Question

The heating oil delivery business's assets consisted solely of a customer list, service parts, oil inventory and three delivery trucks and no real property: Truck

The heating oil delivery business's assets consisted solely of a customer list, service parts, oil inventory and three delivery trucks and no real property:

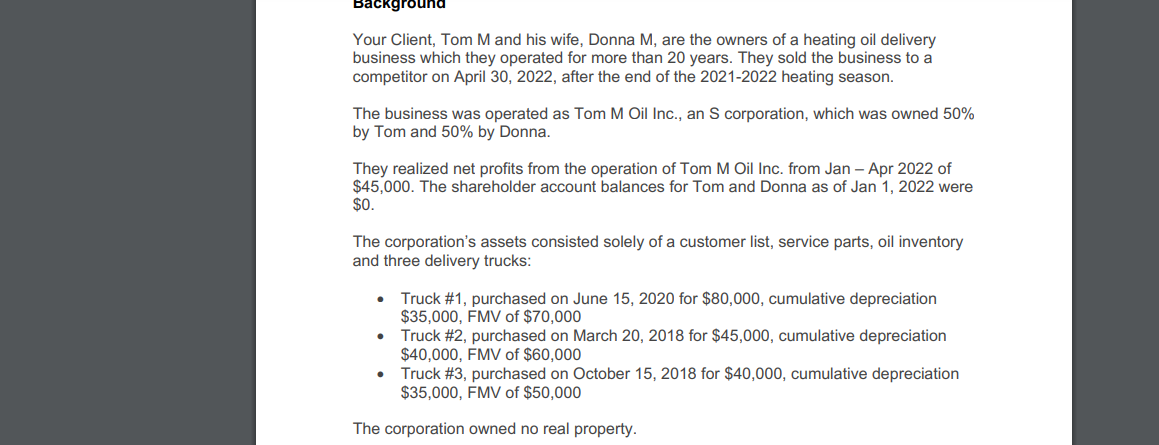

Truck #1, purchased on June 15, 2020 for $80,000, cumulative depreciation $35,000, FMV of $70,000

Truck #2, purchased on March 20, 2018 for $45,000, cumulative depreciation $40,000, FMV of $60,000

Truck #3, purchased on October 15, 2018 for $40,000, cumulative depreciation $35,000, FMV of $50,000

The business was owned by both of them with a share of 50% each.

They realized net profits of $45,000 (JAN-APR , 2022) from their operations.

The shareholder account balances for Tom and Donna as of Jan 1, 2022 were $0.

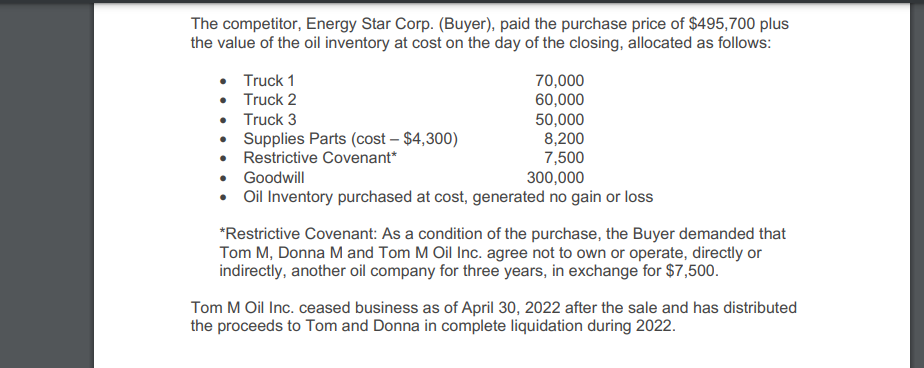

Their competitor, Energy Star Corp. (Buyer), paid the purchase price of $495,700 plus the value of the oil inventory at cost on the day of the closing, allocated as follows:

Truck 1 70,000

Truck 2 60,000

Truck 3 50,000

Supplies Parts (cost - $4,300) 8,200

Restrictive Covenant* 7,500

Goodwill 300,000

Oil Inventory purchased at cost, generated no gain or loss

*Restrictive Covenant: As a condition of the purchase, the Buyer demanded that Tom M, Donna M and Tom M Oil Inc. agree not to own or operate, directly or indirectly, another oil company for three years, in exchange for $7,500. Tom M Oil Inc. ceased business as of April 30, 2022 after the sale and has distributed the proceeds to Tom and Donna in complete liquidation during 2022.

PLS HELP ME CALCULATE THE FOLLOWING:

What is the COST OF GOODS SOLD= ?

