Question

The impact of a recession on a levered firm. Consider the simple firm we described on slides 24 and 25 with fixed operating expenses (the

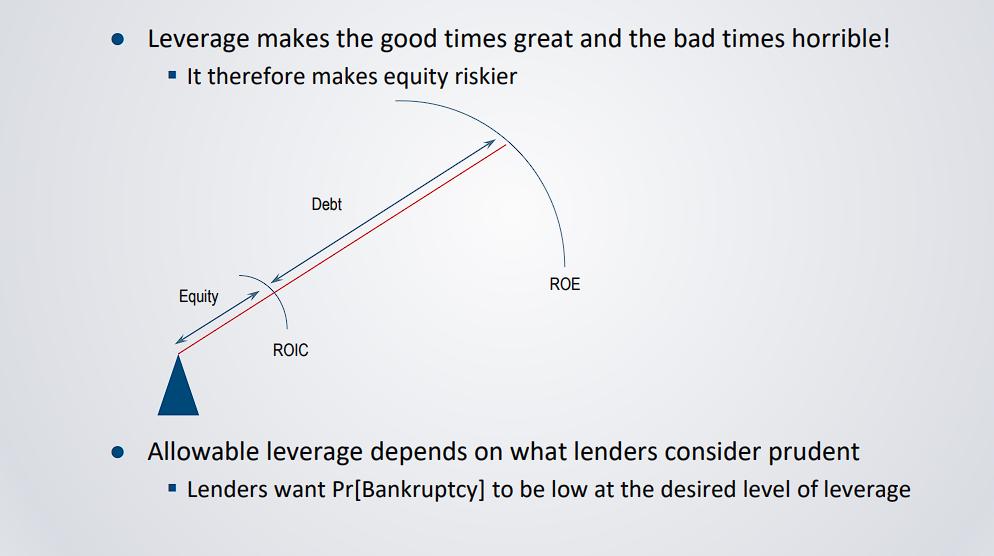

The impact of a recession on a levered firm. Consider the simple firm we described on slides 24 and 25 with fixed operating expenses (the right hand picture on both slides). We want to determine the impact of the firm’s capital structure on the size of the economic shock needed to push the firm into bankruptcy.

Required:

Keeping the invested capital fixed at $100, vary the amount of debt from $0 to $100, and for each level of debt, compute the level of revenues that makes earnings go to 0. Plot the computed revenue level (think of this as a bankruptcy threshold) against the % of debt.

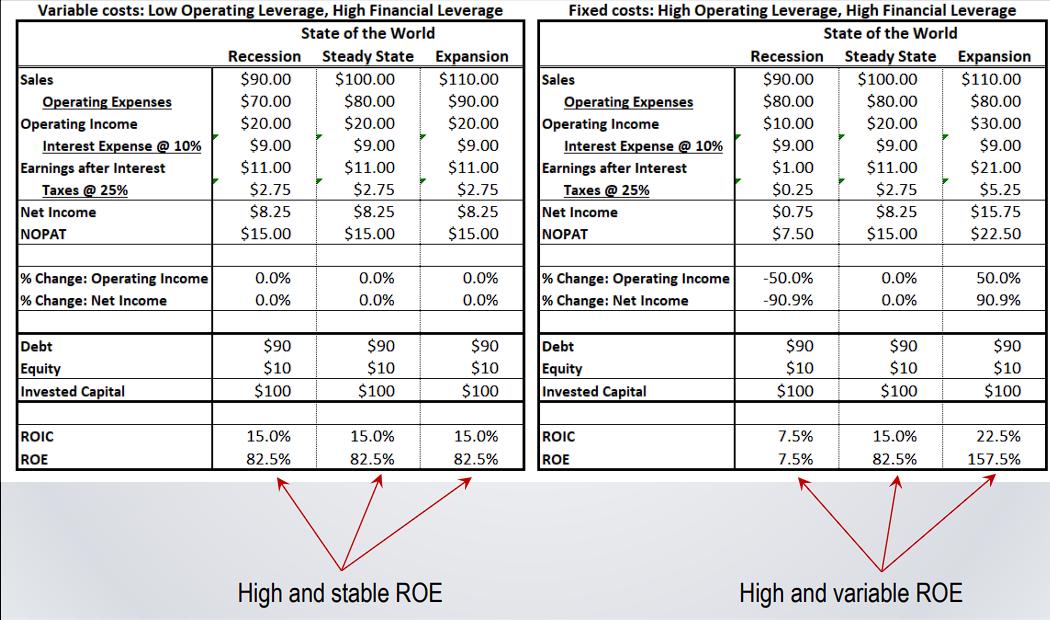

Variable costs: Low Operating Leverage, High Financial Leverage State of the World Sales Operating Expenses Operating Income Interest Expense @ 10% Earnings after Interest Taxes @ 25% Net Income NOPAT % Change: Operating Income % Change: Net Income Debt Equity Invested Capital ROIC ROE Recession $90.00 $70.00 $20.00 $9.00 $11.00 $2.75 $8.25 $15.00 0.0% 0.0% $90 $10 $100 15.0% 82.5% Steady State Expansion $110.00 $90.00 $20.00 $9.00 $11.00 $2.75 $8.25 $15.00 $100.00 $80.00 $20.00 $9.00 $11.00 $2.75 $8.25 $15.00 0.0% 0.0% $90 $10 $100 15.0% 82.5% High and stable ROE 0.0% 0.0% $90 $10 $100 15.0% 82.5% Fixed costs: High Operating Leverage, High Financial Leverage State of the World Sales Operating Expenses Operating Income Interest Expense @ 10% Earnings after Interest Taxes @ 25% Net Income NOPAT % Change: Operating Income. % Change: Net Income Debt Equity Invested Capital ROIC ROE Recession $90.00 $80.00 $10.00 $9.00 $1.00 $0.25 $0.75 $7.50 -50.0% -90.9% $90 $10 $100 7.5% 7.5% Steady State Expansion $110.00 $100.00 $80.00 $20.00 $9.00 $11.00 $2.75 $8.25 $15.00 0.0% 0.0% $90 $10 $100 15.0% 82.5% High and variable ROE $80.00 $30.00 $9.00 $21.00 $5.25 $15.75 $22.50 50.0% 90.9% $90 $10 $100 22.5% 157.5%

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

is Zero having Level of revenues when the earning low operating leverage and high financ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started