Question

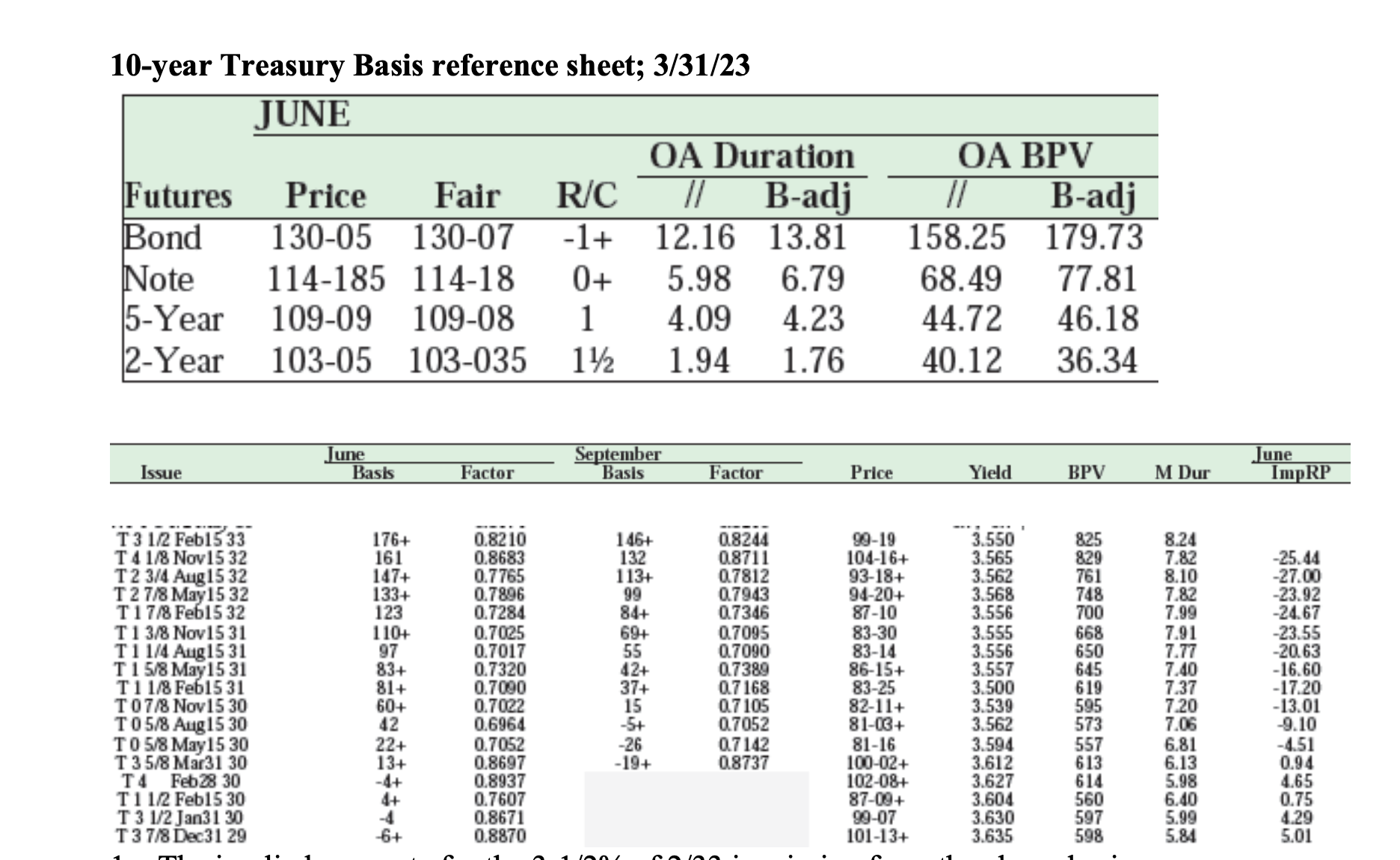

The implied repo rate for the 3-1/2% of 2/33 is missing from the above basis reference sheet. Calculate it by hand for first delivery day.

The implied repo rate for the 3-1/2% of 2/33 is missing from the above basis reference sheet. Calculate it by hand for first delivery day. (Note: you'll need to calculate accrued interest for this bond for the June 1 delivery date). Which Treasury issue is CTD into June futures and why?

2) Calculate the BPV of the June10-year futures contract using the rule of thumb on the cheapest to deliver issue assuming parallel yield changes.

