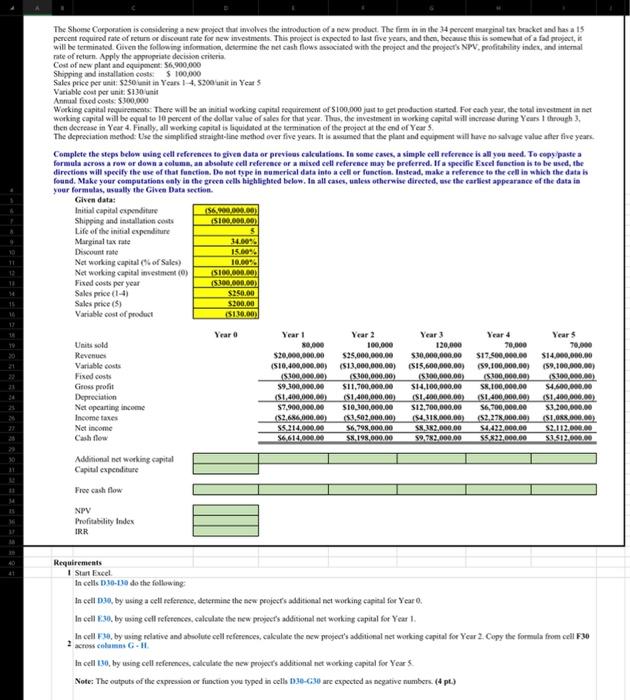

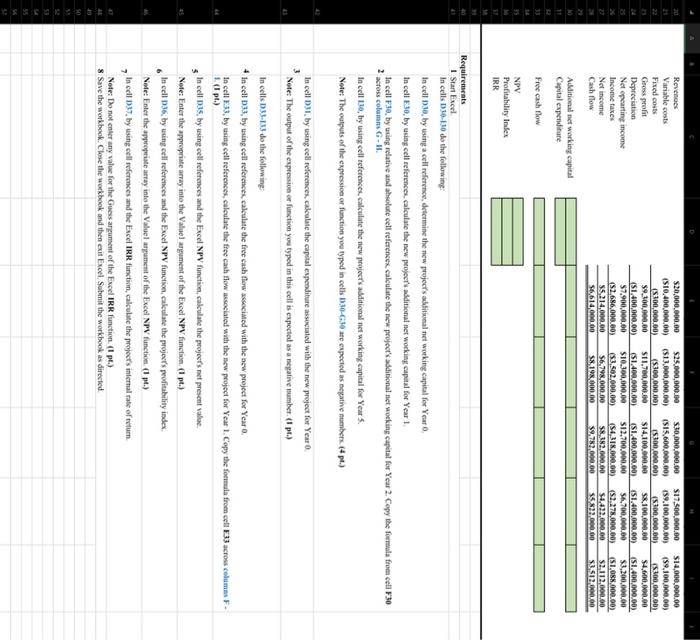

The \$home Corporative is considering a new project that involves the introduction of a sew product. The firm in in the 34 peroent marginal tak bracket and bss a is percent required rate of returs or disceust rate for new investments. This project is expected to last five years, and then, becauct this is somentut of a fad projert, if will be terminath. Given the following informstiod, determine the net cash flows assaciated with the project and the project's NPV, peofitability index, and intemal nate of return. Apply the appropeiate decision criseria Cos of acw plant and equipencen: 56,900,000 Shipping and installation soots $100000 Variable cont per unit: $130 unit Anmal foud coste $300000 working capital will be equal to to percent of the dollar valse of sales for that year. Thas, the investinent in working copital will increase durine Years 1 throuph 3 , then decrease in Year 4. Fieally, all woeking eapital is liquidaled ar the termination of the project at the end of Year 5. Complete the steps belon wing celf referenes to gives data or previess calculations. In some caves, a simple cell referrace is all yeu aend. To copy yaste a formuls across a row or down a colema, an absolate cell refercece or a mived cell refereace may be preferred. If a specific Escel fasction is to be used, tbe sour formelas, usualty the Given Data sectien. In cells D30-110 de the following: In cell D30, by using a cell referesee, determine the new peojecr's additseal net working capinal for Year 0. In eel R.30, by woing cell referonses, calewlate the new pryeefs additional net werking capial for Year 1. In cell F to by wing relative and absolute cell references, calculate the new project's adStional net working copital for Year 2. Copy the formula from cell F 30 2 acruss colainns G-11. In cell 130, by wsing cell references, alculate the new poojer's additional net working copital for Year 5 Note: The outputs of the cupressioa or function you typed in sells D3e-G30 are cepectod as negative numbers. (4 pt.) I Start Execl In cells D 20 - 130 de the fellawing: In eril D3e, by using a cell reference, detcrmine the new projeci's ablitivnal net working capical for Year 0 . In cell E 30, by asing cell references, calculate the new peoject's additional net working sapat for Year 1. In cell F3e, by using relative and ahoolute cell references. calculate the rewe project's additional net woeking capital for Year 2 . Copy the formula foom cell F 30 2 across colamens 6 - II. In coll 135, by using cell teferehces, ealculate the new projoct's asditional net working capital for Year 5. Neter The outputs of the expressioe or function yoe ryped in oelts 0.30-G.30 afe espected as nefathe numbers. (4 p4.) In cell D31, by using cell references, culculate the capital expenditure associated with the new project for Year 0. 3 Nete: The output of the espressioe er function you typed in this cell is expected as a negative sumber. (I pt.) In colls D33-13.3 do the folluwing: 4 In cell D33, by waing cell referchces, calculase the free cash flerw associaaed with the acw project for Year 0. In cell F.33, by asiag cell eeferences, calculate the free cash How associated with the acw peoject for Year 1 . Copy the focrala froen cell Ea3 across columas F - 1. (I pt.) 5 In cell D35, by wing cell reforences and the Exeel NPY function, calculate the projecfs net prescnt value. Nete: Enter the appropriate amay into the Valuel argument of the Excel NPV function. (I pt.) 6 In cell D36, by woing cell fefenences and the Excel NPY functisen, calculate the projects profitabelity index. Vode: Enter the approgeiate array inte the Valuel asgument of the Exeel NPY functive. (I pt.) 7 In cell 1937, by using cell wfermees and the Excel IRR function, calculate the project's internal rate of teturn. Nede: Do not cnier any valus for the Guess arzumsent of the Escel IRR function. (1 pt.) 8 Save the workbook. Clese the workbook and then exit Excel. Submit the workbook as dirtcied