Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hanks Company has the following income statement for the year ended December 31, 2006: Subscription revenue Interest revenue on municipal bonds Total revenues

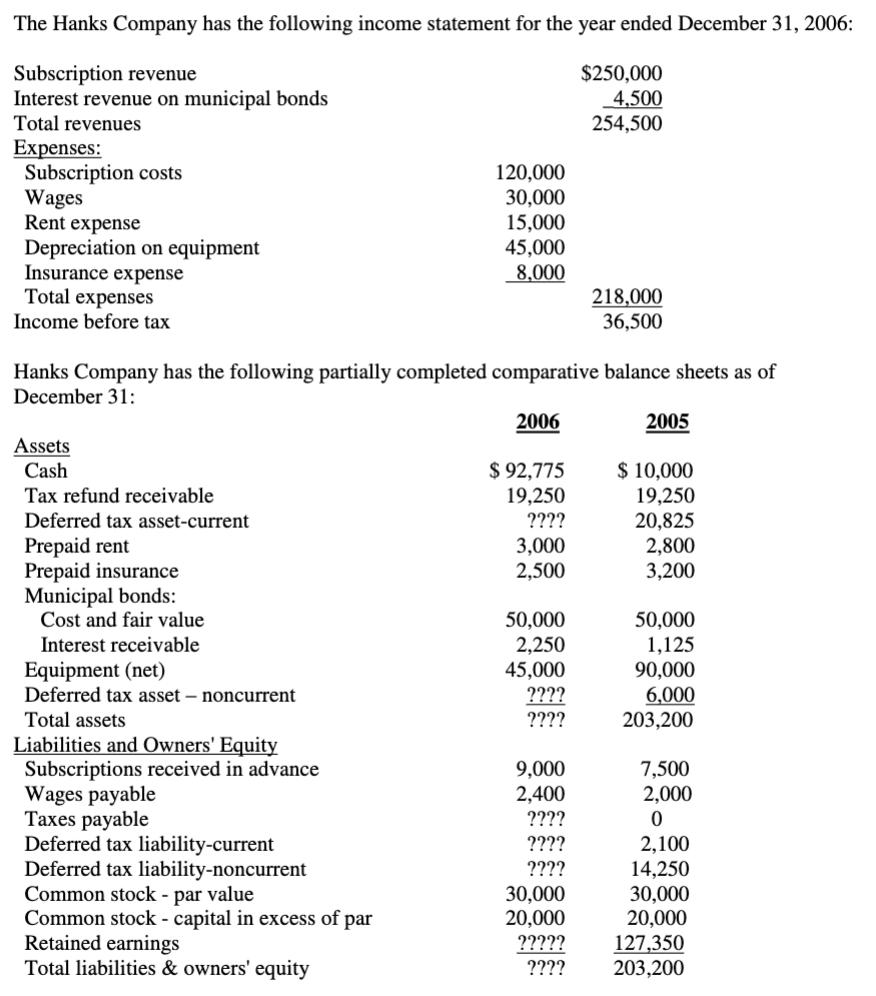

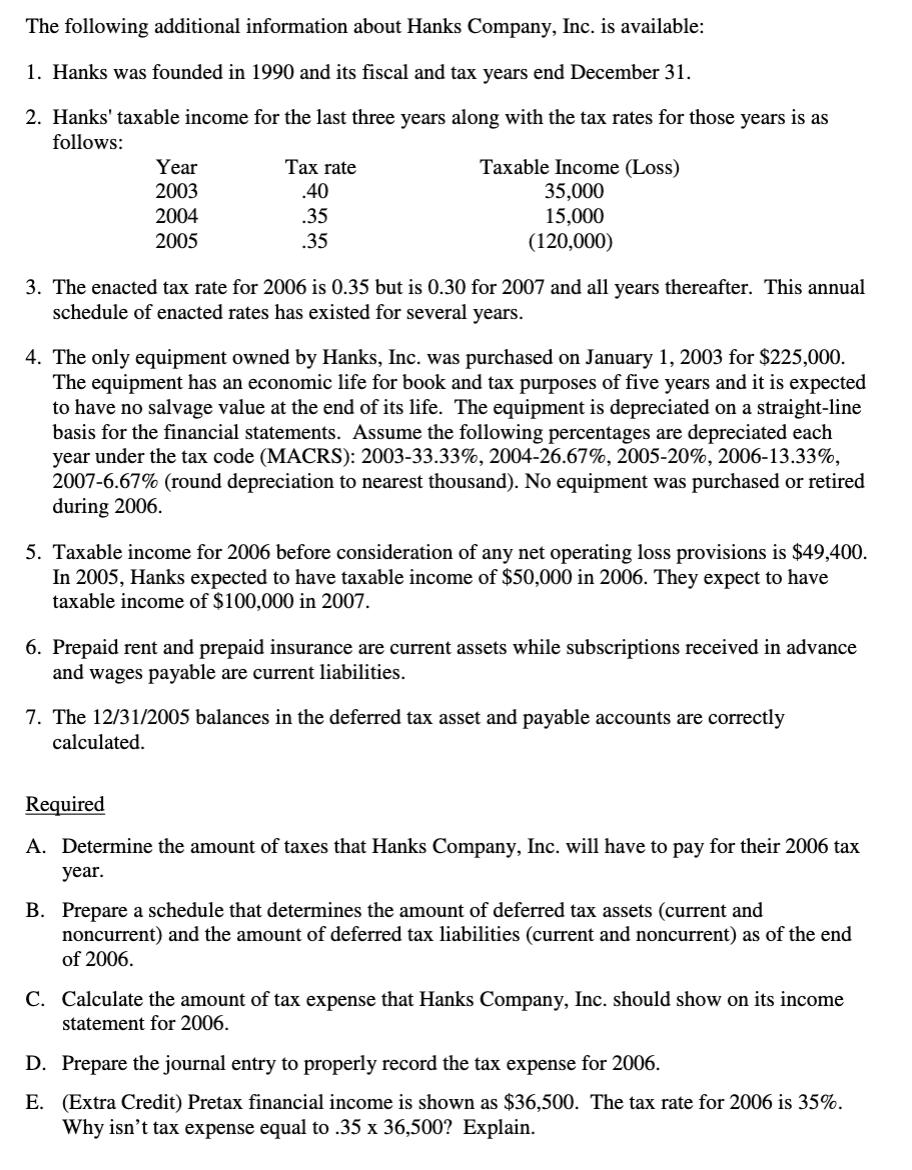

The Hanks Company has the following income statement for the year ended December 31, 2006: Subscription revenue Interest revenue on municipal bonds Total revenues Expenses: Subscription costs Wages Rent expense Depreciation on equipment Insurance expense Total expenses $250,000 4,500 254,500 120,000 30,000 15,000 45,000 8,000 218,000 36,500 Income before tax Hanks Company has the following partially completed comparative balance sheets as of December 31: 2006 2005 Assets Cash Tax refund receivable $92,775 $ 10,000 19,250 19,250 Deferred tax asset-current Prepaid rent Prepaid insurance Municipal bonds: Cost and fair value Interest receivable ???? 20,825 3,000 2,800 2,500 3,200 50,000 50,000 2,250 1,125 Equipment (net) 45,000 90,000 Deferred tax asset-noncurrent ???? 6,000 Total assets ???? 203,200 Liabilities and Owners' Equity Subscriptions received in advance 9,000 7,500 Wages payable 2,400 2,000 Taxes payable ???? 0 Deferred tax liability-current ???? 2,100 Deferred tax liability-noncurrent ???? 14,250 Common stock - par value 30,000 30,000 Common stock - capital in excess of par 20,000 20,000 Retained earnings ????? 127,350 Total liabilities & owners' equity ???? 203,200 The following additional information about Hanks Company, Inc. is available: 1. Hanks was founded in 1990 and its fiscal and tax years end December 31. 2. Hanks' taxable income for the last three years along with the tax rates for those years is as follows: Year 2003 Tax rate .40 2004 .35 2005 .35 Taxable Income (Loss) 35,000 15,000 (120,000) 3. The enacted tax rate for 2006 is 0.35 but is 0.30 for 2007 and all years thereafter. This annual schedule of enacted rates has existed for several years. 