Answered step by step

Verified Expert Solution

Question

1 Approved Answer

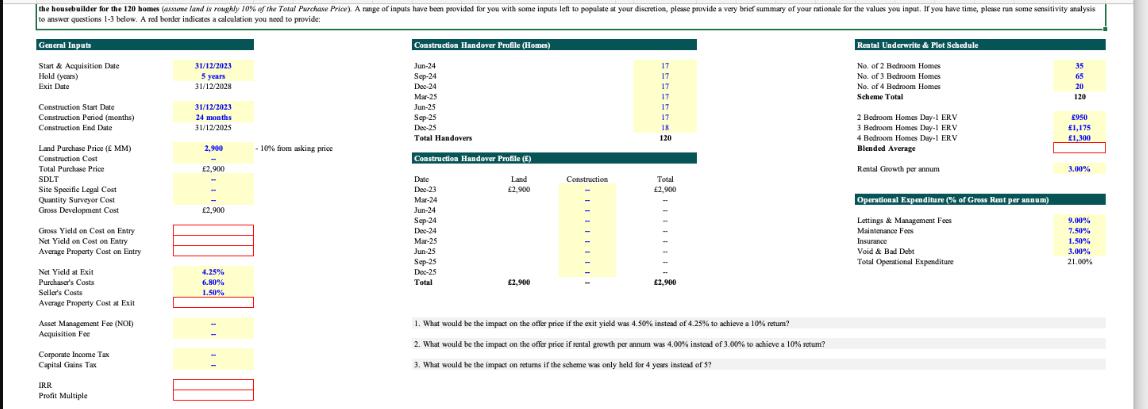

the housebuilder for the 120 homes (assume land is roughly 10% of the Total Purchase Price) A range of inputs have been provided for

the housebuilder for the 120 homes (assume land is roughly 10% of the Total Purchase Price) A range of inputs have been provided for you with some inputs left to populate at your discretion, please provide a very brief summary of your rationale for the values you input. If you have time, please run some sensitivity analysis to answer questions 1-3 below. A rod border indicates a calculation you need to provide: General Inputs Start & Acquisition Date Hold (years) Exit Date Construction Start Date 31/12/2023 5 years 31/12/2028 31/12/2023 Construction Handover Profile (Homes) Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Rental Underwrite & Plot Schedule No. of 2 Bedroom Homes No. of 3 Bedroom Homes No. of 4 Bedroom Homes Scheme Total 17 17 17 17 17 17 2 Bedroom Homes Day-1 ERV 950 18 3 Bedroom Homes Day-1 ERV 1,175 120 4 Bedroom Homes Day-1 ERV 1,300 Blended Average Rental Growth per annum 3.00% Construction Period (months) Construction End Date 24 months 31/12/2025 Sep-25 Dec-25 Total Handovers Land Purchase Price (EMM) 2,900 -10% from asking price Construction Cost Construction Handover Profile (E) Total Purchase Price 2,900 SDLT Site Specific Legal Cost Quantity Surveyor Cost Date Dec-23 Land 2,900 Construction Total 2,900 Mar-24 Jun-24 Gross Development Cost 2,900 Gross Yield on Cost on Entry Sep 24 Dec-24 Net Yield on Cost on Eatry Mar-25 Average Property Cost on Entry Jun 25 Net Yield at Exit Sep-25 4.25% Dec-25 Purchaser's Costs 6.80% Total Seller's Costs 1.50% Average Property Cost at Exit Asset Management Fee (NOI) 2,900 2,900 Operational Expenditure (% of Gross Rent per annum) Lettings & Management Fees 9.00% Maintenance Fees 7.50% Insurance Void & Bad Debt Total Operational Expenditure 1.50% 3.00% 21.00% Acquisition For Corporate Income Tax Capital Gains Tax IRR Profit Multiple 1. What would be the impact on the offer price if the exit yield was 4.50% instead of 4.25% to achieve a 10% retum? 2. What would be the impact on the offer price if rental growth per annum was 4.00% instead of 3.00% to achieve a 10% retum? 3. What would be the impact on returns if the scheme was only held for 4 years instead of 5?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 If the exit yield was 450 instead of 425 the offer price would decrease to achieve a 10 return Thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started