Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hilltop Corporation is considering (as of 1/1/08) the replacement of an old machine that is currently being used. The old machine is fully depreciated

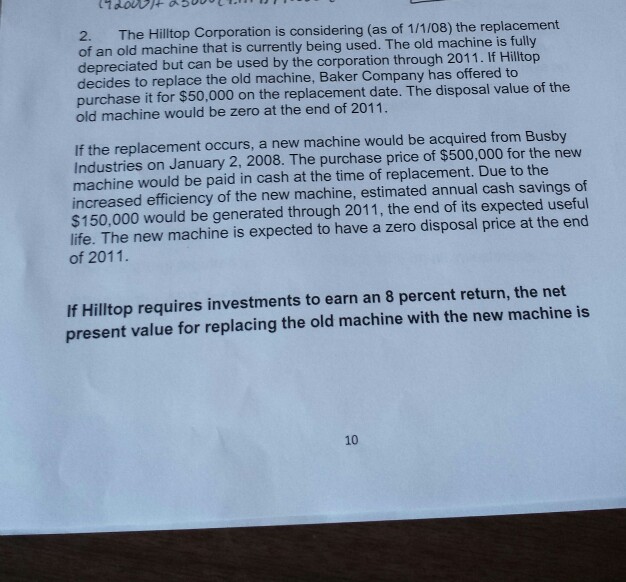

The Hilltop Corporation is considering (as of 1/1/08) the replacement of an old machine that is currently being used. The old machine is fully depreciated but can be used by the corporation through 2011. If Hilltop decides to replace the old machine, Baker Company has offered to purchase it for $50,000 on the replacement date. The disposal value of the old machine would be zero at the end of 2011. If the replacement occurs, a new machine would be acquired from Busby Industries on January 2, 2008. The purchase price of $500,000 for the new machine would be paid in cash at the time of replacement. Due to the increased efficiency of the new machine, estimated annual cash savings of $150,000 would be generated through 2011, the end of its expected useful life. The new machine is expected to have a zero disposal price at the end of 2011. If Hilltop requires investments to earn an 8 percent return, the net present value for replacing the old machine with the new machine is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started