Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hosta Trust reports gross rent income of $152,000, expenses attributable to the rents of $106,400, and tax-exempt interest from state bonds of $38,000.

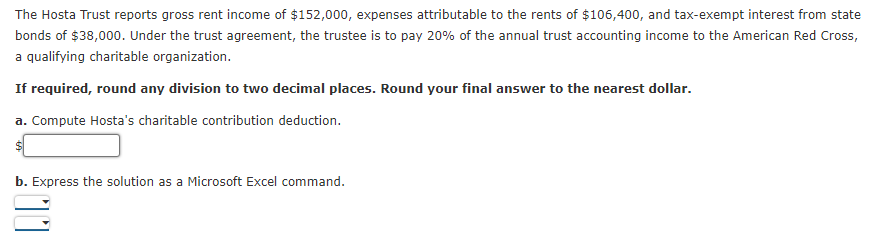

The Hosta Trust reports gross rent income of $152,000, expenses attributable to the rents of $106,400, and tax-exempt interest from state bonds of $38,000. Under the trust agreement, the trustee is to pay 20% of the annual trust accounting income to the American Red Cross, a qualifying charitable organization. If required, round any division to two decimal places. Round your final answer to the nearest dollar. a. Compute Hosta's charitable contribution deduction. b. Express the solution as a Microsoft Excel command.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Hostas Charitable Contribution Deduction We cant directly include taxexempt interest in the calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started