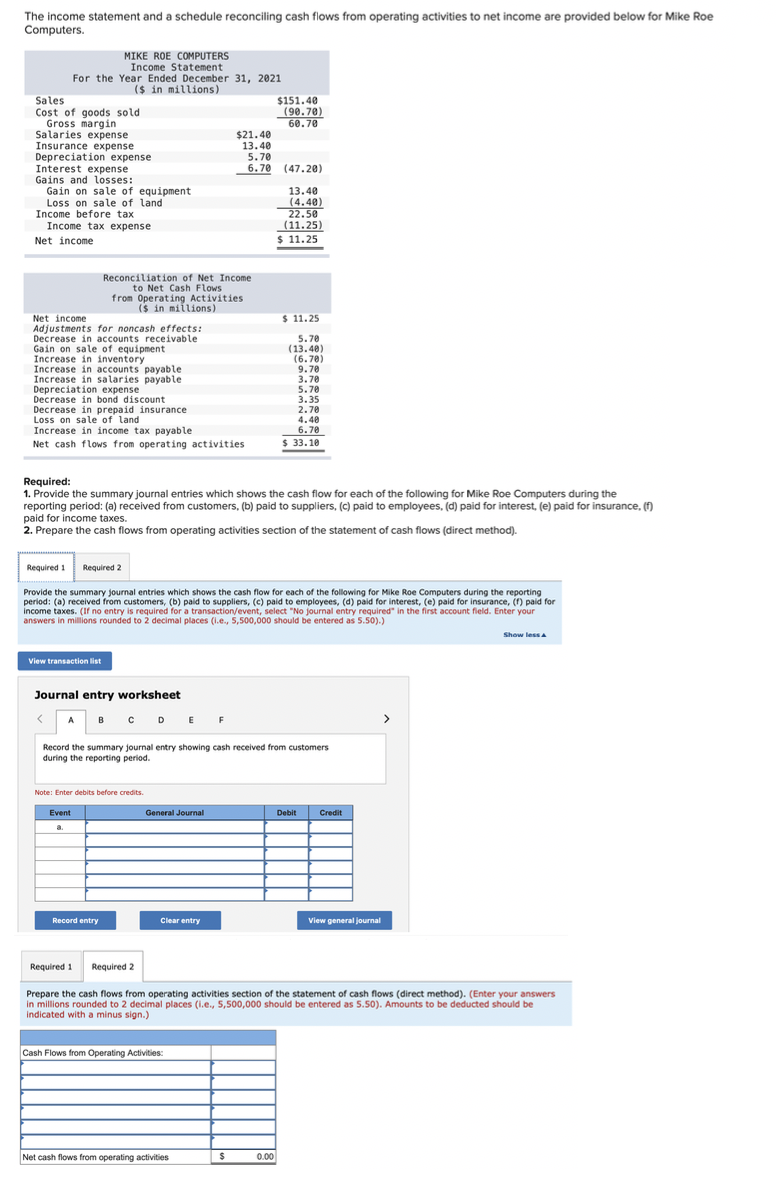

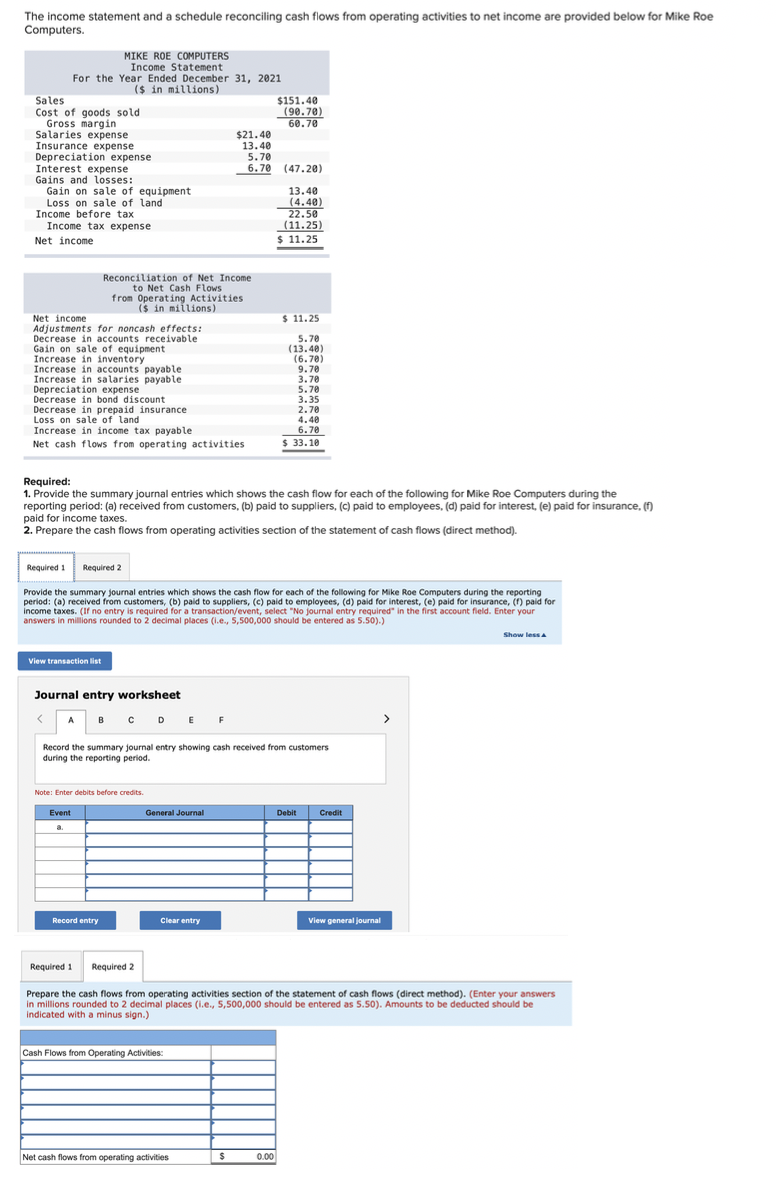

The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Mike Roe Computers. MIKE ROE COMPUTERS Income Statement For the Year Ended December 31, 2021 ($ in millions) Sales $151.40 Cost of goods sold (90.70) Gross margin 60.70 Salaries expense $21.40 Insurance expense 13.40 Depreciation expense 5.70 Interest expense 6.70 (47.20) Gains and losses: Gain on sale of equipment 13.40 Loss on sale of land (4.40) Income before tax 22.50 Income tax expense (11.25) Net income $ 11.25 $ 11.25 Reconciliation of Net Income to Net Cash Flows from Operating Activities ($ in millions) Net income Adjustments for noncash effects: Decrease in accounts receivable Gain on sale of equipment Increase in inventory Increase in accounts payable Increase in salaries payable Depreciation expense Decrease in bond discount Decrease in prepaid insurance Loss on sale of land Increase in income tax payable Net cash flows from operating activities 5.70 (13.40) (6.78) 9.70 3.70 5.70 3.35 2.70 4.40 6.70 $ 33. 10 Required: 1. Provide the summary journal entries which shows the cash flow for each of the following for Mike Roe Computers during the reporting period: (a) received from customers, (b) paid to suppliers, (c) paid to employees, (d) paid for interest, (e) paid for insurance, it) paid for income taxes. 2. Prepare the cash flows from operating activities section of the statement of cash flows (direct method). Required 1 Required 2 Provide the summary journal entries which shows the cash flow for each of the following for Mike Roe Computers during the reporting period: (a) received from customers, (b) paid to suppliers, (c) paid to employees, (d) paid for interest, (e) paid for insurance, (1) paid for income taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (.e., 5,500,000 should be entered as 5.50).) Show less View transaction list Journal entry worksheet B C D E F Record the summary journal entry showing cash received from customers during the reporting period. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general Journal Required 1 Required 2 Prepare the cash flows from operating activities section of the statement of cash flows (direct method). (Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50). Amounts to be deducted should be Indicated with a minus sign.) Cash Flows from Operating Activities: Net cash flows from operating activities $