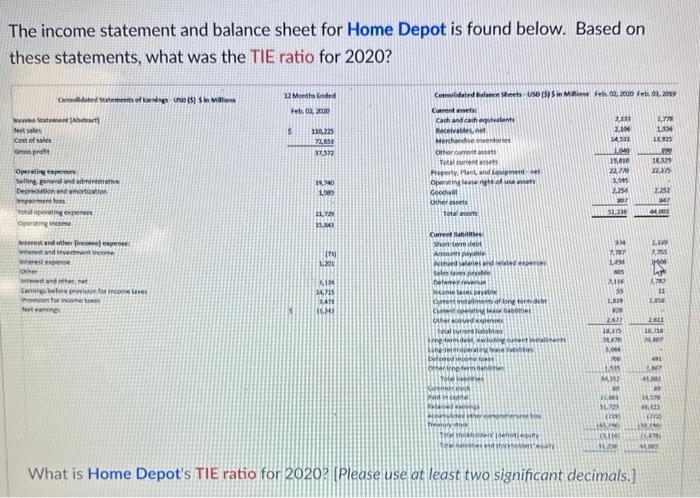

The income statement and balance sheet for Home Depot is found below. Based on these statements, what was the TIE ratio for 2020? Consolidated

The income statement and balance sheet for Home Depot is found below. Based on these statements, what was the TIE ratio for 2020? Consolidated Statements of amnings unso (5) $in Milli Income Statement (Abtract) Net sales Operating expe Selling general and administrative Depreciation and mortization parment loss Total operating expenses Operating income terest and other fincome) expense interest and invent other Intered and eher net Camings before pronson for income res Provision for income taxes Net am 12 Monthanded Feb. 02, 200 S 110,225 71,633 17,372 19,740 1.000 11,729 15.04 (78) 1,201 KIM 14,715 341 IGHE Consolidated Balance Sheets-USD (5) Sin Miions Feb 02, 2000 Febs 03, 2009 Current assets Cash and cash orquivalents Receivables, net Merchandnes anventories Other current assets Total current assets Property, Plant, and quipment-et Openting lease night of us ats Goodwill Other assets Total assets Current afec Sho tem debt Acours payable Actrued salaries and related expenses Saim taxes peable SE come taxes payable Currest installment of long term debt Current penting lease abres Other acued expens FIAT Iturers] det, eriting butent eral Filt 44040 vere herre 2,311 2.106 14,511 1040 15,410 22.7709 5,545 2,254 31,236 2637 18,10 MEM 5,064 no 1.315 MISI 31729 (739) MON960 Til folkere leboti epit nes and taktoder What is Home Depot's TIE ratio for 2020? [Please use at least two significant decimals.] KLIM ALE 3,778 1.396 18925 122 18.529 22.15 18,216 46,423

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Times Interest Earned TIE ratio is a financial metric used to measure a companys ability to meet ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started