Question

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances: Estimated expenses of liquidation were $10,000. Henry, Isaac, and

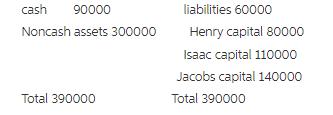

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances:

Estimated expenses of liquidation

were $10,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

Before liquidating any assets, the partners determined the amount of safe cash and distributed it. The noncash assets were then sold for $120,000, and the liquidation expenses of $10,000 were paid. How much of the $120,000 would be distributed to Henry?

cash 90000 liabilities 60000 Noncash assets 300000 Henry capital 80000 Isaac capital 110000 Jacobs capital 140000 Total 390000 Total 390000

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App