4. The only equipment owned by Hanks, Inc. was purchased on January 1, 2003 for $225,000. The equipment has an economic life for book and tax purposes of five years and it is expected to have no salvage value at the end of its life. The equipment is depreciated on a straight-line basis for the financial statements. Assume the following percentages are depreciated each year under the tax code (MACRS): 2003-33.33%, 2004-26.67%, 2005-20%, 2006-13.33%, 2007-6.67% (round depreciation to nearest thousand). No equipment was purchased or retired during 2006. 5. Taxable income for 2006 before consideration of any net operating loss provisions is $49,400. In 2005, Hanks expected to have taxable income of $50,000 in 2006. They expect to have taxable income of $100,000 in 2007. 6. Prepaid rent and prepaid insurance are current assets while subscriptions received in advance and wages payable are current liabilities. 7. The 12/31/2005 balances in the deferred tax asset and payable accounts are correctly calculated. Required A. Determine the amount of taxes that Hanks Company, Inc. will have to pay for their 2006 tax year. B. Prepare a schedule that determines the amount of deferred tax assets (current and noncurrent) and the amount of deferred tax liabilities (current and noncurrent) as of the end of 2006. C. Calculate the amount of tax expense that Hanks Company, Inc. should show on its income statement for 2006. D. Prepare the journal entry to properly record the tax expense for 2006. E. (Extra Credit) Pretax financial income is shown as $36,500. The tax rate for 2006 is 35%. Why isn't tax expense equal to .35 x 36,500? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION A Determine the amount of taxes that Hanks Company Inc will have to pay for their 2006 tax year To calculate the amount of taxes that Hanks C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started