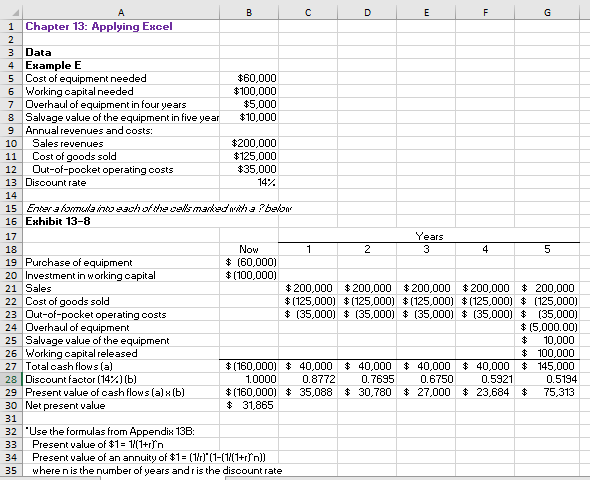

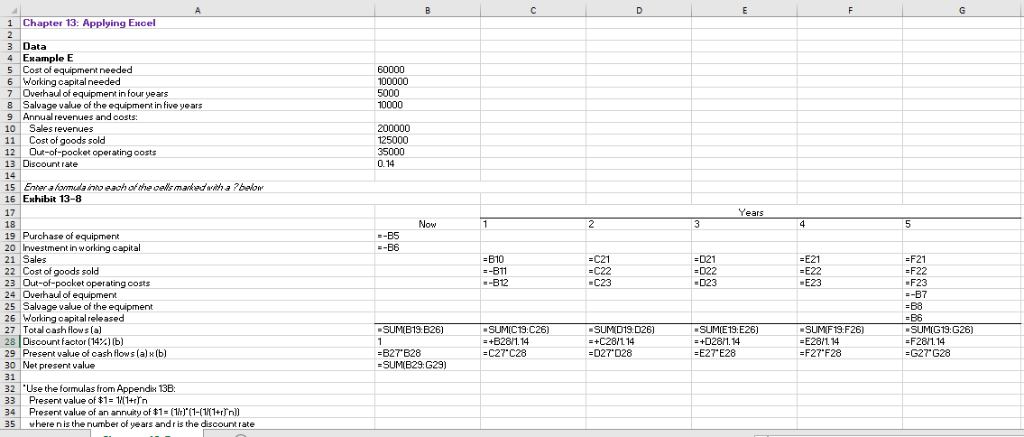

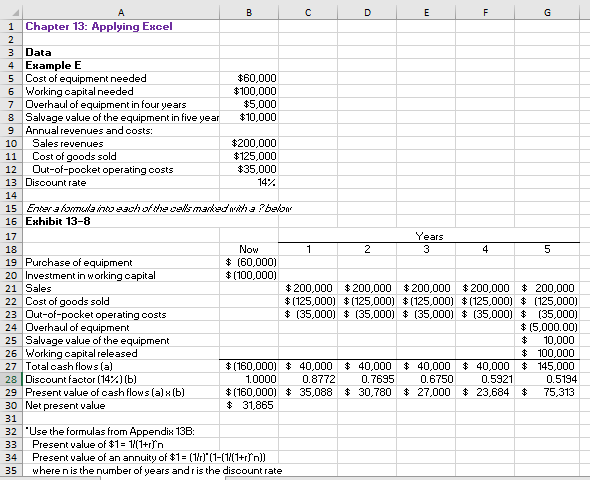

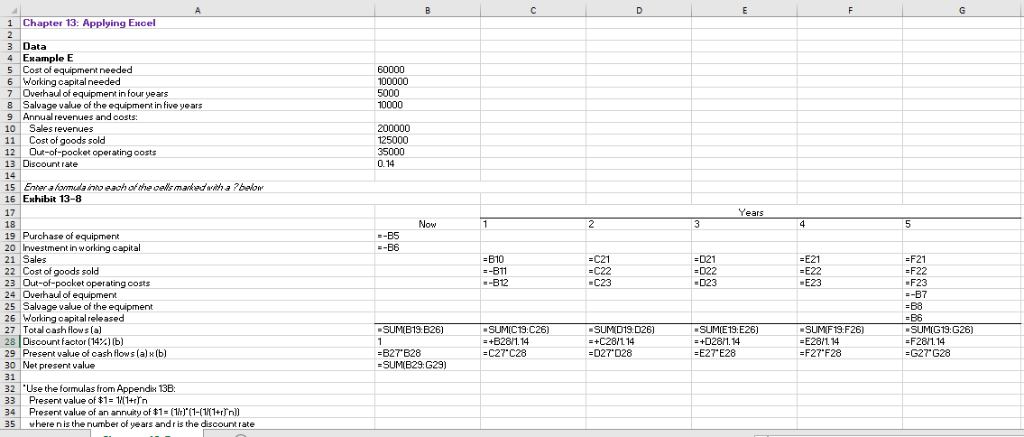

The homework problem I am working on says the Net Present Value should be between $56,518 and $56,535. I'm not sure if I'm doing my formulas wrong but I keep getting this answer. Here are the formulas I am using as well

The homework problem I am working on says the Net Present Value should be between $56,518 and $56,535. I'm not sure if I'm doing my formulas wrong but I keep getting this answer. Here are the formulas I am using as well

1 Chapter 13: Applying EHcel 3 Data 4 Eample E 5 Cost of equipment needed 6 Working capital needed 7 Overhaul of equipment in four years 8 Salvage value of the equipment in five yer $10,000 9 Annual revenues and costs: 10 Sales revenues 11 Cost of goods sold $60,000 $100,000 $5,000 $200,000 $125,000 $35,000 ut-of-pocket operating costs 13 Discount rate 15 Enraahelsma^>- bn 16 Exhibit 13-8 Now $ (60,000) (100,000) 18 19 Purchase of equipment 20 Investment in working capital 21 Sale:s 22 Cost of goods sold t200,000 $200,000 $ 200,000 200,000 200,000 125,000) $(125,000)$(125,000)$(125,000) $(125,000) $(35,000) (35,000) $ 35,000)t(35,000) $ (35,000) $5,000.00) $10,000 $100,000 $(160,000)$40,000 $ 40,000$ 40,000 $40,000$145,000 0.5194 $(160,000) $ 35,088$ 30,78027,00023,684 75,313 ut-of-pocket operating costs 24 Overhaul of equipment 25 Salvage value of the equipment 26 Workingapialeleased 27 Total cash flows (a) 28 Discount factor (14%)(b) 29 Present value of cash flows(a) (b) 30 Net present value 31 32 Use the formulas rom Appendix 13B 33 Present value of $1-101+rn 34 Present value of an annuity of $1 )HIN1+n) 35 where n is the number of years andr is the discount rate 1.0000 0.8772 0.7695 0.6750 0.5921 $31865 1 Chapter 13: Applying Excel 3 Data 4 Example E 5 Cost of equipment needed 6 Working capitalneeded 7 Overhaul of equipment in four years 8 Salvage value of the equipment in five years 9 Annual revenues and costs: 60000 100000 5000 10000 10 Sales revenues 11 Cost of goods sold 12 Out-of-pocket operatingoosts 13 Discount rate 14 1S Enter a formda into each of the ce/is marked\ 16 Exhibit 13-8 125000 35000 0.14 ? a ? below Years 17 18 19 Purchase of equipment 20 Investment in working capital 21 Sales 22 Cost of goods sold 23 Out-of-pocket operating costs 24 Ovethaul of equipment 25 Salvage value of the equipment 26 Workingpitaleeased 27 Total cash flows (a) 28 Discount factor (14%lb 29 Present value of cash flow s a)(b) 30 Net present value 31 Now -F21 -F22 F23 B10 :-B11 -B12 C21 C22 C23 021 022 023 E21 -E22 E23 SUMD19 D26) +C281114 D27 028 SUMIE 19:E26) +028/1.14 -E27 E28 SUMIB19:826) SUMICT9:C26) SUMIF19 F26) E2811. 14 -F27 F28 SUMIG19:G26) -F281.14 G27 G28 +828/1.14 C27 C28 827 B28 SUMB29:G29) 32 Use the formulas from Appendls 13B: 33 Present value of $1-11+n 34 Present value of an annuity of $111-+nl) 35 where n is the number of years andr is the discountrate

The homework problem I am working on says the Net Present Value should be between $56,518 and $56,535. I'm not sure if I'm doing my formulas wrong but I keep getting this answer. Here are the formulas I am using as well

The homework problem I am working on says the Net Present Value should be between $56,518 and $56,535. I'm not sure if I'm doing my formulas wrong but I keep getting this answer. Here are the formulas I am using as well