Answered step by step

Verified Expert Solution

Question

1 Approved Answer

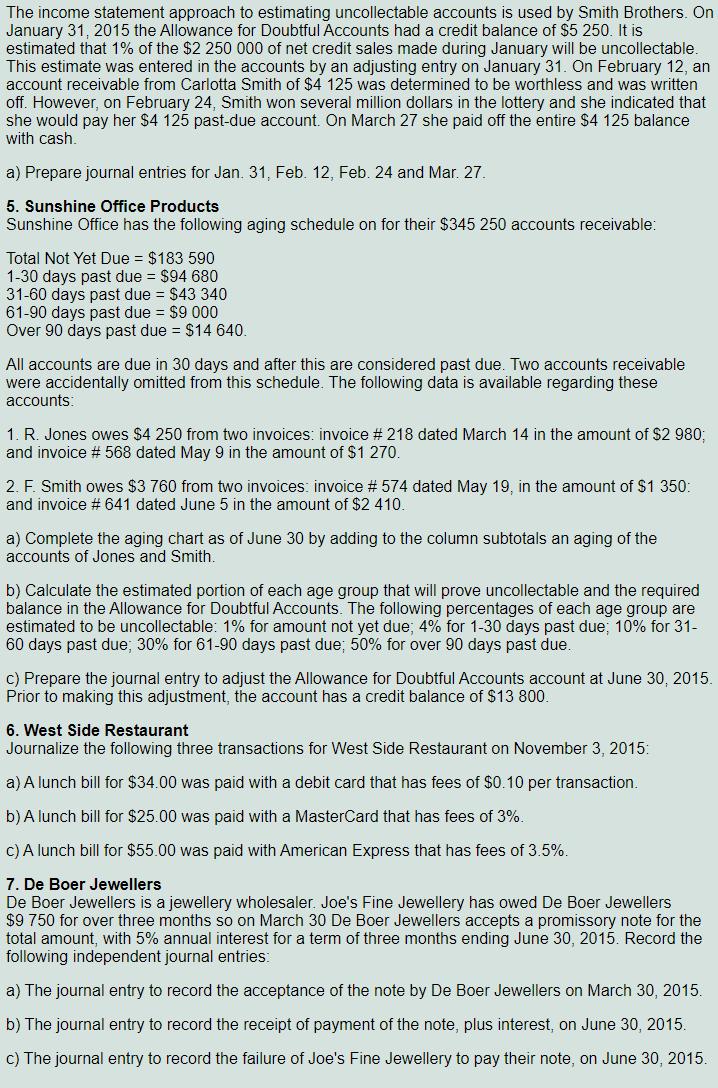

The income statement approach to estimating uncollectable accounts is used by Smith Brothers. On January 31, 2015 the Allowance for Doubtful Accounts had a

The income statement approach to estimating uncollectable accounts is used by Smith Brothers. On January 31, 2015 the Allowance for Doubtful Accounts had a credit balance of $5 250. It is estimated that 1% of the $2 250 000 of net credit sales made during January will be uncollectable. This estimate was entered in the accounts by an adjusting entry on January 31. On February 12, an account receivable from Carlotta Smith of $4 125 was determined to be worthless and was written off. However, on February 24, Smith won several million dollars in the lottery and she indicated that she would pay her $4 125 past-due account. On March 27 she paid off the entire $4 125 balance with cash. a) Prepare journal entries for Jan. 31, Feb. 12, Feb. 24 and Mar. 27. 5. Sunshine Office Products Sunshine Office has the following aging schedule on for their $345 250 accounts receivable: Total Not Yet Due = $183 590 1-30 days past due = $94 680 31-60 days past due = $43 340 61-90 days past due = $9 000 Over 90 days past due = $14 640. All accounts are due in 30 days and after this are considered past due. Two accounts receivable were accidentally omitted from this schedule. The following data is available regarding these accounts: 1. R. Jones owes $4 250 from two invoices: invoice #218 dated March 14 in the amount of $2 980; and invoice # 568 dated May 9 in the amount of $1 270. 2. F. Smith owes $3 760 from two invoices: invoice # 574 dated May 19, in the amount of $1 350: and invoice # 641 dated June 5 in the amount of $2 410. a) Complete the aging chart as of June 30 by adding to the column subtotals an aging of the accounts of Jones and Smith. b) Calculate the estimated portion of each age group that will prove uncollectable and the required balance in the Allowance for Doubtful Accounts. The following percentages of each age group are estimated to be uncollectable: 1% for amount not yet due; 4% for 1-30 days past due; 10% for 31- 60 days past due; 30% for 61-90 days past due; 50% for over 90 days past due. c) Prepare the journal entry to adjust the Allowance for Doubtful Accounts account at June 30, 2015. Prior to making this adjustment, the account has a credit balance of $13 800. 6. West Side Restaurant Journalize the following three transactions for West Side Restaurant on November 3, 2015: a) A lunch bill for $34.00 was paid with a debit card that has fees of $0.10 per transaction. b) A lunch bill for $25.00 was paid with a MasterCard that has fees of 3%. c) A lunch bill for $55.00 was paid with American Express that has fees of 3.5%. 7. De Boer Jewellers De Boer Jewellers is a jewellery wholesaler. Joe's Fine Jewellery has owed De Boer Jewellers $9 750 for over three months so on March 30 De Boer Jewellers accepts a promissory note for the total amount, with 5% annual interest for a term of three months ending June 30, 2015. Record the following independent journal entries: a) The journal entry to record the acceptance of the note by De Boer Jewellers on March 30, 2015. b) The journal entry to record the receipt of payment of the note, plus interest, on June 30, 2015. c) The journal entry to record the failure of Joe's Fine Jewellery to pay their note, on June 30, 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started