3) Suppose 10-year yields fall 10 basis points. By how much (in 32nds) would you expect the June futures price to increase or decrease by assuming parallel changes in deliverable note yields?

4) Suppose the yield beta on the "hot-run" 10-year is 1 while the yield beta on the CTD is 1.15. How would this change your answer to question 3?

5) You are long $100 million of the 3-1/2% of 2/33. How many contracts would you buy or sell to hedge this position against changes in interest rates? Compare 2 alternative hedge ratios based on different bpv estimates for note futures: 1) rule of thumb bpv assuming parallel yield changes and 2) beta adjusted bpv shown at the top of the basis reference sheet (77.81). Why are they different?

6) Suppose the yield curve between 7-year and 10-year Treasuries were to steepen significantly. How would this affect the value of your hedged position shown in question 5?

7. Record your hedge ratios and the above prices for the 3-1/2% of 2/33 and June 10-year note futures. Next week, I'll provide you with updated prices as of April 7, 2023. You'll be asked to evaluate the results of the rule of thumb hedge calculated assuming parallel yield changes and the hedge ratio constructed using option-adjusted BPV

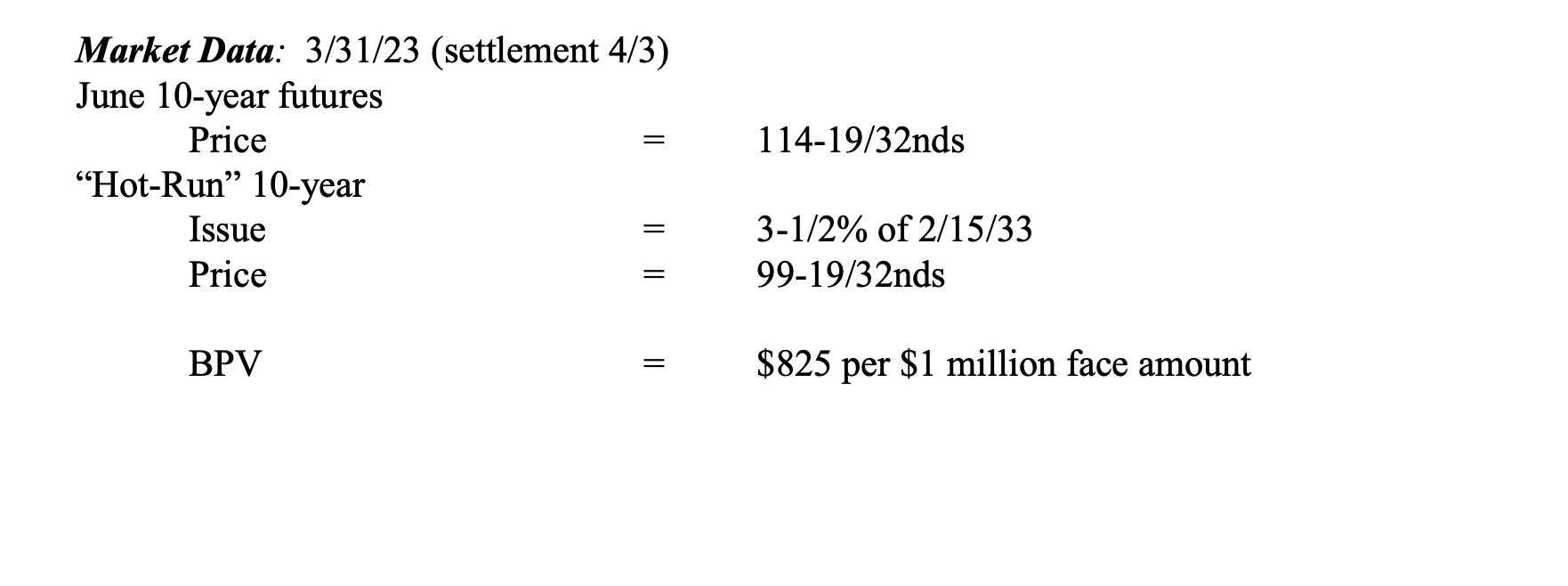

Market Data: 3/31/23 (settlement 4/3) June 10-year futures Price "Hot-Run" 10-year Issue Price = = 114-19/32nds 3-1/2% of 2/15/33 99-19/32nds BPV = $825 per $1 million face amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started