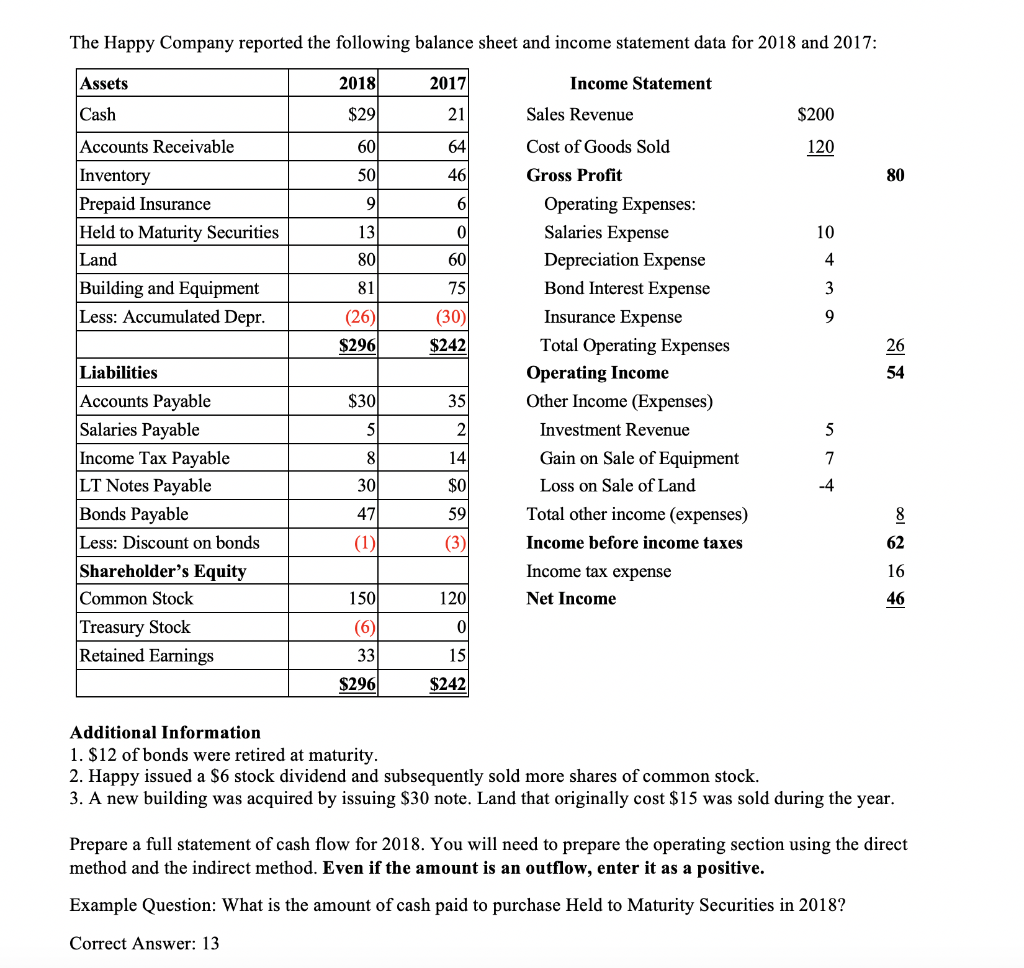

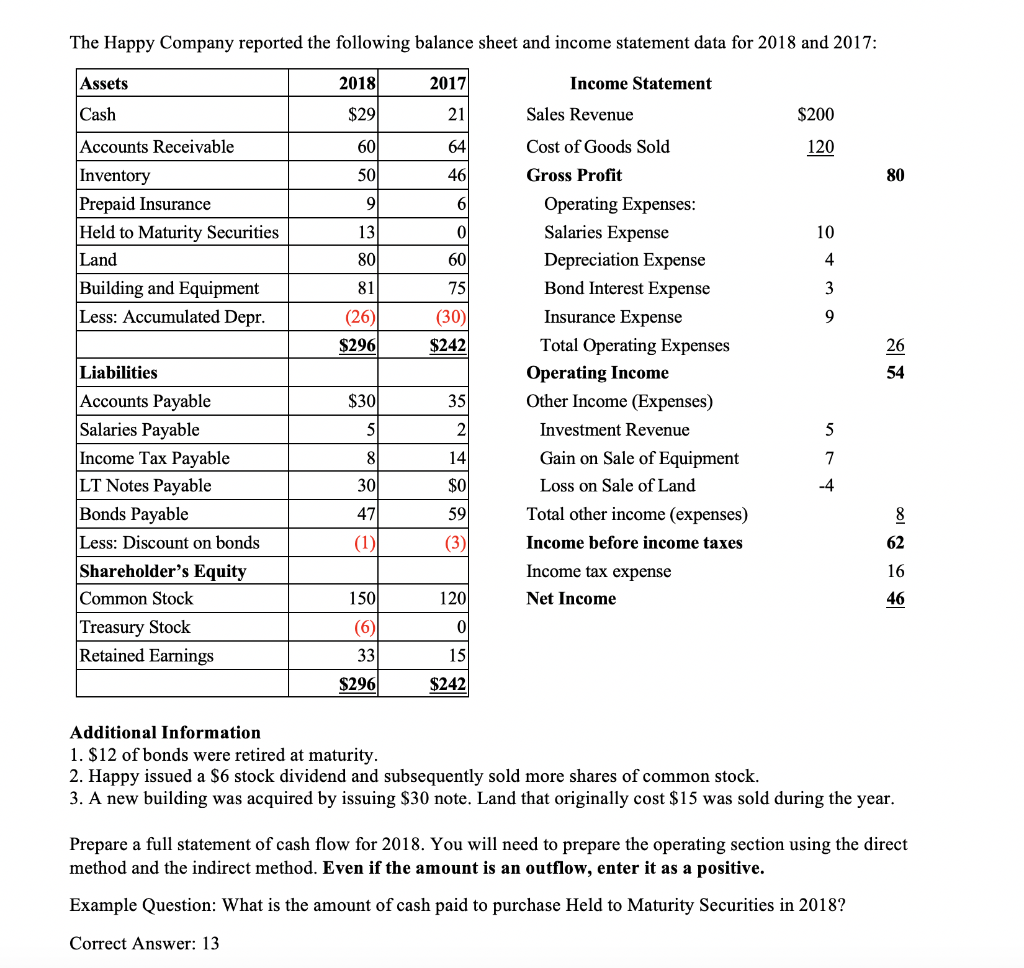

The Happy Company reported the following balance sheet and income statement data for 2018 and 2017: Assets 2017 Income Statement 2018 $29 21 $200 120 64 50 461 80 6 Cash Accounts Receivable Inventory Prepaid Insurance Held to Maturity Securities Land Building and Equipment Less: Accumulated Depr. 81 (26) $296 (30) $242 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense Bond Interest Expense Insurance Expense Total Operating Expenses Operating Income Other Income (Expenses) Investment Revenue Gain on Sale of Equipment Loss on Sale of Land Total other income (expenses) Income before income taxes Income tax expense Net Income $30 n lin Kle Liabilities Accounts Payable Salaries Payable Income Tax Payable LT Notes Payable Bonds Payable Less: Discount on bonds Shareholder's Equity Common Stock Treasury Stock Retained Earnings 10 es # 5 1201 150 (6) 0 33 $296 $242 Additional Information 1. $12 of bonds were retired at maturity. 2. Happy issued a $6 stock dividend and subsequently sold more shares of common stock. 3. A new building was acquired by issuing $30 note. Land that originally cost $15 was sold during the year. Prepare a full statement of cash flow for 2018. You will need to prepare the operating section using the direct method and the indirect method. Even if the amount is an outflow, enter it as a positive. Example Question: What is the amount of cash paid to purchase Held to Maturity