Answered step by step

Verified Expert Solution

Question

1 Approved Answer

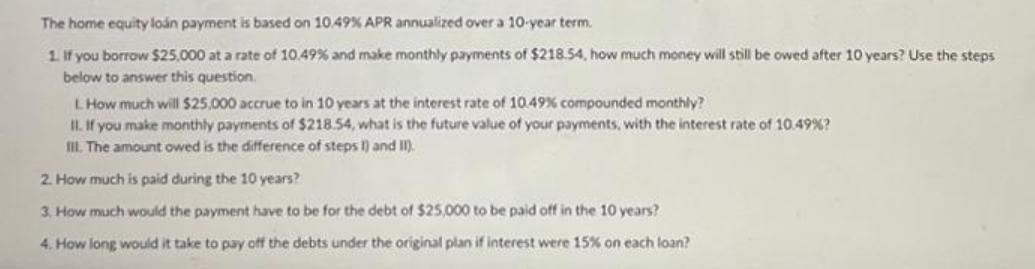

The home equity lon payment is based on 10.49 % APR annualized over a 10-year term. 1. If you borrow $25,000 at a rate

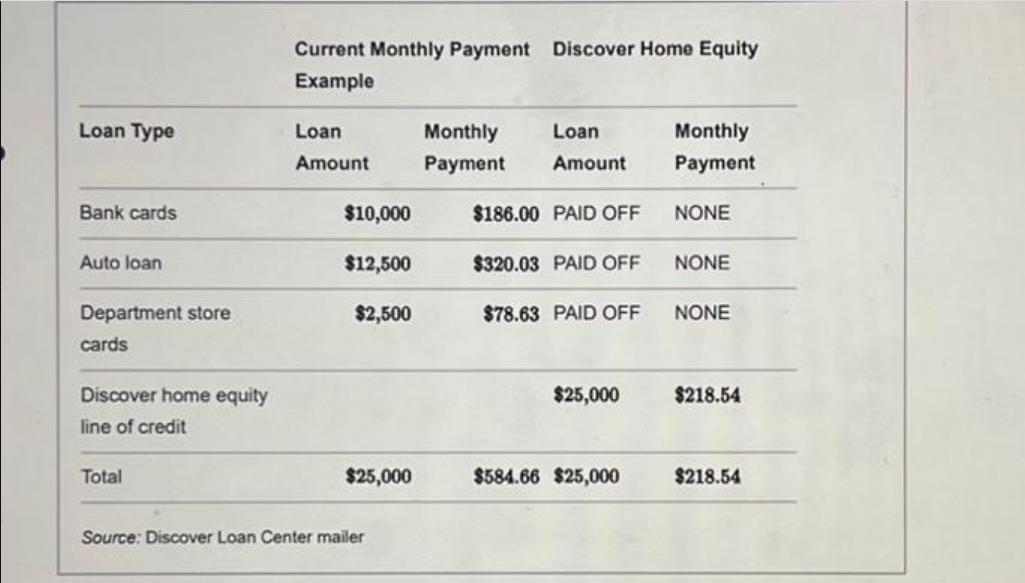

The home equity lon payment is based on 10.49 % APR annualized over a 10-year term. 1. If you borrow $25,000 at a rate of 10.49% and make monthly payments of $218.54, how much money will still be owed after 10 years? Use the steps below to answer this question. L. How much will $25,000 accrue to in 10 years at the interest rate of 10.49% compounded monthly? II. If you make monthly payments of $218.54, what is the future value of your payments, with the interest rate of 10.49%? Ill. The amount owed is the difference of steps I) and II). 2. How much is paid during the 10 years? 3. How much would the payment have to be for the debt of $25,000 to be paid off in the 10 years? 4. How long would it take to pay off the debts under the original plan if interest were 15% on each loan? Loan Type Bank cards Auto loan Department store cards Discover home equity line of credit Total Current Monthly Payment Discover Home Equity Example Loan Amount $10,000 $12,500 $2,500 $25,000 Source: Discover Loan Center mailer Monthly Loan Payment Amount $186.00 PAID OFF $320.03 PAID OFF $78.63 PAID OFF $25,000 $584.66 $25,000 Monthly Payment NONE NONE NONE $218.54 $218.54

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 Calculate the future value of the loan The future value of the loan is the amount of money that will be owed after 10 years including interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started