The Hootie and the Blowfish Company keeps no Work in Process inventories. At the beginning of 2020, the company had no beginning Finished Goods

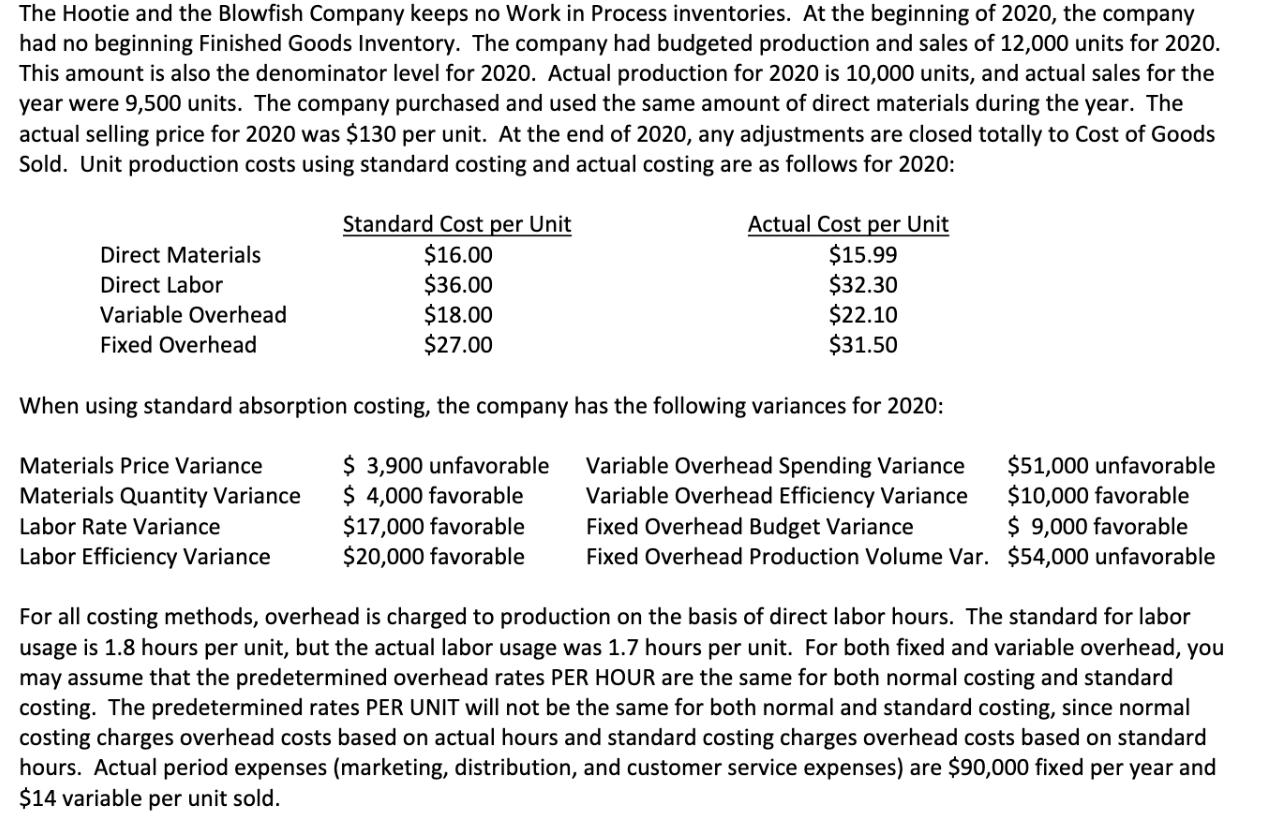

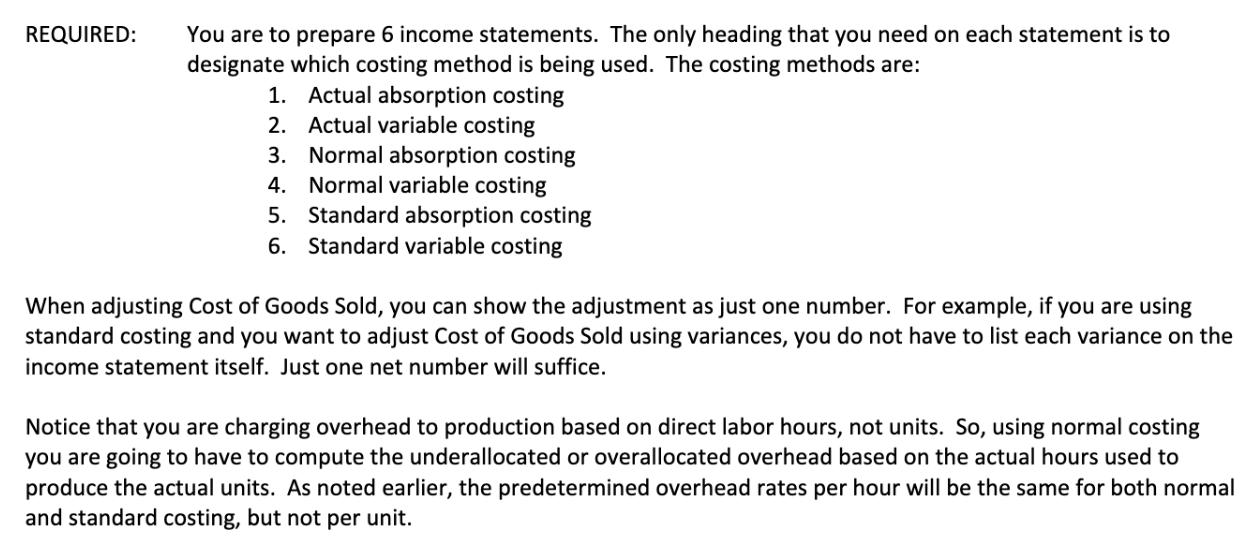

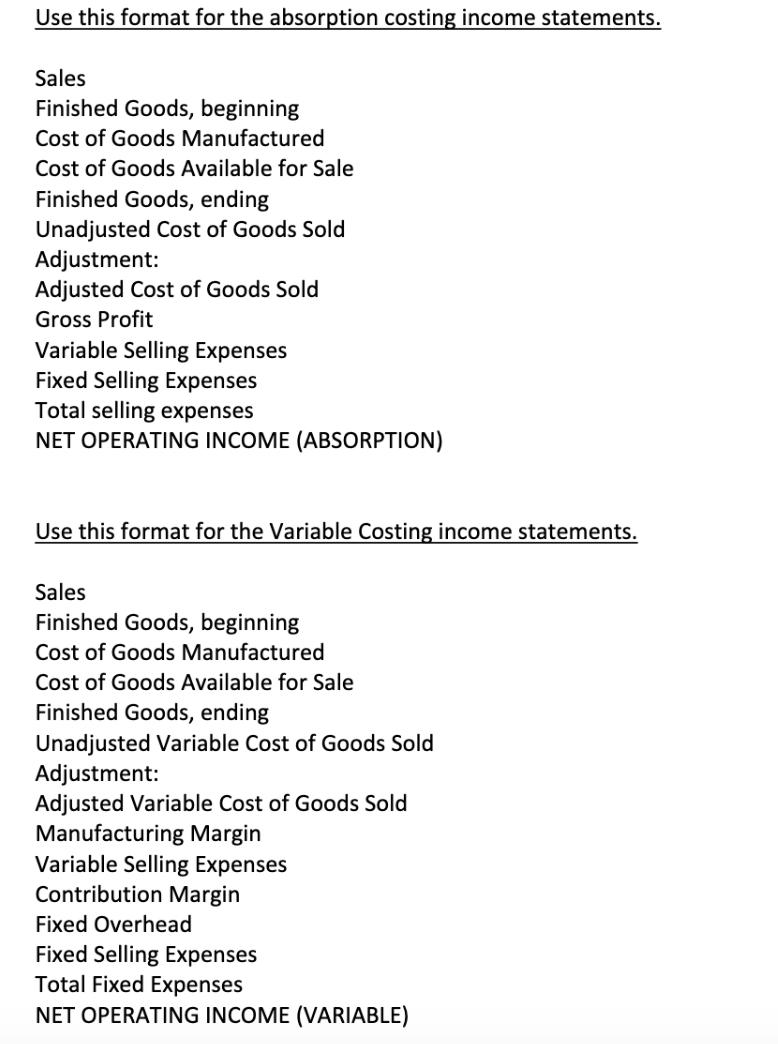

The Hootie and the Blowfish Company keeps no Work in Process inventories. At the beginning of 2020, the company had no beginning Finished Goods Inventory. The company had budgeted production and sales of 12,000 units for 2020. This amount is also the denominator level for 2020. Actual production for 2020 is 10,000 units, and actual sales for the year were 9,500 units. The company purchased and used the same amount of direct materials during the year. The actual selling price for 2020 was $130 per unit. At the end of 2020, any adjustments are closed totally to Cost of Goods Sold. Unit production costs using standard costing and actual costing are as follows for 2020: Standard Cost per Unit $16.00 $36.00 $18.00 $27.00 Actual Cost per Unit $15.99 $32.30 $22.10 $31.50 Direct Materials Direct Labor Variable Overhead Fixed Overhead When using standard absorption costing, the company has the following variances for 2020: $ 3,900 unfavorable $ 4,000 favorable $17,000 favorable $20,000 favorable $51,000 unfavorable $10,000 favorable $ 9,000 favorable Materials Price Variance Variable Overhead Spending Variance Variable Overhead Efficiency Variance Fixed Overhead Budget Variance Fixed