Securities in 2018? Correct Answer: 13 The Happy Company reported the following balance sheet and income statement data for 2018 and 2017: Assets 2017 Income Statement 2018 $29 21 $200 120 64 50 461 80 6 Cash Accounts Receivable Inventory Prepaid Insurance Held to Maturity Securities Land Building and Equipment Less: Accumulated Depr. 81 (26) $296 (30) $242 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense Bond Interest Expense Insurance Expense Total Operating Expenses Operating Income Other Income (Expenses) Investment Revenue Gain on Sale of Equipment Loss on Sale of Land Total other income (expenses) Income before income taxes Income tax expense Net Income $30 n lin Kle Liabilities Accounts Payable Salaries Payable Income Tax Payable LT Notes Payable Bonds Payable Less: Discount on bonds Shareholder's Equity Common Stock Treasury Stock Retained Earnings 10 es # 5 1201 150 (6) 0 33 $296 $242 Additional Information 1. $12 of bonds were retired at maturity. 2. Happy issued a $6 stock dividend and subsequently sold more shares of common stock. 3. A new building was acquired by issuing $30 note. Land that originally cost $15 was sold during the year. Prepare a full statement of cash flow for 2018. You will need to prepare the operating section using the direct method and the indirect method. Even if the amount is an outflow, enter it as a positive. Example Question: What is the amount of cash paid to purchase Held to Maturity Securities in 2018? Correct Answer: 13