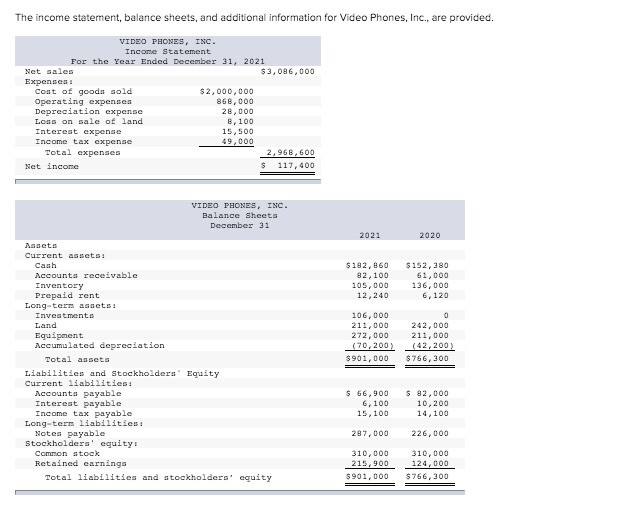

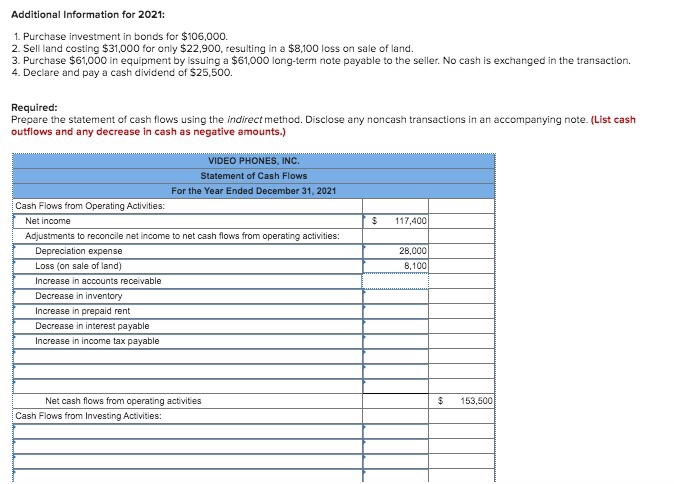

The income statement, balance sheets, and additional information for Video Phones, Inc., are provided. VIDEO PHONES, INC. Income Statement For the Year Ended December 31, 2021 Net sales $3,086, 000 Expenses Cont of goods sold $2,000,000 Operating expenses 868,000 Depreciation expense 28,000 Lons on sale of land 8,100 Interest expense 15.500 Income tax expense 49,000 Total expenses 2,968, 600 $ 117.400 Net Income VIDEO PHONES, INC Balance Sheets December 31 2021 2020 $182, 860 82.100 105,000 12,240 $152,380 61.000 136,000 6, 120 106,000 211.000 272,000 (70, 200) $901,000 242,000 211,000 (42,200) $766,300 Aaneto Current assets Canh Accounts receivable Inventory Prepaid rent Long-term onts Investments Land Equipment Accumulated depreciation Total assets Liabilities and stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders equity. Common stock Retained earnings Total liabilities and stockholders' equity $ 56,900 6 100 15,100 92.000 10,200 14,100 287,000 226,000 310,000 215,900 $901.000 310,000 124.000 $756.300 Additional Information for 2021: 1. Purchase investment in bonds for $106,000. 2. Sell land costing $31,000 for only $22.900, resulting in a $8,100 loss on sale of land. 3. Purchase $61,000 in equipment by issuing a $61,000 long-term note payable to the seller. No cash is exchanged in the transaction. 4. Declare and pay a cash dividend of $25,500. Required: Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note. (List cash outflows and any decrease in cash as negative amounts.) $ 117,400 VIDEO PHONES, INC. Statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities: Net income Adjustments to reconcile net income to net cash flows from operating activities: Depreciation expense Loss (on sale of land) Increase in accounts receivable Decrease in inventory Increase in prepaid rent Decrease in interest payable Increase in income tax payable 28,000 8.100 $ 153,500 Net cash flows from operating activities Cash Flows from Investing Activities