Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Home Office in Global City bills its QC branch for shipments of goods at 25% above cost. At the close of the business

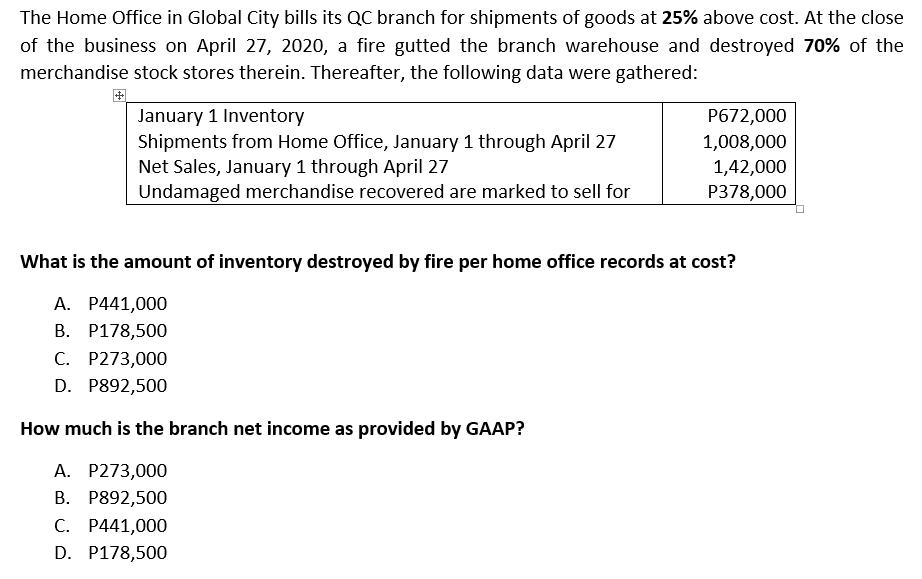

The Home Office in Global City bills its QC branch for shipments of goods at 25% above cost. At the close of the business on April 27, 2020, a fire gutted the branch warehouse and destroyed 70% of the merchandise stock stores therein. Thereafter, the following data were gathered: January 1 Inventory P672,000 Shipments from Home Office, January 1 through April 27 Net Sales, January 1 through April 27 Undamaged merchandise recovered are marked to sell for 1,008,000 1,42,000 P378,000 What is the amount of inventory destroyed by fire per home office records at cost? A. P441,000 B. P178,500 C. P273,000 D. P892,500 How much is the branch net income as provided by GAAP? A. P273,000 B. P892,500 C. P441,000 D. P178,500

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Inventory as on January 1 Shipment from Jan 1 to Apr 27 672000 100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started