is now considering building a hotel on the site as the rental lease is expiring. The current value of the land is $347,500. The firm has no loans or mortgages secured by the property. What value should be included in the initial cost of the hotel project for the use of this land? c) Waterfront Shirts is a specialty retailer offering T-shirts, sweatshirts, and caps. Its most recent annual sales consisted of $14,000 of T-shirts, $11,000 of sweatshirts. and $1,300 of caps. The company is adding polo shirts to the line-up and projects that this addition will result in sales next year of $12,000 of T-shirts, $8,000 of sweatshirts, $7,800 of polo shirts, and $1,300 of caps. What sales amount should be used when evaluating the Polo shirt project? (6p) d) Great Woods sells specialty equipment for mountain climbers. Its sales for last year included $238,000 of tents and $411,000 of climbing gear. For next year, management has decided to sell specialty sleeping bags also. As a result of this change, sales projections for next year are $254,000 of tents, $426,000 of climbing gear, and $51,000 of sleeping bags. How much of next year's sales are derived from the side effects of adding the new product to its sales offerings? e) Glass Blowers, Inc. has a new project in mind that will increase accounts receivable by $18,000, decrease accounts payable by $6,000, increase fixed assets by $36,000. and decrease inventory by $11,000. What is the amount the firm should use as the initial cash flow attributable to net working capital when it analyzes this project? f) A 9-year project is expected to generate annual revenues of $114,500, variable costs of $73,600, and fixed costs of $14,000. The annual depreciation is $3,500 and the tax rate is 34 percent. What is the annual operating cash flow? g) Your local athletic center is planning a $1.23 million expansion to its current facility. This cost will be depreciated on a straight-line basis over a 20-year period. The Green Shingle purchased a parcel of land 6 years ago for $299,500. At that time, the firm invested $64,000 grading the site so that it would be usable. Since the firm wasn't ready to use the site itself at that time, it decided to lease the land for $28,000 a year. The Green Shingle is now considering building a hotel on the site as the rental lease is expiring. The current value of the land is $347,500. The firm has no loans or mortgages secured by the property. What value should be included in the initial cost of the hotel project for the use of this land? c) Waterfront Shirts is a specialty retailer offering T-shirts, sweatshirts, and caps. Its most recent annual sales consisted of $14,000 of T-shirts, $11,000 of sweatshirts. and $1,300 of caps. The company is adding polo shirts to the line-up and projects that this addition will result in sales next year of $12,000 of T-shirts, $8,000 of sweatshirts, $7,800 of polo shirts, and $1,300 of caps. What sales amount should be used when evaluating the Polo shirt project? (6p) d) Great Woods sells specialty equipment for mountain climbers. Its sales for last year included $238,000 of tents and $411,000 of climbing gear. For next year, management has decided to sell specialty sleeping bags also. As a result of this change, sales projections for next year are $254,000 of tents, $426,000 of climbing gear, and $51,000 of sleeping bags. How much of next year's sales are derived from the side effects of adding the new product to its sales offerings? e) Glass Blowers, Inc. has a new project in mind that will increase accounts receivable by $18,000, decrease accounts payable by $6,000, increase fixed assets by $36,000. and decrease inventory by $11,000. What is the amount the firm should use as the initial cash flow attributable to net working capital when it analyzes this project? f) A 9-year project is expected to generate annual revenues of $114,500, variable costs of $73,600, and fixed costs of $14,000. The annual depreciation is $3,500 and the tax rate is 34 percent. What is the annual operating cash flow? g) Your local athletic center is planning a $1.23 million expansion to its current facility. This cost will be depreciated on a straight-line basis over a 20-year period. The Green Shingle purchased a parcel of land 6 years ago for $299,500. At that time, the firm invested $64,000 grading the site so that it would be usable. Since the firm wasn't ready to use the site itself at that time, it decided to lease the land for $28,000 a year. The Green Shingle is now considering building a hotel on the site as the rental lease is expiring. The current value of the land is $347,500. The firm has no loans or mortgages secured by the property. What value should be included in the initial cost of the hotel project for the use of this land? c) Waterfront Shirts is a specialty retailer offering T-shirts, sweatshirts, and caps. Its most recent annual sales consisted of $14,000 of T-shirts, $11,000 of sweatshirts. and $1,300 of caps. The company is adding polo shirts to the line-up and projects that this addition will result in sales next year of $12,000 of T-shirts, $8,000 of sweatshirts, $7,800 of polo shirts, and $1,300 of caps. What sales amount should be used when evaluating the Polo shirt project? (6p) d) Great Woods sells specialty equipment for mountain climbers. Its sales for last year included $238,000 of tents and $411,000 of climbing gear. For next year, management has decided to sell specialty sleeping bags also. As a result of this change, sales projections for next year are $254,000 of tents, $426,000 of climbing gear, and $51,000 of sleeping bags. How much of next year's sales are derived from the side effects of adding the new product to its sales offerings? e) Glass Blowers, Inc. has a new project in mind that will increase accounts receivable by $18,000, decrease accounts payable by $6,000, increase fixed assets by $36,000. and decrease inventory by $11,000. What is the amount the firm should use as the initial cash flow attributable to net working capital when it analyzes this project? f) A 9-year project is expected to generate annual revenues of $114,500, variable costs of $73,600, and fixed costs of $14,000. The annual depreciation is $3,500 and the tax rate is 34 percent. What is the annual operating cash flow? g) Your local athletic center is planning a $1.23 million expansion to its current facility. This cost will be depreciated on a straight-line basis over a 20-year period.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Initial Cost of the Hotel Project The Green Shingle purchased the land 6 years ago for 299500 They invested 64000 in grading the site The current va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started