Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The head of the accounting department at a major software manufacturer has asked you to put together a pro forma statement of the company's

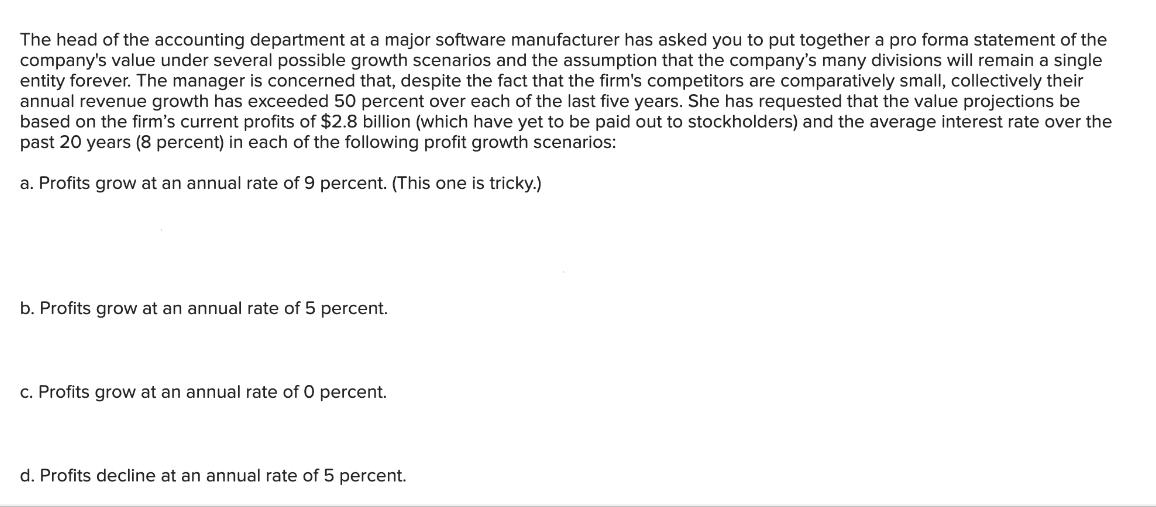

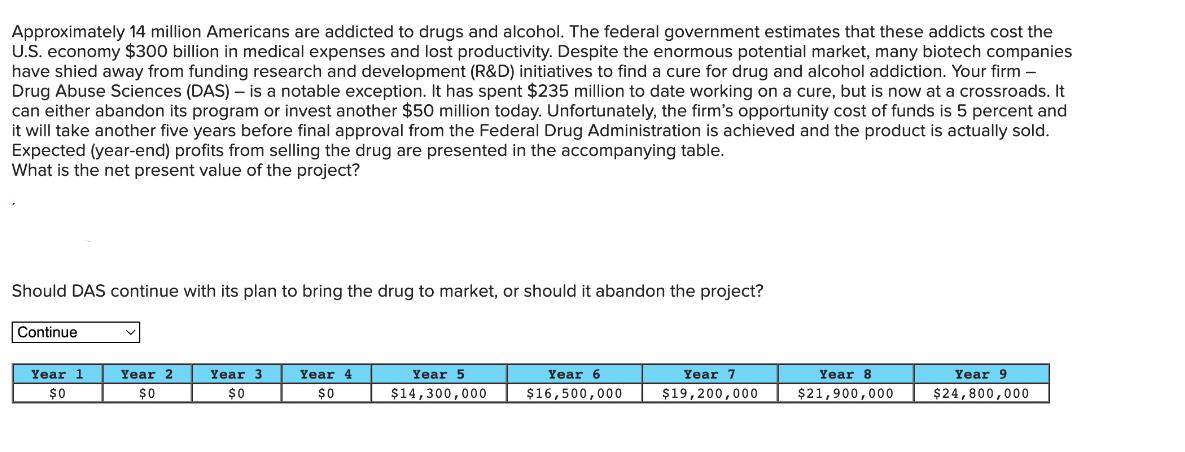

The head of the accounting department at a major software manufacturer has asked you to put together a pro forma statement of the company's value under several possible growth scenarios and the assumption that the company's many divisions will remain a single entity forever. The manager is concerned that, despite the fact that the firm's competitors are comparatively small, collectively their annual revenue growth has exceeded 50 percent over each of the last five years. She has requested that the value projections be based on the firm's current profits of $2.8 billion (which have yet to be paid out to stockholders) and the average interest rate over the past 20 years (8 percent) in each of the following profit growth scenarios: a. Profits grow at an annual rate of 9 percent. (This one is tricky.) b. Profits grow at an annual rate of 5 percent. c. Profits grow at an annual rate of 0 percent. d. Profits decline at an annual rate of 5 percent. Approximately 14 million Americans are addicted to drugs and alcohol. The federal government estimates that these addicts cost the U.S. economy $300 billion in medical expenses and lost productivity. Despite the enormous potential market, many biotech companies have shied away from funding research and development (R&D) initiatives to find a cure for drug and alcohol addiction. Your firm - Drug Abuse Sciences (DAS) - is a notable exception. It has spent $235 million to date working on a cure, but is now at a crossroads. It can either abandon its program or invest another $50 million today. Unfortunately, the firm's opportunity cost of funds is 5 percent and it will take another five years before final approval from the Federal Drug Administration is achieved and the product is actually sold. Expected (year-end) profits from selling the drug are presented in the accompanying table. What is the net present value of the project? Should DAS continue with its plan to bring the drug to market, or should it abandon the project? Continue Year 1 $0 Year 2 $0 Year 3 $0 Year 4 $0 Year 5 $14,300,000 Year 6 $16,500,000 Year 7 $19,200,000 Year 8 $21,900,000 Year 9 $24,800,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started