Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. The Honorable East India Company must pay two liabilities, 100, 000 in exactly three years (t = 3) and 120, 000 in exactly

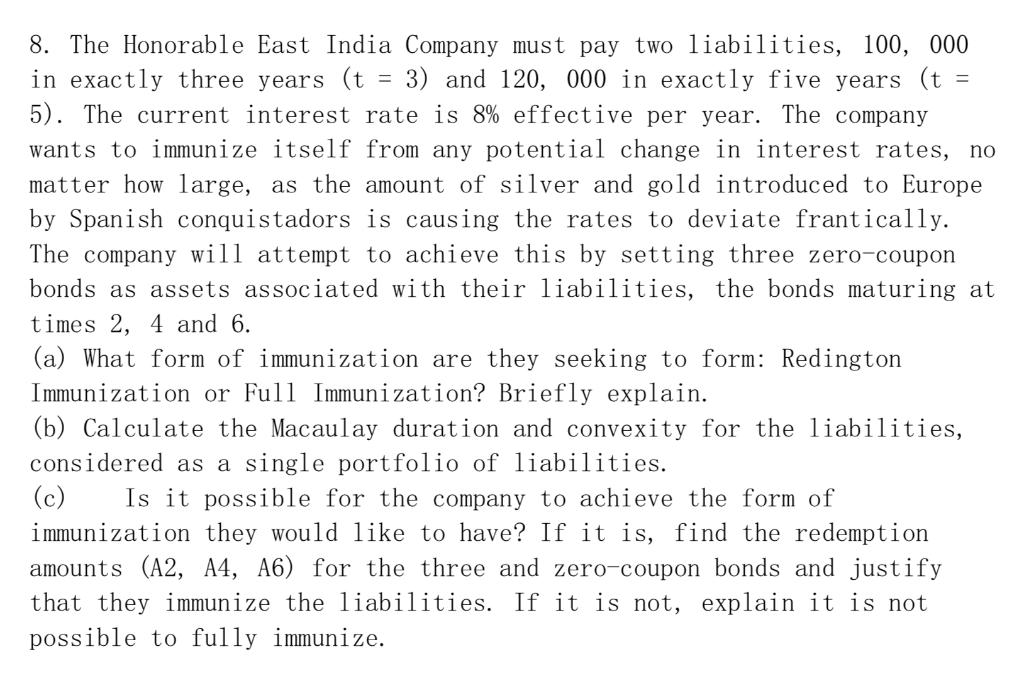

8. The Honorable East India Company must pay two liabilities, 100, 000 in exactly three years (t = 3) and 120, 000 in exactly five years (t = 5). The current interest rate is 8% effective per year. The company wants to immunize itself from any potential change in interest rates, no matter how large, as the amount of silver and gold introduced to Europe by Spanish conquistadors is causing the rates to deviate frantically. The company will attempt to achieve this by setting three zero-coupon bonds as assets associated with their liabilities, the bonds maturing at times 2, 4 and 6. (a) What form of immunization are they seeking to form: Redington Immunization or Full Immunization? Briefly explain. (b) Calculate the Macaulay duration and convexity for the liabilities, considered as a single portfolio of liabilities. (c) i mmunization they would like to have? If it is, find the redemption amounts (A2, A4, A6) for the three and zero-coupon bonds and justify Is it possible for the company to achieve the form of that they immunize the liabilities. If it is not, explain it is not possible to fully immunize.

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer a As a company wnts to Immunize itself from any potential change in interest rate no matter ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started