COLLECTIBLES (28%) (GAIN/LOSS)= ?

OTHER INCOME/LOSS= ?

ITEMS AFFECTING SHAREHOLDER BASIS =?

SHAREHOLDERS NUM OF SHARES AT THE BEGINNING OF TAX YEAR= ?

SHAREHOLDERS NUM OF SHARES AT THE NE DOF TAX YEAR= ?

LOANS FROM SHAREHOLDERS AT BEGINNNING OF TAX YEAR= ?

LOANS FROM SHAREHOLDERS AT END OF TAX YEAR= ?

WHAT IS THE USE OF RESTRICTIVE COVENANT GIVEN IN THE QUESTION AND WHERE IT IS USED IN CALCULATIONS= ?

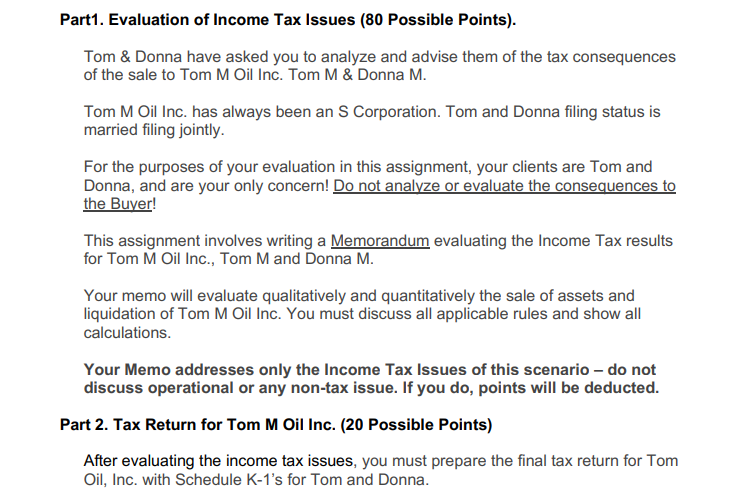

Your Client, Tom M and his wife, Donna M, are the owners of a heating oil delivery business which they operated for more than 20 years. They sold the business to a competitor on April 30, 2022, after the end of the 2021-2022 heating season. The business was operated as Tom M Oil Inc., an S corporation, which was owned 50% by Tom and 50% by Donna. They realized net profits from the operation of Tom M Oil Inc. from Jan - Apr 2022 of $45,000. The shareholder account balances for Tom and Donna as of Jan 1, 2022 were $0. The corporation's assets consisted solely of a customer list, service parts, oil inventory and three delivery trucks: - Truck \#1, purchased on June 15, 2020 for $80,000, cumulative depreciation $35,000, FMV of $70,000 - Truck \#2, purchased on March 20, 2018 for $45,000, cumulative depreciation $40,000, FMV of $60,000 - Truck \#3, purchased on October 15, 2018 for $40,000, cumulative depreciation $35,000, FMV of $50,000 The corporation owned no real property. The competitor, Energy Star Corp. (Buyer), paid the purchase price of $495,700 plus the value of the oil inventory at cost on the day of the closing, allocated as follows: *Restrictive Covenant: As a condition of the purchase, the Buyer demanded that Tom M, Donna M and Tom M Oil Inc. agree not to own or operate, directly or indirectly, another oil company for three years, in exchange for $7,500. Tom M Oil Inc. ceased business as of April 30, 2022 after the sale and has distributed the proceeds to Tom and Donna in complete liquidation during 2022. Part1. Evaluation of Income Tax Issues (80 Possible Points). Tom \& Donna have asked you to analyze and advise them of the tax consequences of the sale to Tom M Oil Inc. Tom M \& Donna M. Tom M Oil Inc. has always been an S Corporation. Tom and Donna filing status is married filing jointly. For the purposes of your evaluation in this assignment, your clients are Tom and Donna, and are your only concern! Do not analyze or evaluate the consequences to the Buyer! This assignment involves writing a Memorandum evaluating the Income Tax results for Tom M Oil Inc., Tom M and Donna M. Your memo will evaluate qualitatively and quantitatively the sale of assets and liquidation of Tom M Oil Inc. You must discuss all applicable rules and show all calculations. Your Memo addresses only the Income Tax Issues of this scenario - do not discuss operational or any non-tax issue. If you do, points will be deducted. Part 2. Tax Return for Tom M Oil Inc. (20 Possible Points) After evaluating the income tax issues, you must prepare the final tax return for Tom Oil, Inc. with Schedule K-1's for Tom and Donna

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started