Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects. The firm can earn a higher

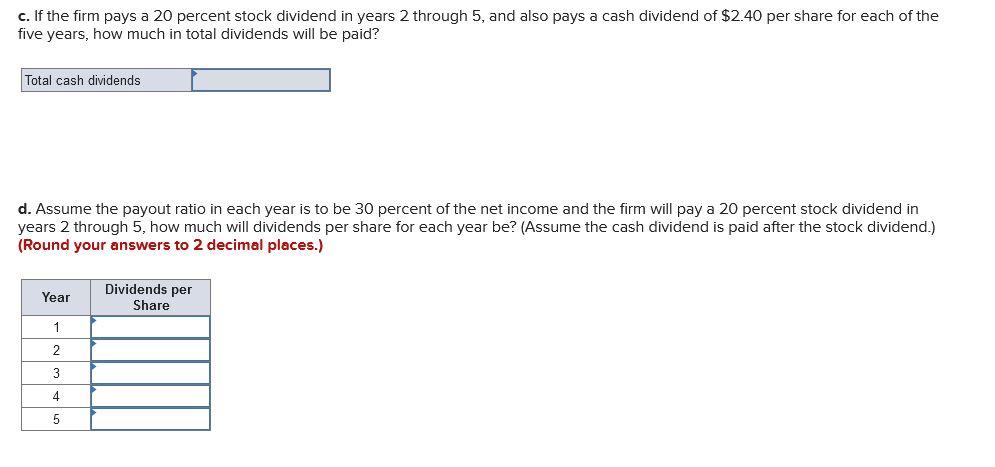

The Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects. The firm can earn a higher return on the projects than the stockholders could earn if the funds were paid out in the form of dividends. Year 1 2 3 4 5 Net Income $13 million 21 million 11 million 14 million 17 million The Hastings Corporation has 2 million shares outstanding. (The following questions are separate from each other). a. If the marginal principle of retained earnings is applied, how much in total cash dividends will be paid over the five years? (Enter your answer in millions.) Total cash dividends Profitable Capital Expenditure $ 7 million 12 million 7 million 8 million 9 million Total cash dividends million b. If the firm simply uses a payout ratio of 40 percent of net income, how much in total cash dividends will be paid? (Enter your answer in millions and round your answer to 1 decimal place.) million c. If the firm pays a 20 percent stock dividend in years 2 through 5, and also pays a cash dividend of $2.40 per share for each of the five years, how much in total dividends will be paid? Total cash dividends d. Assume the payout ratio in each year is to be 30 percent of the net income and the firm will pay a 20 percent stock dividend in years 2 through 5, how much will dividends per share for each year be? (Assume the cash dividend is paid after the stock dividend.) (Round your answers to 2 decimal places.) Year 1 2 3 4 5 Dividends per Share

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a If the marginal principal of retained earnings is applied the total cash dividends paid over the five years will be the difference between net income and profitable capital expenditure each year Yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started