Answered step by step

Verified Expert Solution

Question

1 Approved Answer

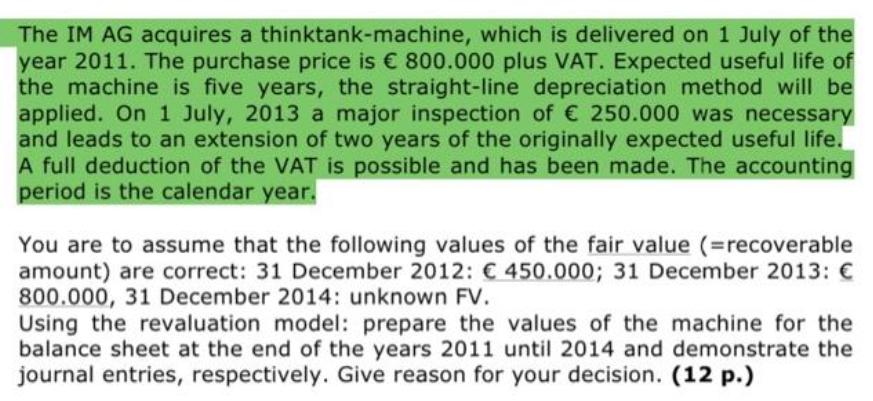

The IM AG acquires a thinktank-machine, which is delivered on 1 July of the year 2011. The purchase price is 800.000 plus VAT. Expected

The IM AG acquires a thinktank-machine, which is delivered on 1 July of the year 2011. The purchase price is 800.000 plus VAT. Expected useful life of the machine is five years, the straight-line depreciation method will be applied. On 1 July, 2013 a major inspection of 250.000 was necessary and leads to an extension of two years of the originally expected useful life. A full deduction of the VAT is possible and has been made. The accounting period is the calendar year. You are to assume that the following values of the fair value (=recoverable amount) are correct: 31 December 2012: 450.000; 31 December 2013: 800.000, 31 December 2014: unknown FV. Using the revaluation model: prepare the values of the machine for the balance sheet at the end of the years 2011 until 2014 and demonstrate the journal entries, respectively. Give reason for your decision. (12 p.)

Step by Step Solution

★★★★★

3.25 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

step 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started