Overhead Production Volume Var. $54,000 unfavorable Materials Quantity Variance Labor Rate Variance Labor Efficiency Variance For all costing methods, overhead is charged to production on the basis of direct labor hours. The standard for labor usage is 1.8 hours per unit, but the actual labor usage was 1.7 hours per unit. For both fixed and variable overhead, you may assume that the predetermined overhead rates PER HOUR are the same for both normal costing and standard costing. The predetermined rates PER UNIT will not be the same for both normal and standard costing, since normal costing charges overhead costs based on actual hours and standard costing charges overhead costs based on standard hours. Actual period expenses (marketing, distribution, and customer service expenses) are $90,000 fixed per year and $14 variable per unit sold. You are to prepare 6 income statements. The only heading that you need on each statement is to designate which costing method is being used. The costing methods are: REQUIRED: 1. Actual absorption costing 2. Actual variable costing 3. Normal absorption costing 4. Normal variable costing 5. Standard absorption costing 6. Standard variable costing When adjusting Cost of Goods Sold, you can show the adjustment as just one number. For example, if you are using standard costing and you want to adjust Cost of Goods Sold using variances, you do not have to list each variance on the income statement itself. Just one net number will suffice. Notice that you are charging overhead to production based on direct labor hours, not units. So, using normal costing you are going to have to compute the underallocated or overallocated overhead based on the actual hours used to produce the actual units. As noted earlier, the predetermined overhead rates per hour will be the same for both normal and standard costing, but not per unit. Use this format for the absorption costing income statements. Sales Finished Goods, beginning Cost of Goods Manufactured Cost of Goods Available for Sale Finished Goods, ending Unadjusted Cost of Goods Sold Adjustment: Adjusted Cost of Goods Sold Gross Profit Variable Selling Expenses Fixed Selling Expenses Total selling expenses NET OPERATING INCOME (ABSORPTION) Use this format for the Variable Costing income statements. Sales Finished Goods, beginning Cost of Goods Manufactured Cost of Goods Available for Sale Finished Goods, ending Unadjusted Variable Cost of Goods Sold Adjustment: Adjusted Variable Cost of Goods Sold Manufacturing Margin Variable Selling Expenses Contribution Margin Fixed Overhead Fixed Selling Expenses Total Fixed Expenses NET OPERATING INCOME (VARIABLE)

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Actual absorption costing Sales 1265000 Finished Goods beginning Cost of Goods Manufactured 1142000 Cost of Goods Available for Sale 1142000 Finishe...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started