Question

The income statement and reorganized balance sheet for HH Plc. are given below. (a). Determine the following values for year 1: net operating profit after

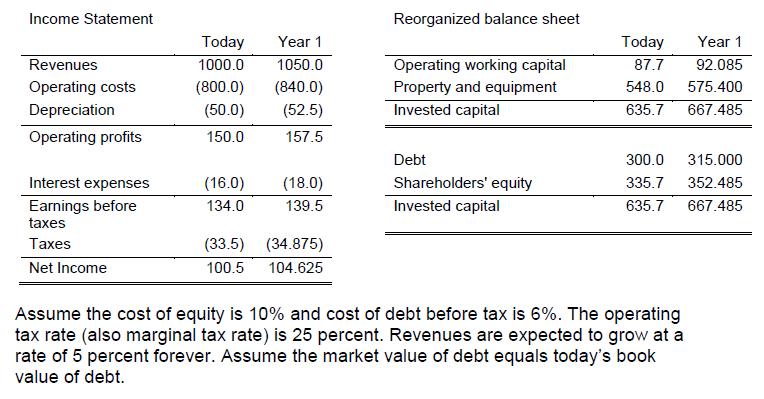

The income statement and reorganized balance sheet for HH Plc. are given below.

(a). Determine the following values for year 1: net operating profit after tax (NOPLAT), the free cash flow to firm (FCFF), and free cash flow to equity holders (FCFE).

(b). Assume HH Plc. currently has 60 million shares outstanding. Compute ExE’s equity value and price per share by using the free cash flow to equity holders (FCFE) model. Assume FCFE are growing at 5 percent. Calculate the weighted average cost of capital and the enterprise economic profit (RIF).

(c). Estimate ExE’s enterprise value using the DCF model and the growing-perpetuity formula. Assume free cash flow grows at 5 percent.

Income Statement Reorganized balance sheet Today Year 1 Today Year 1 Revenues 1000.0 1050.0 Operating working capital 87.7 92.085 Operating costs (800.0) (840.0) Property and equipment 548.0 575.400 Depreciation (50.0) (52.5) Invested capital 635.7 667.485 Operating profits 150.0 157.5 Debt 300.0 315.000 Interest expenses (16.0) (18.0) Shareholders' equity 335.7 352.485 Earnings before 134.0 139.5 Invested capital 635.7 667.485 taxes Taxes (33.5) (34.875) Net Income 100.5 104.625 Assume the cost of equity is 10% and cost of debt before tax is 6%. The operating tax rate (also marginal tax rate) is 25 percent. Revenues are expected to grow at a rate of 5 percent forever. Assume the market value of debt equals today's book value of debt.

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Cost of Company Kc Cost of Equity Ke 900 Cost of Debt Kd before tax 400 Cost of Debt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started